Guidebook | Authors: Anil Tirunagari Google Asia Pacific Pte Ltd, Roopa Dhawan Google Asia Pacific Pte Ltd, Shilpa Kolte Xandr, Gregory Fournier Unruly Group, Cheeri Leo Twitch, Delilah Chan TikTok SEA

This Guidebook is designed to present a standardised view of the Streaming industry. It clarifies definitions of the different forms of Streaming, the size of the opportunity and provides a fresh point of view when looking at this opportunity versus traditional planning and buying media. It is relevant for all levels of Media Planners and Buyers.

Executive Summary:

Since the advent of the Internet to the present day, the world of digital video has been changing at a rapid pace. The last five years have seen exponential growth due to increased access to high bandwidth data and smartphones. Adding to the hockey stick growth has been the impact of Covid which forced people to stay at home and consume even more digital video. The ecosystem has seen such tremendous growth that every 3 months the landscape changes with emerging technologies, players, platforms and devices.

Each of these dimensions quickly go from emerging to mature in no time. This has brought an influx of new names, jargon, acronyms and terms such as OTT, CTV, Streaming etc, that generate not only excitement but also a fair bit of confusion and overlap.

This Guidebook scopes out digital video, its evolution, definitions, industry size, emerging platforms such as connected TV and live streaming, consumer profile and others. We hope this will help marketers and media practitioners tap into this exploding opportunity.

The Great Pandemic Shift to Online

-

-

Covid has accelerated the migration of users from offline to online

-

Digital video has exploded exponentially in the new stay-at-home paradigm

-

Streaming services such as Netflix, Prime, and Disney went from niche to mainstream

-

Video entrenched deeply on social platforms such as YouTube, Facebook, Instagram, and Tiktok

-

Two new stars: Connected TV and Live streaming

-

Explosion of Connected TV

-

Live streaming = Live Gaming + Live Shopping

-

Digital video has gone from cat & catch-up videos to the prima donna world of premiers, originals and blockbusters.

