White Paper | Authors: Catherine Candano Google, June Cheung Oracle Advertising and CX, Rupesh Kumar Carat Media, Tara Crosby Twitch, Vidyarth Eluppai Srivatsan The Coca-Cola Company

PLAYBOOK FOR FMCG BRANDS FOR EFFECTIVE ATTRIBUTION VIA MARKETING MIX MODELING (MMM)

Let’s now take a deeper look at how Josh, Marketing Head at FMCG (Fast-moving Consumer Goods) brand and Jessica, Marketing Head at eCommerce brand best optimize marketing channels given the differences in data accessible to them as a FMCG brand vs eCommerce. What does each one’s digital attribution playbook look like?

Today, Josh will share his coach’s playbook on how he utilises MMM (marketing mix modelling) to identify the optimised marketing mix to drive sales.

Josh: MMM is an analysis technique that allows marketers to measure the impact of their marketing and advertising campaigns to determine how various elements contribute to their goals (Brand Awareness, Sales or Consideration Lift, Weekly Consumption etc.)

Jessica: Josh, what is your perspective on measuring the impact of the various media touchpoints at FMCG? What factors would you like to consider?

Fundamentally, we at FMCG organisation would like to understand the impact of different media activities, as the user journey is not linear anymore. A single user can interact with multiple touchpoints before making a sale.

However, a sale is not only dependent on media touchpoints; it is also dependent on internal factors like price changes, sales, inventory changes, change in distribution methods, and external factors like economic factors, competitive conditions, seasonality, weather etc.

Internal and external factors have a significant impact on sales. For example, sales during the pandemic year for an FMCG brand can go down if people don’t have money and shops are closed.

Being an FMCG brand organisation, we have most of our sales going through retail channels. In fact, less than 1% of our overall sales are coming from online channels; hence, we would prefer to go with MMM only because measuring the attribution impact through Multi-Touch Attribution is very difficult as most of the sales are offline and assigning direct attribution to touchpoints would be difficult.

We are collaborating with our Media agency to begin our MMM journey to measure the impact of investment on media touchpoints and effects from internal and external factors. MMM is not only utilised to measure the Impact on sales, it is also being used to see the impact on other brand metrics like Brand Awareness, Consideration Lift, Weekly Consumption Numbers, and more.

Jessica: Did you consider any caveats as you brought up MMM at FMCG?

Yes indeed, on a high level there were quite a few considerations before we utilised MMM at scale.

1. Scale: MMM requires scale (marketing investment). MMM needs to reach a specific scale to gather any actionable insights

2. Budget: MMM requires increased investment – recommended to have at least $4MN spent for the last 3 years

3. Media Mix: MMM works when the investments have variation in the Media mix to be used for future planning and benchmarking. If the media mix is heavily dependent on 1 or 2 channels, then MMM is not a correct approach.

What the above implies is that I can’t have a one-size-fits-all approach with MMM. I can’t choose to deploy MMM for all brands or even all markets. Depending on the above caveats we choose the ideal products and markets to specifically work on.

It will be useful to click down one level and understand caveats to consider as we deployed our MMM approach at FMCG. So let’s break down the process of MMM. Typically MMM studies have a 6 step process:

