Image source: Khanh P. Dang, Google

Contributors: Seow Ping Tan, Liveramp, Heidi Monro, Twitch, Pauline Lemaire, Criteo, Fai-keung Ng, The Trade Desk, Khanh P. Dang, Google, Vera Wang, TikTok

Introduction: Unlocking the Retail Media Network Potential in Southeast Asia and India

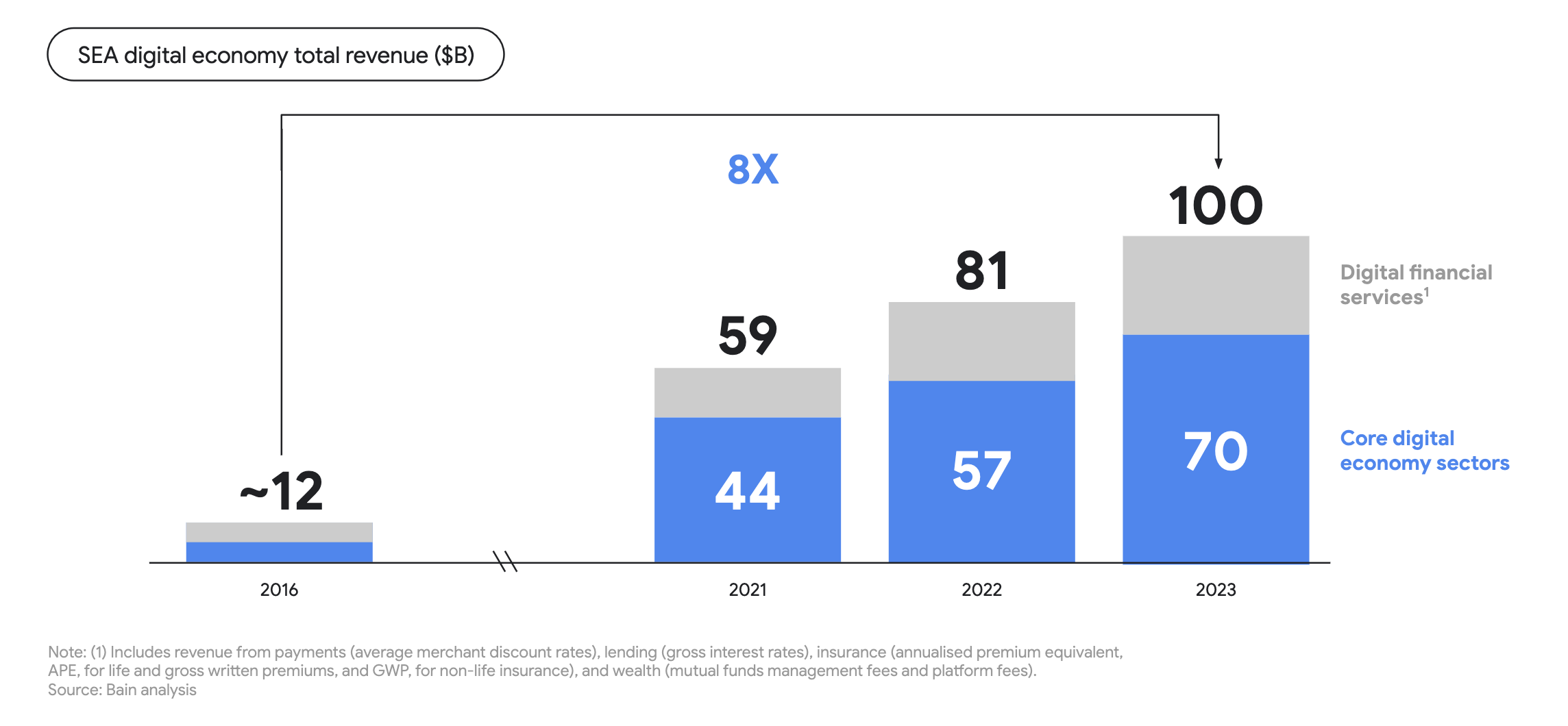

Southeast Asia and India present an unparalleled economic opportunity for retailers, with the digital economy in these regions experiencing meteoric growth. Southeast Asia is on track to generate US$100 billion digital revenue in 2023, an eightfold increase in less than a decade. India aims to reach an impressive US$800 billion by 2030. This boom, powered by a surge in internet penetration and digital engagement, creates a fertile ground for the evolution of Retail Media Networks (RMNs).