-

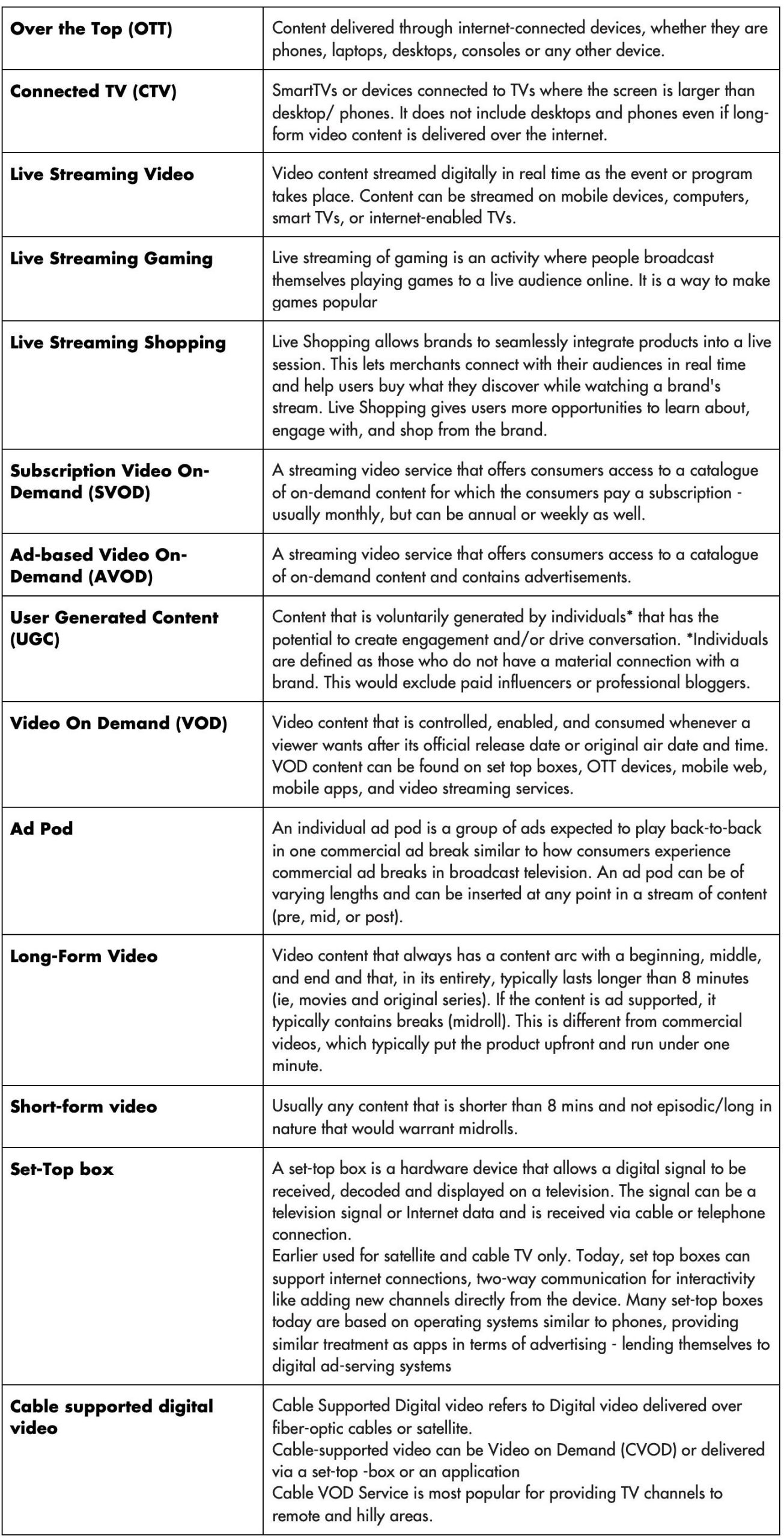

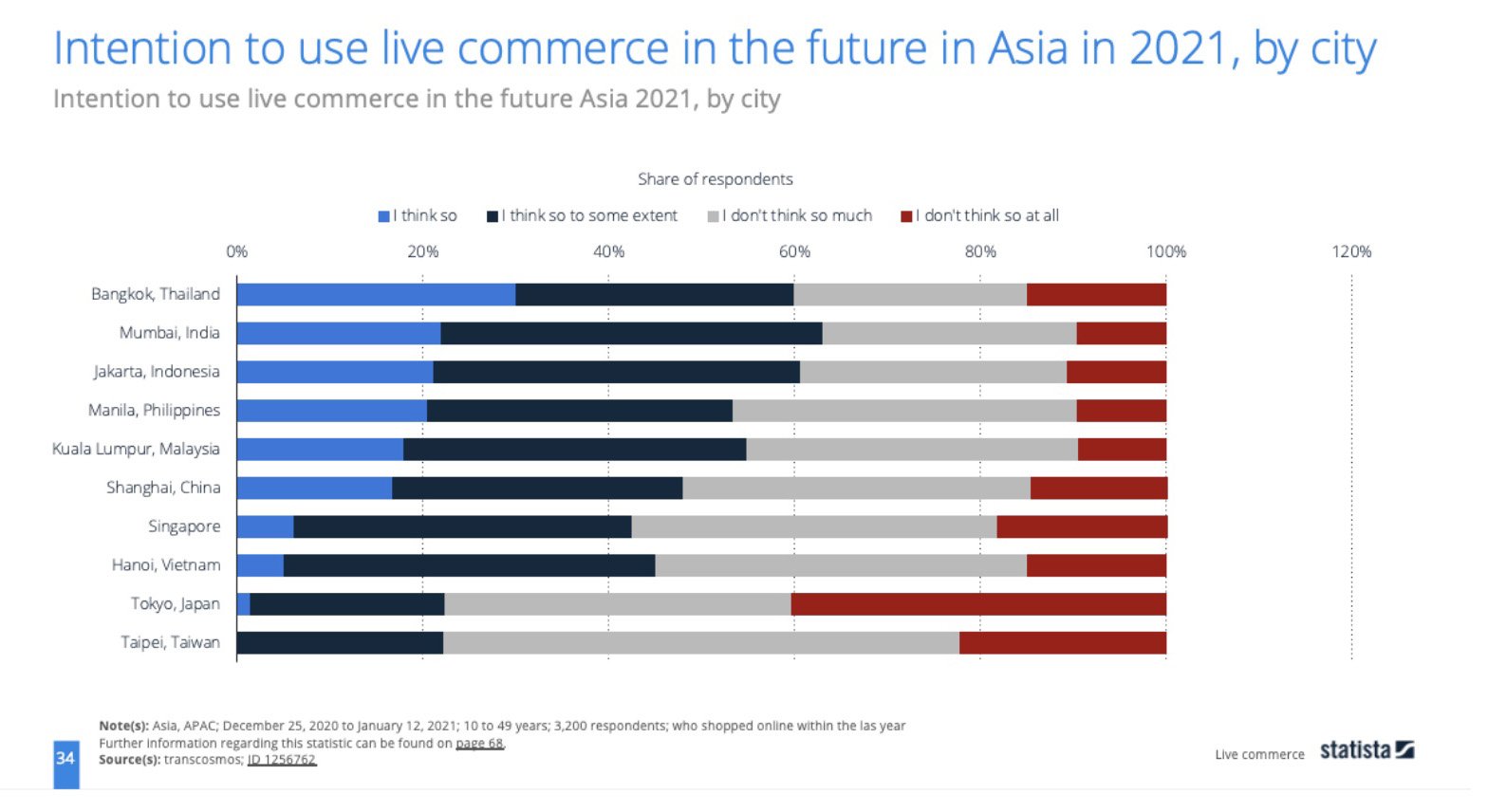

Covid has accelerated the migration of users from offline to online. In a report by Google, Temasek, and Bain & Company, Southeast Asia is charging ahead at full steam, having added 60M new digital consumers to the internet economy since the pandemic started. 20M of them joined in H1 2021 alone. It took four years to add 100M users and just less than 1.5 years to add 60M, bringing the internet penetration in Southeast Asia (SEA) to 75%.

In India,within six months of Reliance Jio’s launch the country became the top mobile data user across the world, consuming more than 1 billion GB of data every month, compared with 200 million GB earlier. In H1 2021, 97.4% of internet users in India said they had watched digital video content in the previous month.

Digital video has skyrocketed exponentially in the new stay-at-home paradigm. Streaming services such as Netflix, Prime, and Disney went from niche to mainstream. Video entrenched deeply on social platforms such as YouTube, Facebook, Instagram, and Tiktok. According to the eMarketer, in many countries, digital video has overtaken broadcast TV.

Specifically, in India, Broadcast TV was still viewed more widely than most digital alternatives. However, thanks to the range of digital viewing options, video streaming reached more people than live TV. In H1 2021, 97.4% of internet users in India said they had watched digital video content in the prior month. That activity accounted for 1:49 per day, on average, compared with 1:31 spent with broadcast TV. In Southeast Asian countries, social networking