- Lachlan Kean, Sales Director, APAC, RhythmOne

- Matt Ware, Head of Programmatic, APAC, MediaCom

- Nilesh Jadhav, Regional Director, Programmatic Supply, APAC, Innity

- Vivek Misra, Group Director, Strategic Initiatives, AnyMind Group

- Yu Yan Tay, Commercials Manager, dataxu

OTT and its importance to Asia - Part 1

OTT has become a buzzword in the media landscape. Very simply, this refers to the delivery of content via the internet and often via an app that can be accessed across multiple platforms, with Netflix being the most well-known global example. Industry predictions highlight the promise of OTT media services and video-on-demand (VOD), with a surge in consumption and revenue anticipated in the next few years. Two key business models have emerged and most providers can be categorized into either:

OTT has become a buzzword in the media landscape. Very simply, this refers to the delivery of content via the internet and often via an app that can be accessed across multiple platforms, with Netflix being the most well-known global example. Industry predictions highlight the promise of OTT media services and video-on-demand (VOD), with a surge in consumption and revenue anticipated in the next few years. Two key business models have emerged and most providers can be categorized into either:

- Subscription Video-On-Demand (SVOD) – the model where users pay for content typically via a monthly subscription.

- Advertising Video-On-Demand (AVOD) – the model where users have access to free content that is paid for via advertising within the content.

Another more traditional model, Transactional Video-On-Demand (TVOD), enables users to purchase content on a pay-per-view basis. TVOD services are traditionally powered by media or delivery channels like cable companies, and are rarely a standalone offering from a single company.Whilst OTT adoption and proliferation has gained momentum globally, this phenomenon is becoming particularly important in Asia for several reasons:

Highest OTT subscription growth rate globally

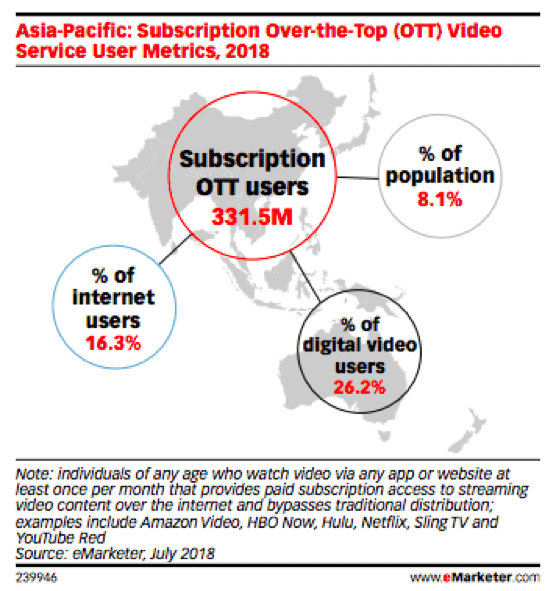

According to eMarketer, whilst current OTT penetration in APAC is still low, the region will clock the highest OTT subscription growth rate in the world at 35 per cent in 2018. This strong growth rate is projected to continue over the next few years and is underpinned by large investments that OTT companies are making towards developing content and programming. Source: eMarketer, July 2018

Source: eMarketer, July 2018

High consumption of online video content

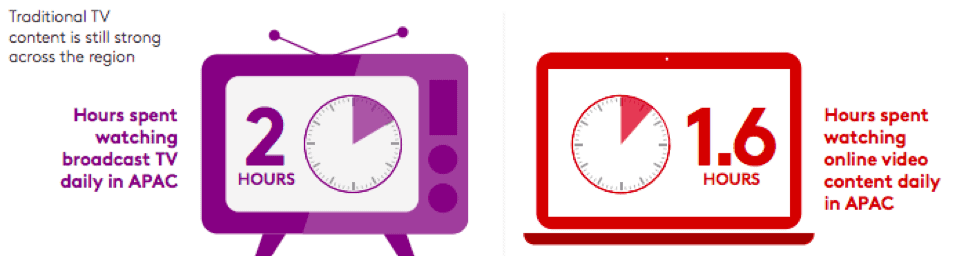

The projections above are also backed by key consumption habits of users in Asia Pacific. According to Kantar TNS 64% of internet users in APAC now consume up to 1.6 hours of online video content daily.

Source: Online video viewing habits across Asia Pacific, Kantar TNS

Whilst OTT in Asia is growing as well, this growth is uneven across and the video consumption growth from countries outside China still comes very much from free or ad-supported online video platforms (including YouTube). According to a recent study by MPA, the net online video ad spend in Asia Pacific will grow from US$13 billion in 2018 to US$30 billion by 2023.

Trends driving OTT growth in Asia

Having established the importance of OTT in the region, it is worth taking a quick look at the four thematic trends driving this growth.

Connectivity

The adoption of smartphones and other connected devices has been a key driver of internet usage in Asia, and this has laid the foundation for OTT growth in the region. In addition to the widespread adoption of connected devices, the region has witnessed an increase in broadband speeds and greater availability of 4G connectivity. Some telcos in the region have even begun bundling OTT services together with their data plans in an effort to add to their value proposition. From a consumer standpoint, this increased connectivity has fuelled a key trend in the region – a general consumer preference towards digital media consumption.

Macro Economics

At a macro level, Asia has benefited from a growing middle class. A rising per capita income across the region has been accompanied by an increase in disposable income and OTT has capitalised on this trend. Affordable pricing plans and improved payment options together with a greater willingness to pay for quality content have all contributed to the continued growth of OTT.

Platforms

Predictive algorithms that recommend content based on a user’s viewing history is just one trick used by OTT providers to foster loyalty and increase content consumption. Over the years, platforms have improved user experience, become more stable and adapted to local market conditions, with some allowing you to download content over Wi-Fi to be viewed later offline – a popular feature in markets like India. This ease and practicality has spurred growth.

Content

OTT providers like Netflix have demonstrated that original content is a big draw, with TV shows like ‘The Crown’ bringing fresh subscribers. This is true to the point that Netflix’s subscription sign ups and cancellations can correlate to a popular show’s first and final episodes respectively. Local content has also proven successful with players like Hotstar building deep libraries of strong local content as a strategic differentiator.