White Paper | Author: Vera Wang, TikTok, Member IAB SEA+India 2022 Commerce Council subgroup

E-commerce and retail continue to be the key pillars in 2023. To win over consumers in commerce, brands know consumer attention is the most expensive marketing currency. Consumers reward brands who connect with their emotions, therefore, brands need to connect with today’s consumers through quality content. This is what we called Shoppertainment, a content-driven commerce that seeks to entertain and educate first

In this exciting new space, there is a new breakthrough to win consumers across all shopping channels. The breakthrough is entertainment-first, commerce-second. When commerce is done in this sequence, it’s called Shoppertainment and this new category of commerce will be worth more than USD $1T in APAC by 2025.

WINNING APAC CONSUMERS

5 Shopper Insights Shaping Commerce Today

Shopping evolved from transactional to communal. Our latest consumer research points to 5 fundamental shifts in shopping behaviors that shape commerce today that marketers need to know.

-

-

-

APAC has always been digitally savvy, and the pandemic has accelerated adoption

According to the World Bank, an additional 37M individuals in Southeast Asia gained access to the internet during the 1st year of the pandemic. [Source: World Bank, 2019-2020 data]In Southeast Asia, people spend between 8 to 10 hours a day online. In Japan and Korea, it’s around 4 to 6 hours a day. That’s between a quarter to a third of a person’s day is spent online.

This is not just limited to a younger population, but across ages. A growing number of senior citizens in Asia are turning to social media, online games and other internet services as they spend more time at home due to the pandemic. In Japan and South Korea, more than 90 percent of seniors (those above 60) are expected to be online by 2030.

-

More choices mean more distractions, higher inertia and less attention.

Shopping has evolved today – there’s physical malls, social commerce, ecommerce, marketplaces, direct-to-consumer and many other channels and forms. More choices resulted in higher inertia to make decisions and less attention. In our report, we discovered that 47% buy on a different day , 85% switch apps while going through consumer journeys and skip 9 out of 10 ads they see. -

Advertising turnoffs dampen shopping intent

The appetite to shop has decreased because advertising today speaks less to consumers. When we asked consumers what turns them away from brands, they tell us it’s overly Exaggerated, Picture-Perfect, Boring and Distracting content. A whopping 7 out of 10 consumers say they are not in the state of mind to purchase when they see branded content and 34% are skeptical about branded content. -

Today, an element of ‘fun’ can turn consumers into customers

Shopping moments today show that consumers increasingly want an element of fun in the process. Either consumers start with wanting to meet a shopping need (need-led shoppers) or simply browsing or discovering content (content-led shoppers) to be entertained and end up making a purchase in the process. When users are entertained faster, they share more, and are more likely to buy a product or service based on the brand’s video as they are engaged. -

Because they are seeking emotional connection with brands

Consumer needs span from basic transactional needs to elevated emotional needs when shopping online. Our report findings pointed out clearly that shoppers value fun and emotional connection with brands. Consumers want shopping to entertain & educate.