and digital video go hand-in-hand. For example, as of H1 2021, nearly 97% of Indonesia’s internet users had streamed video content of some kind in the prior month, whether via free services like YouTube or paid-for sites. Online TV and video content occupied an average 1:07 per day. And this percentage has increased significantly compared with the previous year of 2020.

Two new stars: Connected TV and Live streaming. Smart TVs are gaining ground as high-quality in-home viewing becomes a must-have. According to the same report from eMarketer, except for a few countries, smart TV ownership rose by several percentage points year on year. In many cases, that lifted penetration above 50% for the first time. Across India and Southeast Asia this trend is picking up momentum, with 20 million in India, and 25 million in Vietnam specifically watching YouTube on their CTVs.

Live streaming = Live Gaming + Live Shopping. The live streaming industry has grown by 78.5% from 15.6 billion hours of content in 2019 to 27.9 billion hours in 2020. This was a record-breaking number in which the global lockdown accelerated the world’s appetite for live streamed content as the value of live streaming was thrust front and center where people joined communities to connect and interact with others.

Digital video has gone from cat and catch-up videos to the prima donna world of premiers, originals, blockbusters, and live streaming of gaming and shopping. Let’s dive in and understand the changing landscape of Digital Video. What constitutes digital video? How do you define OTT? Are OTT, Streaming, and CTV synonymous or is one a subset of the other?

