Connecting the Dots to Measure Marketing Impact

Aggregating Short-term Campaign Effectiveness Results to Benchmark Long-term Brand Impact

The need to measure (short-term) marketing campaigns

Against the backdrop of fierce competition for market share and increasingly fragmented media channels, marketers are invariably required to justify advertising spends by demonstrating the return on investment through various KPIs. Whether one is analysing product sales, awareness of the (newly launched) brand, or social media buzz surrounding the brand, uplifts in some, or all of these measures are usually taken to be directly associated with a successfully administrated campaign.

It is therefore common practice for marketers to run a brand uplift study to evaluate the immediate effect of a marketing campaign. This type of study is designed to reflect a consumer’s awareness and perceptions towards the brand at a snapshot in time, and can be done via an online survey using a control vs. exposed methodology, where control typically represents a group of consumers who have not seen the advertising campaign in question, while the exposed group has. Brand uplift studies provide top line results on brand attributes such as awareness, brand favourability, purchase intent, etc. A higher score for brand attributes among the exposed would indicate the success of a campaign.

Chart 1: Short-term vs. long-term measurement techniques

Is it just as important for brands to measure long-term impact?

The answer is yes. Any contemporary marketing 101 textbook will stress on the importance of evaluating long-term impact of the brand from marketing campaigns. According to Kantar Millward Brown’s Getting Media Right 2018, 81% of marketers in APAC acknowledged that the most important measure of ROI is a combination of short and longer-term metrics. Long-term impact requires investment over time and budget. However, the reality is that the need to demonstrate long-term impact is often undermined by short-term demands to account for every dollar spent on marketing activities. Evidence suggests that the absence of long-term impact measure may hurt a brand’s overall marketing and a brand’s ability to turn short-term acquisition into retention and loyalty, according to Tim Fisher, Commercial Head of Attribution, Ebiquity Analytics.

We understand that simply relying on digital measurement metrics may be able to help brands understand impact (typically short-term), but there are limitations and blind spots for campaigns that involve Above the Line (ATL) channels such as TV, OOH, radio, etc. If your campaign only involves digital platforms, it is possible to track purchase conversions and link that back to ad exposure. However, in the omnichannel world that we live in, it has become very tricky to assess the complete purchase journey. For campaigns that have some ATL components, it is important to account for their contributions to the consumer purchase funnel as well. Measuring brand uplifts can help to understand short-term (i.e. awareness, recommendation, purchase intent) as well as long-term (i.e. brand image & equity) impact.

Breaking data silos to build connected intelligence – BBC’s ADImpact Study

While deterministic modelling such as Marketing Mix Modelling may be the ultimate solution, it is a practice more feasible to implement in developed markets (e.g. US, UK) where a unified identification system or a single currency that enables cross-platform campaign measurement exists. In their absence, brands are left with probabilistic modelling, look-alikes and proxies. In addition, one of the most common challenges brands face these days is that they are sitting on many different sets of sales and marketing data; each systematically collected and maintained, but often disparate. The golden question is about what we can do to break these data silos and bring them together in a statistically sound and meaningful way to inform marketing decisions. The last thing we want to do is to let these data silos hinder our ability to gain valuable business insights. You might have already invested in a variety of data collection tools or proprietary business reports, but may be using them independently across different functions of the business. By taking a proactive step and integrating these datasets, you may discover new value.

Here at the BBC, we embarked on a learning journey in connecting different datasets in an effort to strengthen our commercial marketing messages. We achieved this not by investing extra time and budget to acquire more data, but by using data sources that already existed within the business. The main data source that we leveraged on was our campaign effectiveness database, built on ‘ADScore’, our proprietary campaign measurement tool. We have been tracking campaign effectiveness for over a decade, using a standard set of metrics to evaluate the success of TV, online or cross-channel marketing campaigns on the BBC’s platforms. Over the years, we have produced thousands of reports for our commercial partners. While the results from these surveys proved valuable in helping brands understand their campaign performance on our media platforms, we still felt that we could dive deeper to provide our clients with more insight into what the key ingredients for a highly successful campaign really are. Campaigns with similar dollar investment may not lead to similar effectiveness results. In an effort to better inform on our ability to influence the consumer’s purchase journey, we needed to connect the dots.