Projected to be a US$160 billion global industry by 2025, RMNs offer an untapped avenue for retailers in Southeast Asia and India to optimise their advertising strategies and monetise their platforms effectively. Whether choosing to build their RMNs in-house or partnering with seasoned platforms, retailers have the potential to unlock significant value in this vibrant, rapidly growing digital market. The IAB SEA+India Regional Retail Media Council has responded by assembling a strategic guide to help these retailers harness the potential of RMNs and ensure they are poised to lead in the retail media domain.

RMN Opportunities

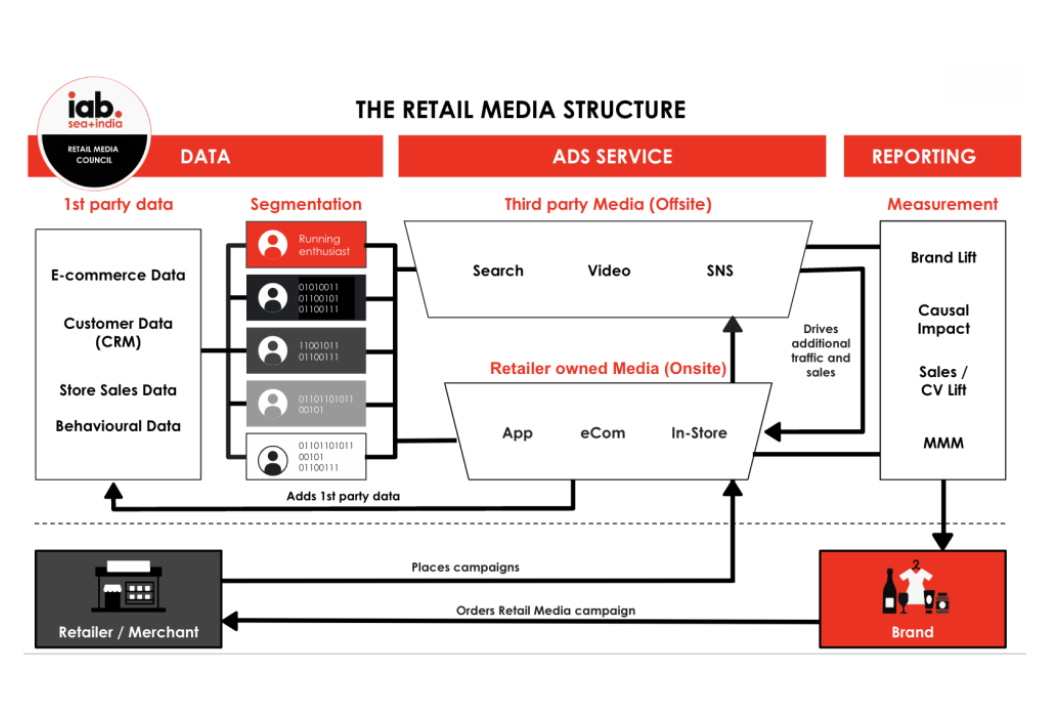

An RMN is a sophisticated advertising framework that empowers brands to display their ads on a retailer’s various digital properties. By doing so, it provides retailers with an avenue to generate revenue from their digital spaces. It offers brands targeted access to consumers at pivotal decision-making moments in the shopping journey.

The advantages of RMNs, particularly in the dynamic markets of Southeast Asia and India, are multifaceted:

-

Strategic Placement – RMNs enable brands to engage with customers at the ‘lower funnel,’ which is closer to the point of purchase, thus increasing the likelihood of conversion.