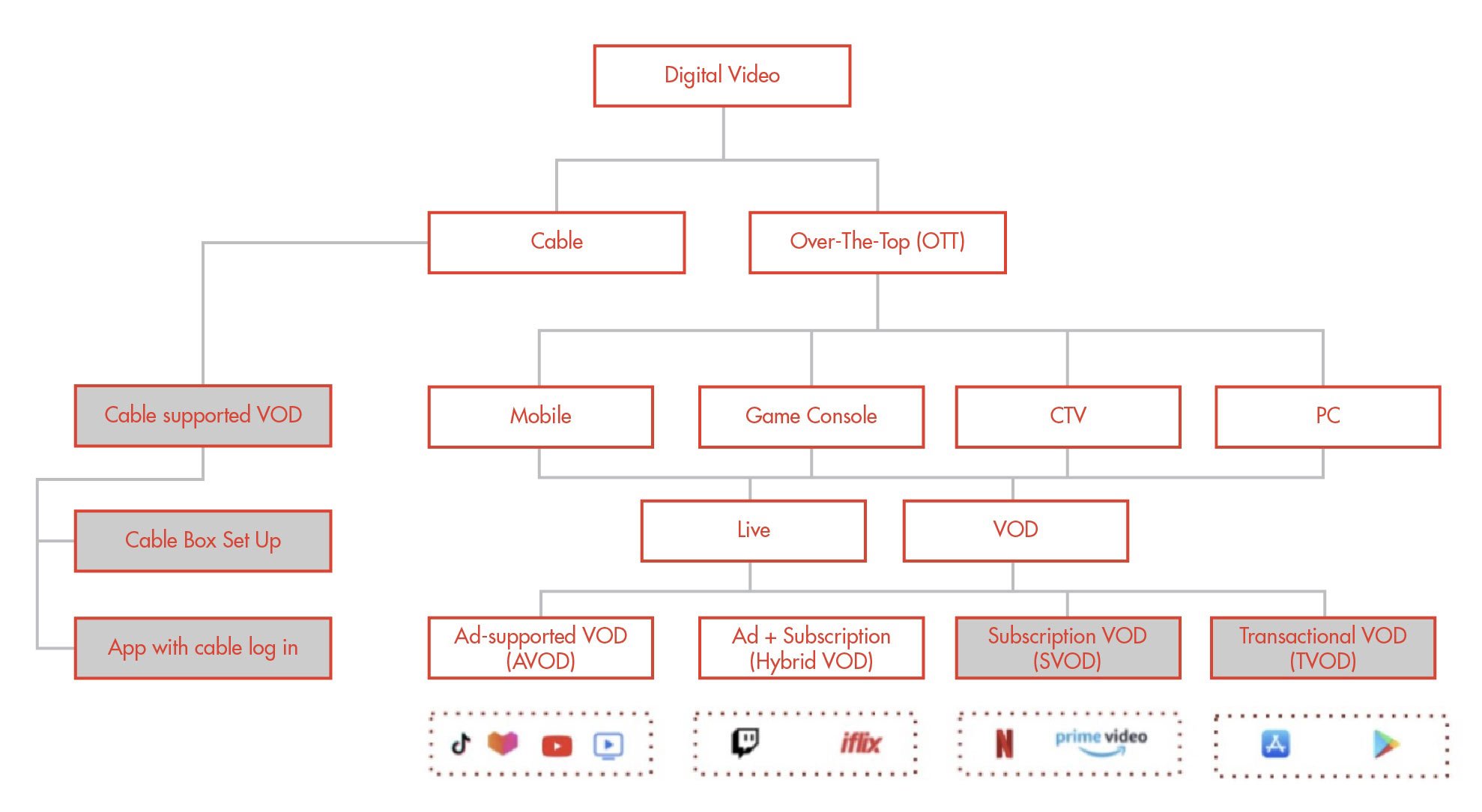

How do you define the OTT/Streaming/CTV industry? OTT/Streaming/CTV = Digital Video

Ever since the early days of 2000s, digital content has skyrocketed and consumers have unlimited choice and this trend only continues to accelerate. While the Internet became a catch net for all sorts of traditional video, a new generation of user generated content took shape that never existed before. Besides popular music, drama and movies, cat memes flooded the Internet and digital video led the torch of cultural zeitgeist. The combination of social networks and device platforms truly democratised video creation and today we see video fit every span of attention, from tiny vanishing Snaps to racing TikToks, to live shopping to streaming to binge-worthy dramas from global and local content platforms. Today, we can see video anywhere, anytime, in any length, on mobile, computers and CTVs. We can interact with them and connect to other aspects of life like cooking, DIY, learning, playing, and shopping. So, it is better for us to think of digital video in a broader context and understand new terms, products, platforms, and offerings.