Working with data scientists and senior consultants from Engine Group, we tapped into our large database of campaign effectiveness results and painstakingly identified and applied multiple bridging techniques to integrate sixteen other data sources to form a more complete picture of each campaign. Most of the integrated data sources were campaign management tools and industry reports that the business had subscribed to. We ended up with a fully connected database and a comprehensive view of the different media elements for each campaign. It allowed us to determine the role each campaign element played in influencing brand performance. This connected intelligence enabled us to perform advanced data mining with various statistical techniques to understand our platforms’ contributions to brand building and campaign effectiveness drivers.

Strength of premium news channels

One key finding from this exercise is that premium media platforms like the BBC add value to a brand’s marketing strategy by influencing critical mid to lower funnel metrics such as consideration and recommendation. Many studies have shown that these metrics are strong determinants of a brand’s in-market purchase. This is particularly important for large brands that want to convert already high awareness levels into stronger positive feelings towards the brand. This finding is also very much in line with the study on the halo effect of premium publishers conducted by Comscore in the US. Their findings proved that advertising with premium publishers vs. non-premium not only showed higher brand lift across all metrics, but also that premium publishers were much more effective in moving the needle on brand favorability and consideration metrics.

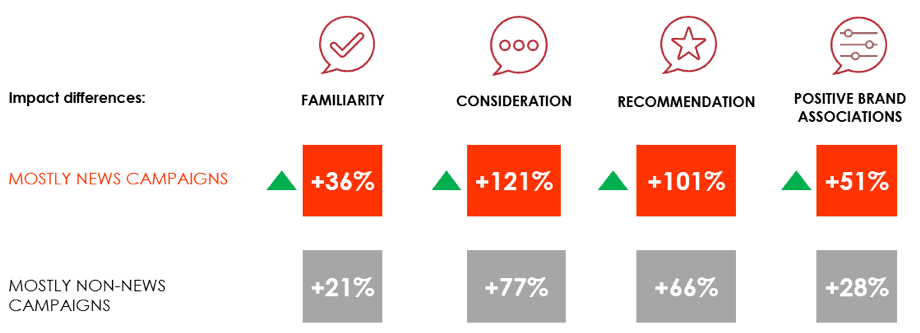

Much has been said about publishers needing to work harder to create a brand safe and effective advertising environment. From ADImpact, we saw little correlation between BBC.com’s viewability scores and the performance of key brand metrics (i.e. familiarity, consideration, recommendation). We believe that this is because in the premium publisher’s environment, viewability and ad fraud are merely hygiene factors. If the brand is associated with quality, objective reporting, it will reap benefits. The results below show that campaigns associated with a higher proportion of news content have a stronger brand impact across various stages of the consumer decision-making journey, compared to campaigns associated with a lower proportion of news content.

Content formats have different roles to play in different regions. In APAC, campaigns with online video delivered stronger impact across metrics in helping to build a brand’s familiarity, consideration and recommendation compared to the global average. We also noted higher impact scores in APAC for campaigns on mobile app when compared to campaigns on desktop/mobile (browser). These regional differences are important for marketers to note when developing multi-regional marketing messages.

Simulating media plans to optimise campaign results

Whilst many companies measure brand impact, the significance of the BBC ADImpact study is that it aggregated the individual results of a multitude of campaigns (short-term impact), distilled a deeper understanding of campaign effectiveness across advertising sectors, and accounted for media influences beyond spend. It gives us deeper understanding of our platforms’ role in influencing a customer’s journey across various stages. It connects and makes sense of disparate datasets and adds value to our business by answering important questions on attribution and effectiveness of BBC channels. We managed to achieve this outcome with minimal investment as it’s all based on existing big datasets that we already have access to.

In addition to publishing the key learning points from ADImpact, we further identified and applied drivers of campaign impact and built a comprehensive simulator for media planning and optimisation. This tool is being used across the organisation globally to support media planning and evaluation of marketing campaigns across different advertising sectors. The simulator generates predictive impact scores for our potential clients, based on delivered campaign results and learnings from ADImpact. This exercise demonstrates our knowledge around our media, our audiences and our content. It provides empirical proof points to support our media recommendations and to provide confidence to our clients that we can attribute real value to the media we are selling.

This article was written by Sally Wu, Research & Insights Director, BBC Global News (APAC) and originally published on Asia Research Q2 2019 Magazine.Or right-click, "Save link as..." to download