-

Multifaceted Advertising Solutions – Advertisers can leverage many formats, from banner ads to immersive video content, ensuring visibility at different touchpoints on the e-commerce platform.

-

Data-Rich Targeting – RMNs offer the advantage of leveraging shopper data to craft personalised advertising experiences, enhancing relevance and efficiency.

-

Cross-Platform Reach – With RMNs, ads aren’t confined to just the retailer’s site; they can extend to external sites and social media, broadening the potential consumer base.

-

Additional Revenue Streams – Retailers benefit from a new revenue stream as they monetise their digital real estate, with top RMNs generating 2-5% of their Gross Merchandise Value (GMV) in ad revenue.

In the dynamic regional landscape of RMNs, we witness a diverse array of platforms capitalising on this model:

-

Online Marketplaces – In Southeast Asia, platforms like Carousell, Lazada, Shopee, TikTok Shop and Tokopedia have become cornerstones for RMNs, leveraging their high user engagement to offer targeted advertising spaces. In India, giants like Flipkart and Amazon India are key players, offering extensive reach and sophisticated ad solutions within their online marketplaces.

-

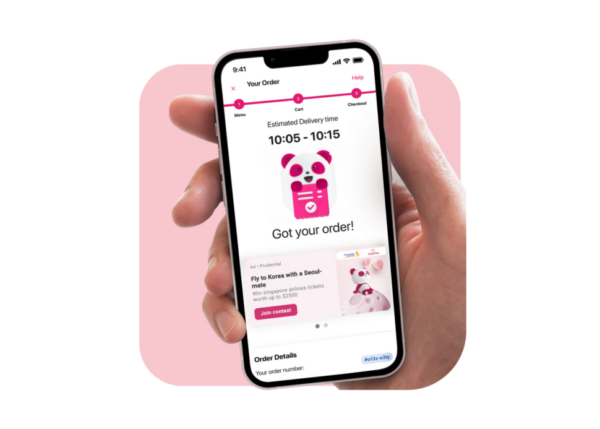

Commerce Intermediaries & Delivery Providers – Grab and Foodpanda exemplify how delivery services in Southeast Asia are transforming into advertising hotspots by utilising customer touchpoints during the ordering process. Similarly, in India, Swiggy and Zomato are pioneering this space, allowing brands to engage with consumers right up to the moment of purchase.

-

Mass Merchant Retailers – FairPrice in Southeast Asia stands out as a mass merchant retailer utilising its platform for advertising, much like Big Bazaar in India, which leverages its vast customer base for tailored promotions and ads within its shopping ecosystem.

These examples underscore the strategic importance of RMNs in facilitating a direct connection between brands and consumers, with the added sophistication of data-driven targeting, right in the epicentre of regional digital commerce growth.

RMNs in Southeast Asia and India are swiftly becoming cornerstones of brand advertising, where language, currency, and cultural nuances play pivotal roles in shaping marketing strategies. These vibrant digital economies are not just burgeoning; they are rich with diversity that demands considered approaches to consumer engagement. Here, RMNs provide a fertile ground for endemic and non-endemic brands to thrive.

Endemic brands naturally fit within the retail platform’s environment because they sell their products or services directly through the retailer. Since they are part of the retail network’s inventory, their marketing efforts can be highly targeted and relevant to shoppers already in a buying mindset. These brands enjoy the advantage of close alignment with the customer’s shopping journey, enabling them to influence purchase decisions at critical touch points effectively. For example, Coca-Cola Indonesia teamed up with GrabAds during the FIFA World Cup 2022 to boost sales and brand presence on the Grab app by targeting high-value customers, resulting in a significant increase in on-platform sales. The campaign was notably influential in reaching new and returning customers, with 66% of orders coming from new users or those who had not ordered in the past month.

sell their products or services directly through the retailer. Since they are part of the retail network’s inventory, their marketing efforts can be highly targeted and relevant to shoppers already in a buying mindset. These brands enjoy the advantage of close alignment with the customer’s shopping journey, enabling them to influence purchase decisions at critical touch points effectively. For example, Coca-Cola Indonesia teamed up with GrabAds during the FIFA World Cup 2022 to boost sales and brand presence on the Grab app by targeting high-value customers, resulting in a significant increase in on-platform sales. The campaign was notably influential in reaching new and returning customers, with 66% of orders coming from new users or those who had not ordered in the past month.