1. Data availability evaluation

2. Choosing the right partner for MMM deployment

3. Data Collection

4. Deployment

5. Testing

6. Optimisation

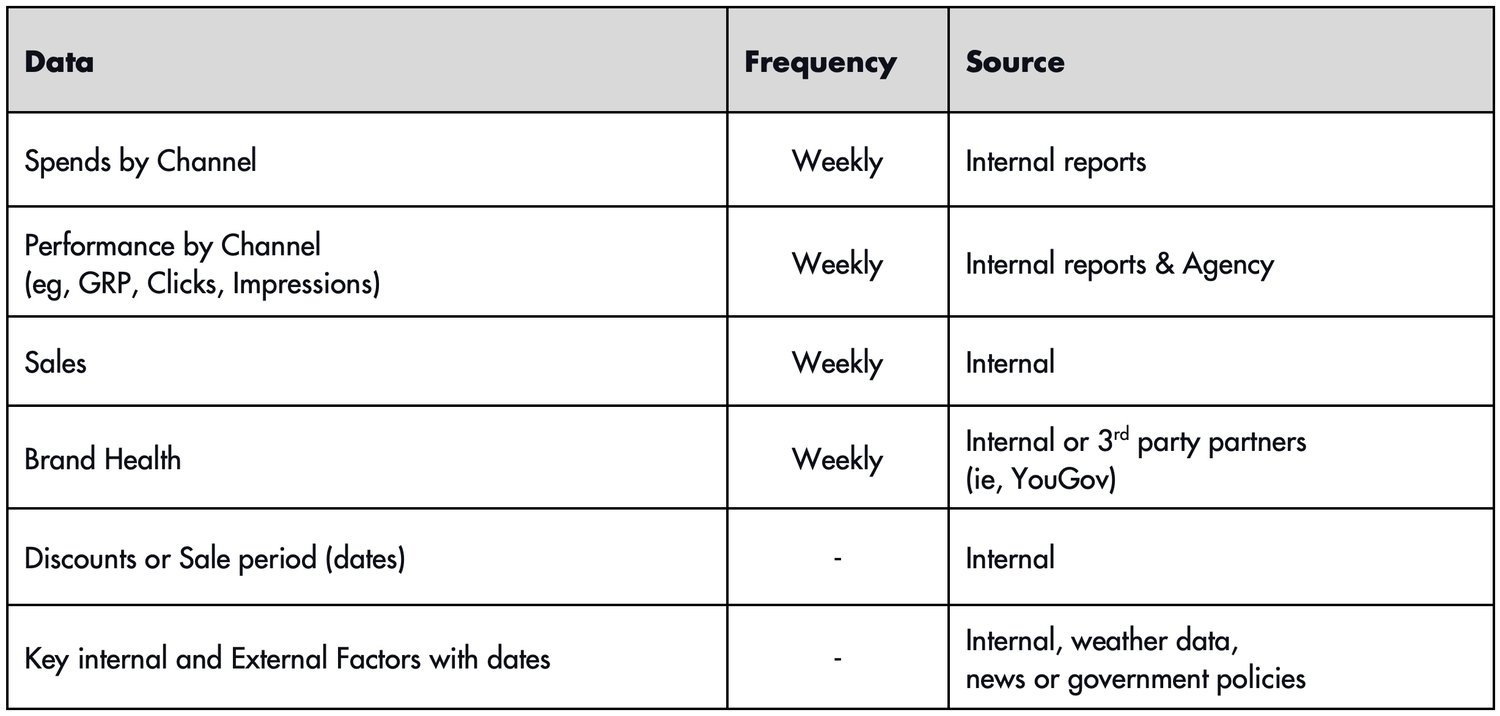

Data Availability Evaluation: Here the primary consideration does we have historical data bifurcated by week for previous years. We will need the data for at least the last three years for MMM. Luckily we did have a lot of the requirements internally or through our media agency as elaborated below.

Choosing the partner: It is critical to research and identify the right partner which can provide MMM services for your brand and can provide customised solutions, good experience, transparency and can provide actionable insights.

Data Collection: This is the most important step: Robust data collection is an essential part of MMM because measurement studies are dependent on the quality of the data. The phrase garbage in, garbage out was our mantra here. Be aware that data inputs are typically not the same level of granularity. The accuracy of the data will help to build a robust model for MMM and provide accurate results. If the data collection process is not accurate, it will disturb the Model and add costs by way of rerunning.

Deployment: MMM requires at least 5-8 months for deployment, including data collection and building effective models. So understanding this was important for us to know when to plan the overall rollout in time for our planning cycles.

Testing the model: Once the MMM models are ready, it is important to test the models at scale in a smaller scope. For example, the initial models suggested that the optimal budget split for a USD 2 MN paid media campaign was 20% on Social, 50% on Television, and 20% on OTT, and 10% on event promotions and that would improve the overall sales by 3% vs. investing equally on each media channel. We went ahead and tested that in the market for a significant period of time and the results were encouraging enough for us to take the next leap. It is important to note that MMM often focuses on sizable time-period data deliverables with the measurement at the media channel level.

Optimization: MMM attempts to answers questions such as “What would be return on ad spend on social” and “What would sales lift be if we shift 20% of the budget allocation to Connected TV or addressable TV?”

With the MMM Model being tested already, it has started showing optimised marketing investment allocations and predicting future KPI outcomes more accurately. Now the key consideration given the deployment time of the models is to see how we can feed more information on a real-time basis to make the model more robust. With more recent data or new media channels addition, we might need to make a choice to refresh the model.

Jessica: Thank you Josh, for sharing your playbook. I have a last question. How would you see the future of Attribution or any trends that you foresee?

As we get better predictions on the media investment strategy that can give us better ROI through MMM, it is also important to consider fundamental changes to our assumptions. Over the last two years we were introduced to a new variable called pandemic and we have had to utilise the impact of Government restrictions, mobility trends and more to tweak our models to suit the times. Now, considering the new normal, we are also seeking to make systematic changes to the way we do MMM. The principles of MMM are still valid after generations of utilisation across a multitude of companies, perhaps there is a window to make the optimisation as fast as possible (and as financially efficient as possible) to suit the changing times. These are indeed exciting times ahead and we are looking forward to it with a lot of excitement.

At the same time a good marketer will use their own contextual knowledge of brand, market, audience, and product knowledge to make any investment decision. For example, MMM might suggest a heavy investment on digital; however, you know from past experience that without investing in Above The Line (ATL) business, we would not be able to make an impact to drive a combination of both ATL and digital strategies. So be prepared to take a business call based on your industry benchmark insights. And then review the data insights again!

I am also excited to learn more about the attribution from you as eCommerce captures more data points for its users because their point of sale is through their app or website. In the pandemic era, more consumers are using eCommerce as a way to stock up or top off their weekly and monthly grocery needs in addition to visiting a physical store, and this trend is here to stay. So we need to learn from eCommerce organisations more about how they use attribution.