A study on advancing TV transformation

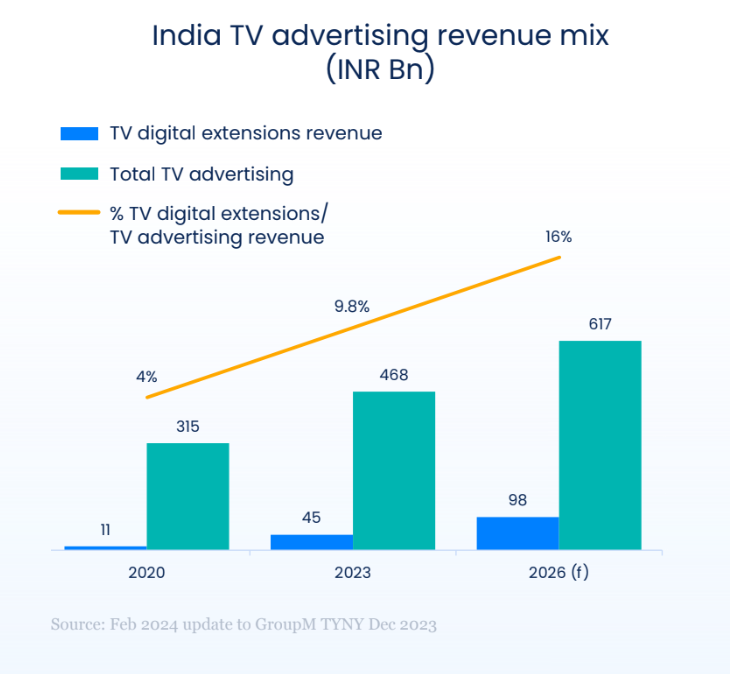

Addressable Advertising Accounted for 9.8% of Total TV Ad Revenues in India in 2023

The addressable advertising segment experiences exponential growth in the Indian market propelled through widespread CTV adoption

Mumbai, February 27, 2024

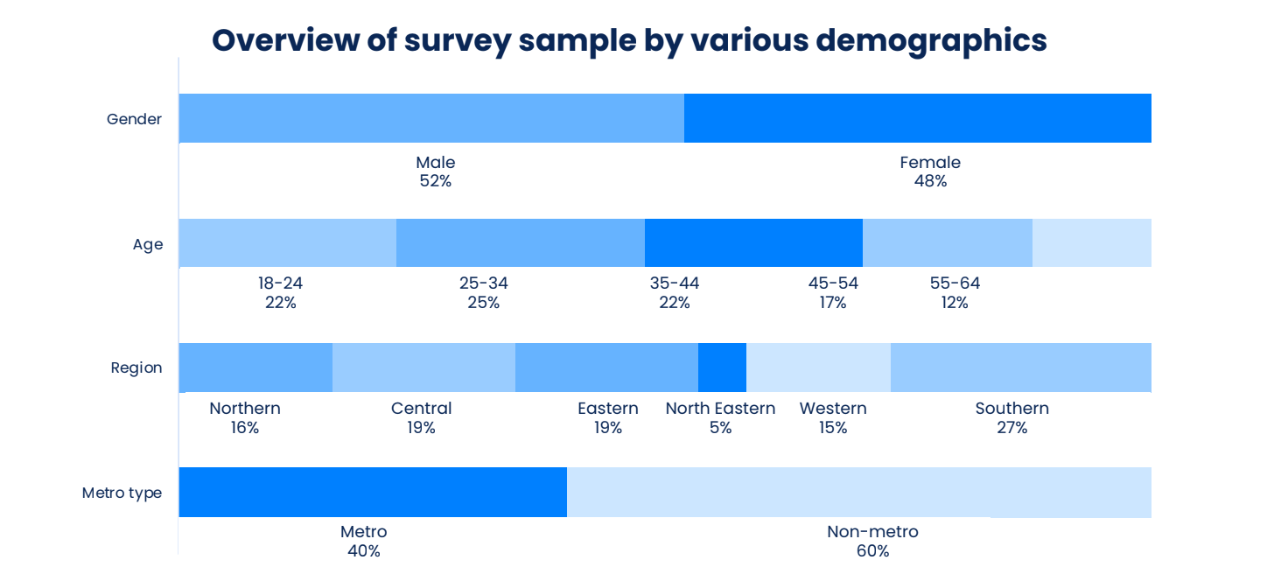

GroupM, WPP’s media investment group, launched the second edition of “The Changing Landscape of Indian Television” on the state and potential of Addressable TV in India today. The report survey by Ampere Analysis that graphed responses from 4000 respondents delves into the significant transition fromlinear TV to CTV within the Indian TV industry, highlighting the subsequent transformation in audience media consumption patterns. It dives deep into how these can be leveraged by advertisers and broadcasters alike to optimize ad spend and enhance audience engagement.

edition of “The Changing Landscape of Indian Television” on the state and potential of Addressable TV in India today. The report survey by Ampere Analysis that graphed responses from 4000 respondents delves into the significant transition fromlinear TV to CTV within the Indian TV industry, highlighting the subsequent transformation in audience media consumption patterns. It dives deep into how these can be leveraged by advertisers and broadcasters alike to optimize ad spend and enhance audience engagement.

