White Paper | Author: Fabio Fedele TheTradeDesk

CTV, Connected TV – is used for talking about Smart TVs and streaming devices that are attached to TVs as opposed to mobiles or desktop devices.

OTT, Over The Top – is used when we talk about ‘OTT content’ and it doesn’t matter which devices it delivers to. OTT is also a valid term that distinguishes premium television content from the vast world of online video where user-generated content is commonplace.

THE STATE OF CTV/OTT IN SOUTHEAST ASIA

What a good time to talk about OTT for a region as rich as Southeast Asia – APAC’s variety of cultures, socioeconomic statuses and languages is today, and will continue in the future, to be a major obstacle for OTT services.

Year on Year OTT consumption is up 22% with Southeast Asian viewers now streaming more than 9.7 billion hours of content every month. View rate increased 9%* since last year with viewers watching more than 48 hours of content per month. So, as you can see, this channel creates opportunities for brands and platforms as it’s here to stay.

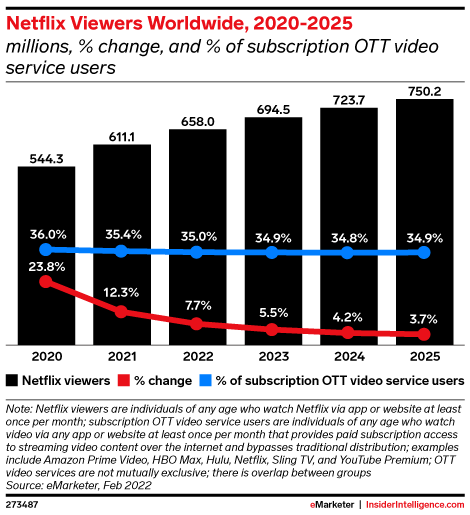

Given the fragmentation of the market with these regional nuances, OTT platforms need to understand and stress the significance of having specialised go-to-market plans to succeed. Despite this, inflation and economic unpredictability are fueling increased rivalry amongst streaming services. This has been observed with the recent news that Netflix is exploring new business models to supplement falling subscriptions, including an advertising model.

According to Nielsen, users are feeling overwhelmed by the growing numbers of platforms and will relook at which streaming services they will use in this inflationary environment.

This increase in platforms is due to several factors:

-

-

-

Younger viewers are fueling OTT’s expansion: in SEA, Gen Zs or young Millennials (16–34) make up 44% of OTT watchers. Furthermore, this young audience is more likely to be heavy users who watch more than four hours of OTT video every day, than just early adopters.

-

OTT is revolutionising traditional TV in Southeast Asia. Two of the main reasons are the availability of premium shows from a variety of regions not typically seen on traditional TV; and the flexibility OTT offers, allowing viewers to choose what they want on their own time, at home, on the go. A consumer can now watch their favorite shows on any screen. For a lot of SEA countries, OTT is an integral part of consumer lives and has shifted TV consumption from free to air TV to OTT.

-

Asian shows are stealing the ‘show’ from the West ; the perfect example to illustrate this is the rise of Korean shows, which rose 21% in popularity in SEA during the past year. In fact, 56%* of Gen Z ranked Korean content amongst their top 2 preferences. On the audience genders, there is a clear split in taste between male and female viewers. GenZ women, young millennials, and mothers all rank Korean dramas as top genres. GenZ male audiences prefer comedies, while young millennial males prefer action.

-

-

Now that we have set the context, it’s important also to share what opportunities lie here for brands and what brands should know:

1. Ad supported OTT is on the rise – advertisers can now reach more than 116 million viewers over OTT*. That’s a 10% year-over-year growth rate. Gen Z women and young millennial women are most likely to use advertising-supported platforms, making OTT an ideal channel for brands looking to reach out and build relationships with younger female consumers.

2. Amongst OTT viewers who are open to seeing ads in exchange for free content, 89% are willing to watch two or more ads (for a one-hour show). They are also most likely to accept 2 or more ads per hour of free content. This shows a real appetite for OTT consumers to watch ads in return for free content, and some platforms have already started to put this into action including Disney+, HBO, and now Netflix.

3. OTT offers higher engagement, less intrusive ad experience than TV or user-generated content (UGC). More importantly, we will see a shift in the next five years as more AVOD services will be used. Brands will spend first on premium content platforms such as OTT rather than YouTube, user-generated content platforms or social.

4. As Smart TV penetration rises, OTT is capturing viewers switching from traditional TV: there are more and more cord cutters (audience moving away from traditional TV). This change of behavior has pushed broadcasters to invest heavily in OTT platforms. To reach all audiences, advertisers need strategies that appeal to both channels, especially to reach younger viewers who are leaving TV. Today, Smart TVs are bringing OTT to the largest screen in the house. Smart TV now claims one-third of all OTT viewing hours: roughly 3 billion every month. However, smartphones still reign supreme among youth. Gen Z consumes 47 percent of their OTT via mobile while the average user consumes 36% on smartphone.

What are the predictions for the future for OTT in Southeast Asia?

There will be different shifts taking place:

1. There will be a consolidation of OTT platforms acquiring other platforms vs the current fragmentation of the market. Or simply we will only see the most prominent surviving platforms, and see the smaller players address a niche of audience with very specific content.

2. With this new strategy it will be crucial for OTT platforms to find the balance between SVOD and AVOD. Just as a refresher here, SVOD is the OTT content available through subscription models such as Netflix, Disney+, HBO, whereas AVOD will be the content available for free, but users will have to watch ads in order to access this free content. It is important in an AVOD model for these platforms to manage their yield correctly. One pillar that may bring a big change in the Southeast Asia region in the next five years is how they will make their inventory available for programmatic buy. This may contribute to the same future scenario for CTV; with an increase of CPM for this premium inventory, as programmatic is enabling today’s advertisers to target their audience with more efficiency, this will increase the race to the top for CPMs as advertisers will be willing to pay more.

3. Diversification or collaboration, where OTT platforms jump into other areas of entertainment, with gaming, or game-inspired shows for example. There is closer collaboration between streaming platforms and game developers. On this front, Netflix may have more than one trick, as they are leading the charge in this area. Today’s gaming audience has reached a very decent size, according to Activision Blizzard Media’s report, gaming consumption consistently exceeds that of live television, and streaming TV only exceeds gaming by a relatively small margin — 57% of consumers versus 43% — during prime time and late evening hours, and gaming activity beats out streaming at all other times. Among younger demographics, gaming is understandably even more dominant. This is really aligned when we see what audience is driving OTT growth and it may be only the beginning of the opportunity the future will offer in this area.