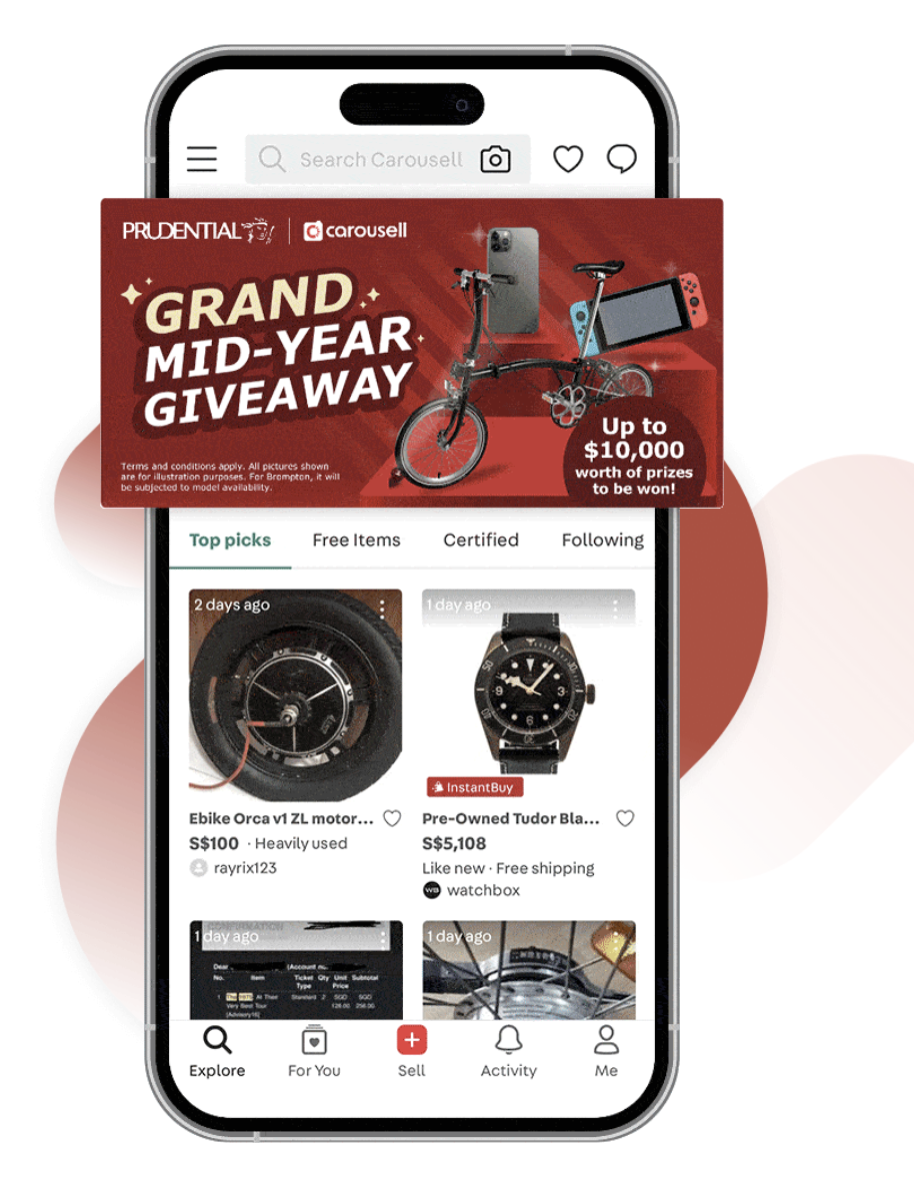

On the other hand, non-endemic brands, though not selling directly on these platforms, recognise the value of the vast audiences that RMNs provide. These brands use RMNs to increase brand awareness and engage with potential customers. For example, leading insurance provider Prudential partnered with Carousell Media Group for a Grand Mid-Year Giveaway campaign, targeting users interested in popular categories like Bicycles, Video Gaming, and Mobile Phones. Carousell-exclusive gifts, attracting substantial interest with a solid click-to-lead rate, resulting in over 2,200 qualified leads within three weeks, surpassing their KPI ahead of schedule. Leveraging Carousell’s insights into top searches, this targeted approach and native advertising integration yielded a successful lead generation drive for Prudential’s insurance services, contributing to a 26-28% increase in daily leads.

On the other hand, non-endemic brands, though not selling directly on these platforms, recognise the value of the vast audiences that RMNs provide. These brands use RMNs to increase brand awareness and engage with potential customers. For example, leading insurance provider Prudential partnered with Carousell Media Group for a Grand Mid-Year Giveaway campaign, targeting users interested in popular categories like Bicycles, Video Gaming, and Mobile Phones. Carousell-exclusive gifts, attracting substantial interest with a solid click-to-lead rate, resulting in over 2,200 qualified leads within three weeks, surpassing their KPI ahead of schedule. Leveraging Carousell’s insights into top searches, this targeted approach and native advertising integration yielded a successful lead generation drive for Prudential’s insurance services, contributing to a 26-28% increase in daily leads.

In both scenarios, RMNs in Southeast Asia and India offer a data-driven, performance-oriented advertising environment that benefits brands looking to maximise their visibility and sales at a local market level. Endemic brands align their marketing closely with consumer intent, whereas non-endemic brands capitalise on the opportunity to engage with a broad audience in a retail context. As these digital ecosystems evolve, the sophistication of RMN strategies will likely increase, presenting even more curated opportunities for brands to connect with consumers.