-

-

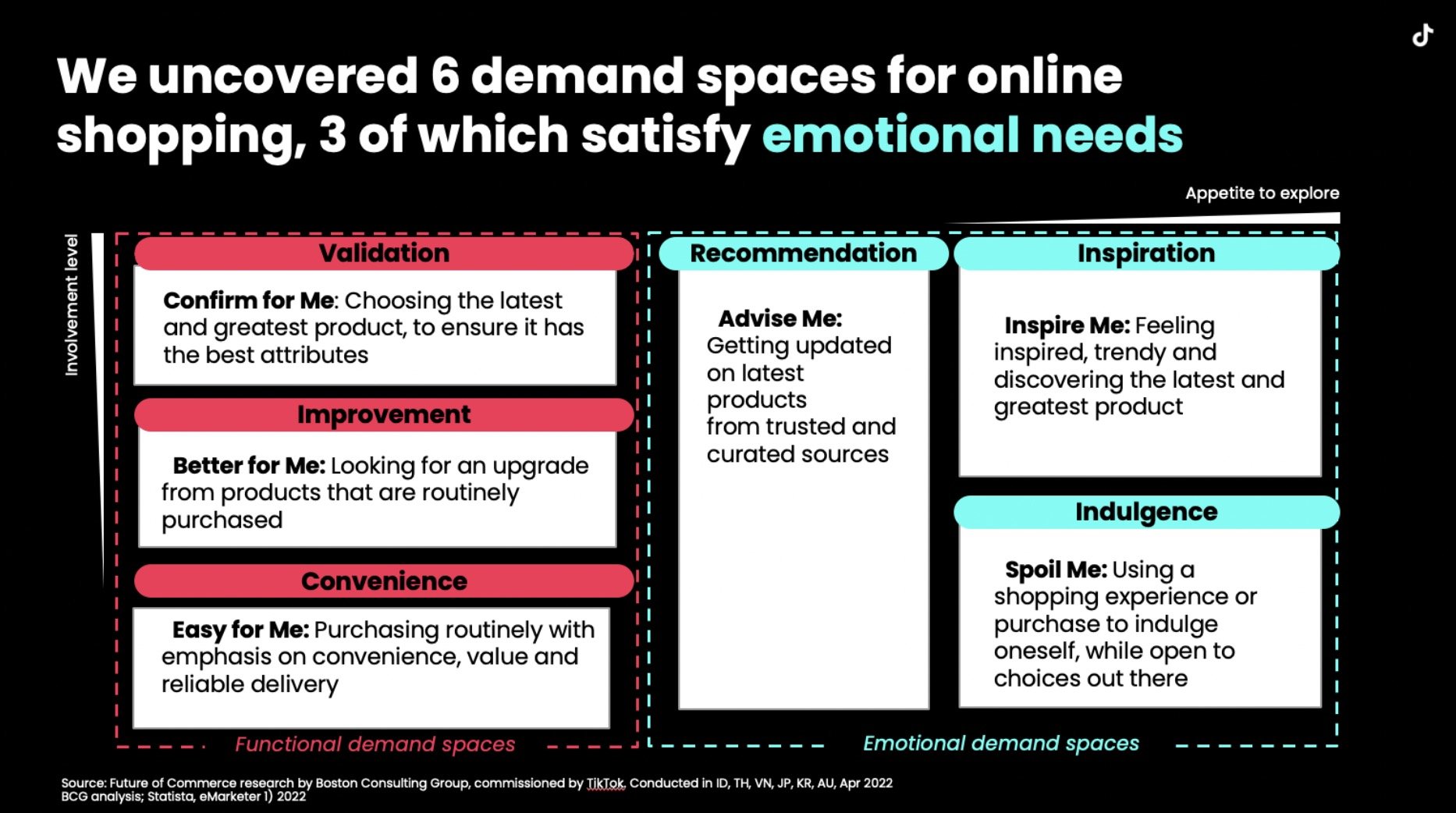

BCG Demand spaces: A powerful tool to uncover needs and unlock disruptive growth

Through BCG’s proprietary demand space framework, we uncovered 6 demand spaces for online shopping, divided into two main groups, functional and emotional demand spaces that will shape how brands engage with consumers.