The 2nd edition of report “The Changing Landscape of Indian Television” indicates that addressable advertising presents unprecedented opportunities to refine audience targeting and is set to surpass 13% of total TV (linear TV and digital extensions of TV) ad revenues in India by 2025– underscoring a substantial shift in the advertising paradigm. It reflects on the growing importance of targeted and personalized approach in the Indian marketing mix.

Prasanth Kumar, CEO – GroupM South Asia, said: “Embracing the transformative tide of technology, our evolving TV landscape in India, from terrestrial to Connected TV, embodies a journey of perpetual adaptation. Serving as the adhesive in Indian households, TV not only unites families but now, with newfound digital capabilities, empowers brands to engage meaningfully. In this age of attention economy, where convenience meets engagement, our commitment is to unlock the power of TV advertising through Advanced TV solutions, fostering a future characterized by insight and fascination for advertiser and broadcaster alike.”

Atique Kazi, President – Data, Performance & Digital Products – GroupM India said: “As we navigate the dynamic landscape of television advertising in India, the forecast of a 10% CAGR growth over the next five years signals a remarkable evolution. The surge in Connected TV advertising, anticipated at an impressive 31% CAGR, underscores the pivotal role it plays in reshaping our television ecosystem. Recognizing the importance of engaging with elusive cord-cutters and cord-nevers, this report delves into the transformative factors and societal influences driving this evolution. Our aim is twofold: to dissect the growth drivers and to provide a profound understanding of addressable TV viewers and their evolving preferences, illuminating the path forward in this exciting era of television.”

Key takeaways for brands and advertisers

-

- 9.8% of total TV ad revenue was from long-form streaming video in 2023, and this is

expected to surpass 13% by 2025 with free, ad-funded services and subscription hybrid products expected to generate most of this growth

expected to surpass 13% by 2025 with free, ad-funded services and subscription hybrid products expected to generate most of this growth - Addressable TV homes to surpass 45 Mn by end of 2024, covering 21% of Indian TV Homes; a growth of 32% over 2023

- 117% growth in delivery of paid media to CTV devices from 2022-2023

- CTV growth emerges from HSM markets, witnessing 4X growth in impressions

from Maharashtra, Haryana, UP, MP, Jharkhand, Uttarakhand, Chhattisgarh & Bihar over last 12 months. Karnataka leads growth in South with 7X growth

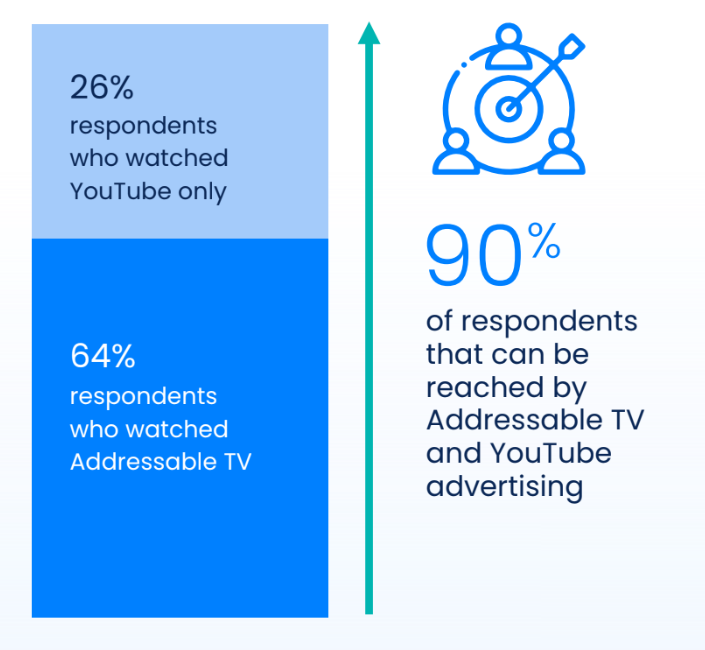

from Maharashtra, Haryana, UP, MP, Jharkhand, Uttarakhand, Chhattisgarh & Bihar over last 12 months. Karnataka leads growth in South with 7X growth - The survey stated that two-thirds of the respondents expressed that they found ads on OTT services more appealing and relevant than their linear TV counterparts, and 41% declared willingness to view ads on OTT Service to reduce subscription costs

- Two-thirds of the respondents co-view while watching addressable TV services, making it comparable to traditional TV viewing patterns

- 11% of respondents are of cord-cutters but 54% of those cord-cutters continue to watch addressable TV services

- 9.8% of total TV ad revenue was from long-form streaming video in 2023, and this is

Additionally…

Nearly half the respondents had a smart TV, and a quarter of those who did not have one expressed intent to buy one within a year. Among respondents in the NCCS A:B grades, 67% recently watched addressable TV and respondents watching addressable TV reported average household incomes 9% greater than respondents watching Free TV.

This comprehensive analysis by GroupM not only highlights the dynamic nature of India’s TV advertising realm but also presents substantial opportunities for advertisers to refine their targeting strategies, promising a future of advertising characterised by precision, engagement, and insight.