Strategies for Developing a Strong Regional RMN

Establishing a robust RMN in the diverse and multifaceted markets of Southeast Asia and India necessitates a customised approach—grounded in understanding and leveraging the distinct local dynamics and consumer patterns. This strategic blueprint begins by setting region-specific success metrics. It extends through local data audits, technical adaptation, and scalable tech foundations, all the way to fostering local partnerships and continuous market-specific optimisation.

Step 1: Define Local Success Metrics

-

Set objectives that resonate with the unique consumer behaviours in different Southeast Asian and Indian markets.

-

Customise Key Performance Indicators (KPIs) for stages such as Awareness, Consideration, and Decision, reflecting regional purchase triggers and cultural nuances.

Step 2: Local Data Audit for In-depth Insights

-

Gather region-specific consumer data, understanding that preferences and behaviours may vary significantly between countries in these regions.

-

Develop a strategy for addressing local data privacy regulations, which can differ from one country to another.

Step 3: Regional Technical Readiness and Compatibility

-

Assess the digital infrastructure with a local lens, ensuring that the RMN can handle linguistic diversity and regional payment preferences.

-

Plan for technical enhancements that cater to regional connectivity variations, like supporting mobile-heavy user bases in rural areas.

Step 4: Build a Locally Scalable Tech Foundation

-

Select a technology framework that can grow with the region’s unique digital landscape, including high mobile usage and social media integration.

-

Prioritise a flexible content management system (CMS) and customer relationship management (CRM) platform for regional customisation and local language support.

Step 5: Establish a Data-Driven Ad Ecosystem with Local Relevance

-

Create ad products that leverage local consumer insights, using data to deliver culturally and regionally relevant messages.

-

Use AI to predict and respond to local market trends, seasonal events, and festivals, pivotal in Southeast Asia and India.