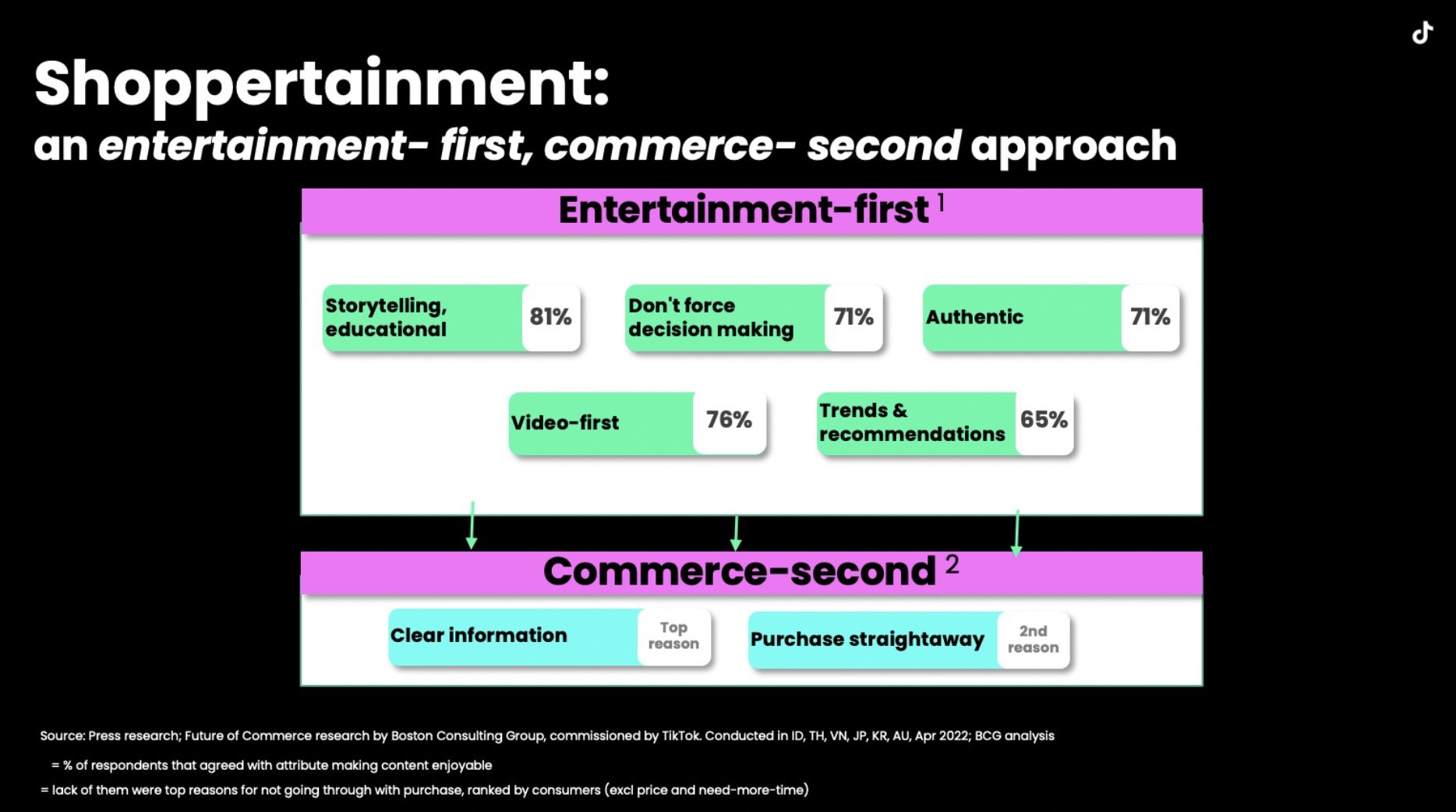

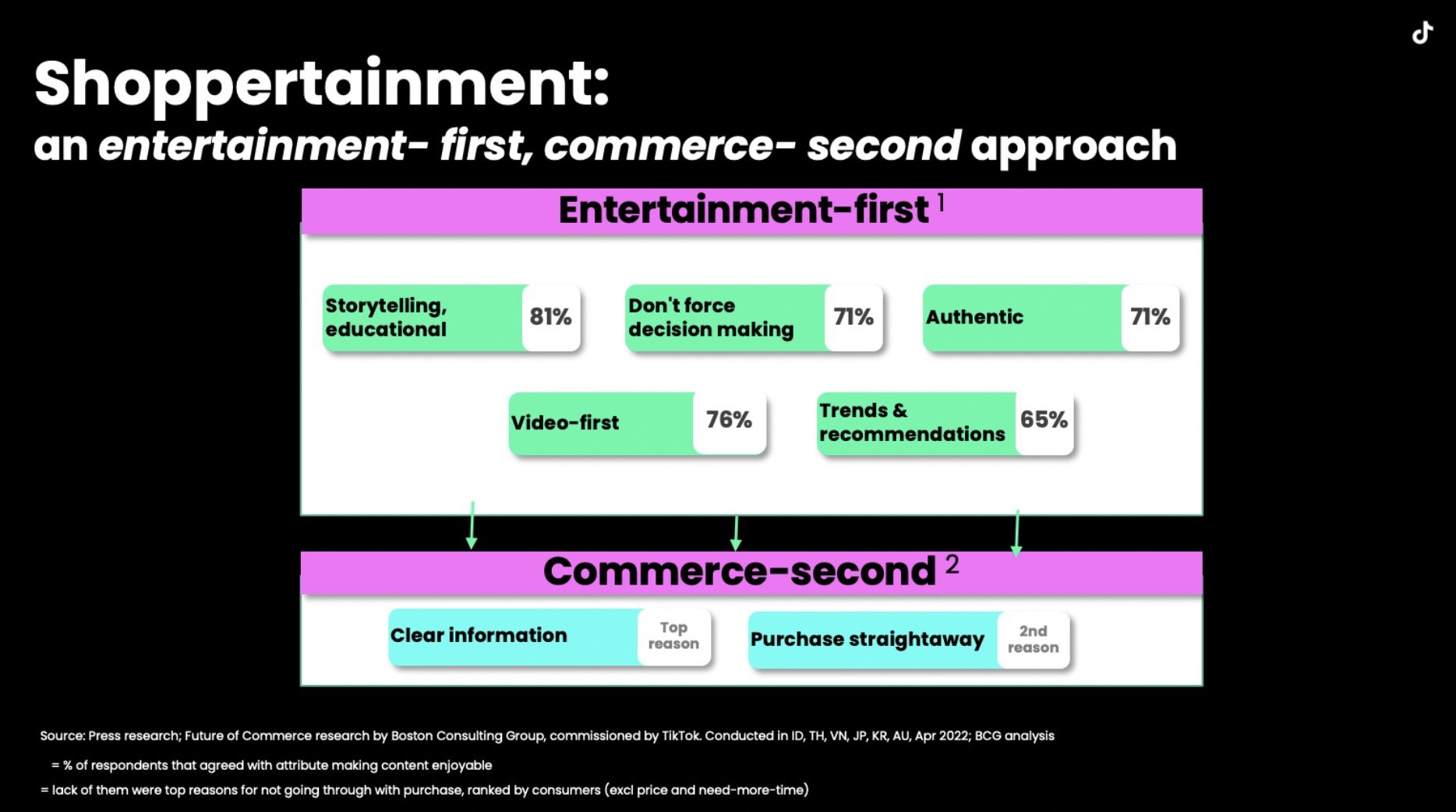

Shoppertainment: an entertainment-first, commerce-second approach

Shoppertainment is the new shopping, driven by immersive entertainment that ignites excitement, trust, knowledge and community passion. Based on findings from our consumers, we observe that the approach to shoppertainment is entertainment-first to commerce-second, centered around 5 key entertainment attributes and 2 key commerce attributes.

Shopping has outranked gaming in the list of Southeast Asian consumers’ top online activities, according to the annual Sync report from Meta and Bain & Company. One reason for this, the report found, is that ecommerce players have evolved by blending shopping with entertainment.

Shoppertainment is defined as content-driven commerce that seeks to entertain & educate first. It combines content, culture & commerce to create highly immersive shopping experiences. The shopping experience can be delivered to consumers through brands, creators, videos, live-streaming, online or physical stores — and achieves its purpose by sparking action within the community, and accelerates the consumers’ path to purchase.

The Shoppertainment opportunity in APAC is projected to expand to a market value of over USD1trillion by 2025, doubling from the USD500bil value today. This is a huge opportunity for marketing leaders willing to commit to fast growing entertainment-first shopping that appeals to emotional demand spaces to capture sustained consumer engagement.

Across APAC, exciting growth potential across key markets, Indonesia is the star-market with high Shoppertainment volume and %share of ecommerce. The Shoppertainment GMV is currently at 6.5Billion USD and will grow at a CAGR of 62% to exceed 27Billion by 2025. Consumers are ready for shoppertainment and the ecosystem is highly mature. When asked about their perception of what makes shopping content entertaining, they prefer short content format so they don’t lose attention. They also enjoy product demos. Indonesia should continue doubling down on scaling up ongoing efforts that work.

Key Takeaways to Act Upon Now

In summary, brands who engage the right Shoppertainment experience with the right strategy have the potential to genuinely engage the consumer, inspiring key brand switching behavior, and capture their future purchasing journeys.

1. Consumer needs have evolved from functional to emotional, and the biggest opportunity for brands lies in the latter. Appeal to consumers’ emotional needs with the right messages as consumers are craving the right entertainment to reignite their purchasing passions.

2. Shoppertainment is the new $1T APAC opportunity redefining the formula of success for brands. Connect with consumers through Shoppertainment, marketers who act first on Shoppertainment can enjoy a valuable opportunity to leapfrog the competition.

3. Today short content format and product demos are two key elements to attract consumers’ attention and drive consideration.