Step 6: Cultivate Regional Partnerships

-

Partner with local brands, content creators, and influencers to ensure the RMN’s offerings are culturally resonant.

-

Engage with local authorities, trade bodies, and industry alliances to align with regional economic initiatives and digital policies.

Step 7: Test with Local Pilot Programs

-

Begin with region-specific pilot campaigns to test and learn what resonates best with local audiences.

-

Collect feedback to fine-tune the RMN for each market, respecting diverse consumer expectations and shopping behaviours.

Step 8: Optimise for Local Markets Continuously

-

Continuously adapt the RMN based on regional consumer trends, feedback, and performance data.

-

Embrace regional innovation trends to keep the network relevant and ahead of the curve in these dynamic markets.

Localising the RMN process ensures that the network is not just a copy-paste of global models but a platform that reflects the diverse array of languages, cultures, and consumer attitudes in Southeast Asia and India.

Advantages of In-House RMN Development

Creating a proprietary RMN offers retailers in Southeast Asia significant benefits by leveraging the region’s unique digital landscape and consumer behaviour. With access to extensive first-party data from a diverse and growing digital consumer base, retailers can provide targeted and contextually relevant advertising directly within their ecosystem. This enables highly personalised shopping experiences, enhancing customer satisfaction and fostering loyalty. Such networks also present opportunities for regional brands to advertise across multiple markets through a single platform, ensuring consistent messaging that resonates with the local culture and shopping habits.

Moreover, in a region characterised by rapid digital adoption and a mobile-first consumer approach, retailers can gain a competitive edge by offering tailored advertising solutions. By operating their networks, they maintain control over ad placements and brand environment, ensuring that promotions are pertinent and aligned with their values. This self-sufficiency in the advertising realm not only boosts revenue streams but also strengthens the retailers’ market position by offering a unique value proposition that external networks cannot match, making them more agile and adaptable to the fast-paced changes in Southeast Asia’s digital markets.

Foodpanda, a leading on-demand food de livery service in Southeast Asia, has built its own RMN to leverage its widespread on-demand delivery ecosystem, allowing brands to seamlessly reach a broad and engaged consumer base across Southeast Asia. The in-house panda ads platform facilitates this by offering integrated advertising solutions within its food delivery and quick-commerce channels. It ensures foodpanda maintains control over the end-to-end advertising process—from campaign creation to data analytics. This also provides advertisers with a contextually relevant, single point of contact for reaching diverse markets and both local and global audiences effectively.

livery service in Southeast Asia, has built its own RMN to leverage its widespread on-demand delivery ecosystem, allowing brands to seamlessly reach a broad and engaged consumer base across Southeast Asia. The in-house panda ads platform facilitates this by offering integrated advertising solutions within its food delivery and quick-commerce channels. It ensures foodpanda maintains control over the end-to-end advertising process—from campaign creation to data analytics. This also provides advertisers with a contextually relevant, single point of contact for reaching diverse markets and both local and global audiences effectively.

Maximising Potential Through Strategic Technology Partnerships

In a dynamic regional retail landscape, retailers are enhancing their competitive advantage and driving more significant returns on investment by entering strategic technology partnerships. This allows them to tap into the advanced technology and specialised skills of these platforms, avoiding the need for substantial in-house development.

By collaborating, a retailer can immediately utilise a broad suite of advertising tools and access comprehensive market analytics, enabling targeted and efficient advertising spending. This is particularly advantageous in the culturally diverse and fragmented market of Southeast Asia, where understanding local consumer behaviours is crucial for advertising success. Tech partnerships allow retailers to focus on their core business operations while still securing a robust and flexible presence in the digital advertising space.

Regional examples include:

Audience Extension with NTUC FairPrice and The Trade Desk

NTUC FairPrice, a major retailer in Singapore, leveraged The Trade Desk’s capabilities to tap into a sophisticated programmatic advertising platform. This partnership enabled FairPrice to harness advanced data analytics and targeting tools, enhancing its ability to reach customers effectively. By collaborating with The Trade Desk, FairPrice delivers personalised advertising at scale, navigating the complexities of Asia’s diverse markets without investing heavily in their digital infrastructure, ensuring their marketing efforts are efficient and impactful.

Data-Driven Decisions with LiveRamp and Carousell Media Group

LiveRamp provides identity resolution that enhances an RMN’s ability to link customer data across channels, leading to better personalisation and customer insights. Carousell Media Group is integrating LiveRamp’s data collaboration platform, which includes LiveRamp’s Authenticated Traffic Solution (ATS), to safely and securely support Carousell’s RMN. ATS allows Carousell to enhance addressability with LiveRamp’s pseudonymous, people-based identifier, increasing the value of Carousell’s media inventory across all channels.

Performance-Driven Solutions with Criteo and GroupM

Criteo announced its partnership with GroupM in APAC to strengthen omnichannel commerce media capabilities for GroupM clients in the region. This partnership combines product sales data and the proprietary media solutions of GroupM with privacy-safe commerce audiences and proximity-based insights provided by Criteo. Criteo’s insights technology will further enhance media planning, budget allocation and best-in-class activation, enabling new levels of relevance, optimisation and conversion for GroupM clients across all channels.

Cloud and AI Integration with Aeon Retail and Google

Aeon Retail has partnered with Google to utilise the Google Cloud Platform, improving data analysis and customer engagement through the AEON Shopping App and facilitating targeted advertising and personalised promotions. This collaboration has streamlined operations, leading to the launch of AEON AD, a platform that boosts customer purchases and enhances the overall shopping experience while ensuring data privacy.

Cloud and AI-Powered Service Delivery with Grab and Microsoft Azure

In 2018, Grab and Microsoft’s cloud platform Azure began a five-year collaboration on technology projects like big data and AI to revolutionise digital services in Southeast Asia. The partnership enhances Grab’s service delivery through advanced AI capabilities, including new authentication mechanisms, fraud prevention, and personalised user experiences.

In a competitive regional retail sector, strategic technology partnerships are crucial, providing RMNs with advanced targeting and data analysis tools essential for reaching and understanding the diverse consumer base. These collaborations are vital for retailers to enhance consumer engagement and drive sales in a digitally evolving marketplace.

Conclusion: Embracing Retail Media’s Future in Southeast Asia

With the regional digital consumer audience expanding, retailers from Southeast Asia are recognising advertising as a potent tool. The successes of both multinational corporations and brick-and-mortar stores in harnessing their audience data underline the vast potential of retail media in the region. The future belongs to retailers who adapt, understanding the ever-evolving landscape of retail media.

The intersection of strategic technology partnerships, endemic and non-endemic brand participation, and the agile balance between in-house development versus outsourcing constructs a matrix that retailers must navigate to maximise their digital revenue potential. A potent RMN in these regions must be built on the foundation of deep market insights, harnessing the power of local consumer data, and operating within the regional context of cultural diversity and distinct market dynamics.

From the examples we’ve discussed to the strategies outlined, the emphasis remains clear: a strong RMN must be rooted in the regional fabric, speaking directly to the needs and behaviours of local consumers. The alliance between retailers and strategic tech partners in Southeast Asia and India is more than a marriage of convenience—it’s a necessity for navigating the complex digital terrains of these markets.

In closing, whether retailers craft their RMNs in-house and engage with seasoned platforms, the success of such networks will hinge on their ability to integrate seamlessly with the retail ecosystems they support. As this integration deepens, RMNs will become not just channels for advertising but crucial pillars for the comprehensive digital experiences that consumers demand.

The growth trajectory of RMNs presents an exciting challenge to innovate, localise, and personalise in a way that resonates with a new generation of digital consumers. Retailers that recognise and rise to this challenge will not only thrive in the present but will set the stage for continued success in the vibrant digital future of Southeast Asia and India.