In this guidebook, when we say OTT or streaming or CTV, they all fall under the category of digital video.

How to visualise OTT, Streaming and CTV

Note 1: this is not a one-stop visual model, but one of the many ways of visualizing the world of digital video.

Note 2: Cable, SVOD and Transactional Video are greyed out because they are not ad-funded platforms.

Note 3: The examples are just to help readers relate the terms with real-world players. They are not exhaustive.

Below is a glossary of terms with which you should familiarise yourself :

4G Access & Covid: The last 5 years has seen an unprecedented shift to online due to two factors: First, low cost access to the Internet via 4G; and secondly, Covid-19.

Quartz India published an article in September 2021 reporting that in 2015, not long after India first got high-speed 4G internet, the cost of 1GB of mobile data in India was 225 rupees ($3). But just over five years later, the industry has witnessed a remarkable decline in pricing that helped truly launch the country’s internet economy. Reliance offered customers an irresistible deal—4GB of data a day for free. Within six months of Reliance Jio’s launch, India became the top mobile data user across the world consuming over 1 billion GB of data every month in comparison with 200 million GB earlier. A far wider range of tech services—from entertainment to payments—became accessible to millions more of the country’s 1.3 billion people.

A similar access story plus the Covid-19 stay-at-home necessity meant that “digital consumption is now ingrained as a way of life in Southeast Asia. Early adopters have deepened usage – pre-pandemic users are consuming four more digital services than they did before 2020 – and the 60M consumers who joined since the pandemic started are here to stay, with 9 in 10 consumers who tried a new digital service in 2020 continuing to use the service in 2021, according to a report by Google, Temasek and Bain & Company.

Source: e-Conomy SEA 2021 report by Google, Temasek, and Bain & Company.)

Explosion of digital video. Looking ahead, the shift to spending more time online, particularly watching online videos, seems set to stay even after the pandemic blows over. According to new research from The Trade Desk, 72% of consumers in the region have said that they plan to maintain or increase OTT viewing in the future. The study also found that roughly 9 in 10 OTT viewers in Southeast Asia are willing to view ads in exchange for free programming.

The pandemic has been instrumental in accelerating the shift towards OTT and CTV viewing, and this presents new and exciting opportunities for advertisers looking to connect with consumers in the region:

-

-

Malaysia: penetration of subscription video-on-demand (SVOD) services like Netflix leapt by almost 10 percentage points, to 66.1%.

-

Indonesia: As of Q1 2021, most video viewers (66.4% of internet users) watched TV or film content via subscription video-on-demand (SVOD) services like Netflix or Catchplay—a gain of about 5 percentage points from H1 2020.

-

In the Philippines, more than 81% of respondents had watched TV shows or movies via subscription video-on-demand (SVOD) services in the prior month, rising by more than 8 percentage points from H1 2020 to Q1 2021.

-

Singapore’s digital video audience has surpassed that of live TV. The number of internet users watching subscription video-on-demand (SVOD) services like Netflix rose from 61.4% to 65.6%.

-

Thailand: Digital video viewing became near-universal, at 96.9% in H1 2021. The share of internet users who accessed subscription video-on-demand (SVOD) services, such as Netflix or WeTV, rose by more than 7 percentage points to 64.3% in Q1 2021.

-

Vietnam: General video viewing registered a massive rise. This year, nearly 95% of respondents had streamed some video content in the month prior, versus 84.0% in 2020. Note: For the first time, GWI included YouTube in its video category, so any respondent streaming from that wildly popular site was included in this metric.

-

Live streaming: While traditional verticals of live music and sports events tapered off due to lockdown, gaming and online shopping have turbocharged live streaming in the pandemic era.

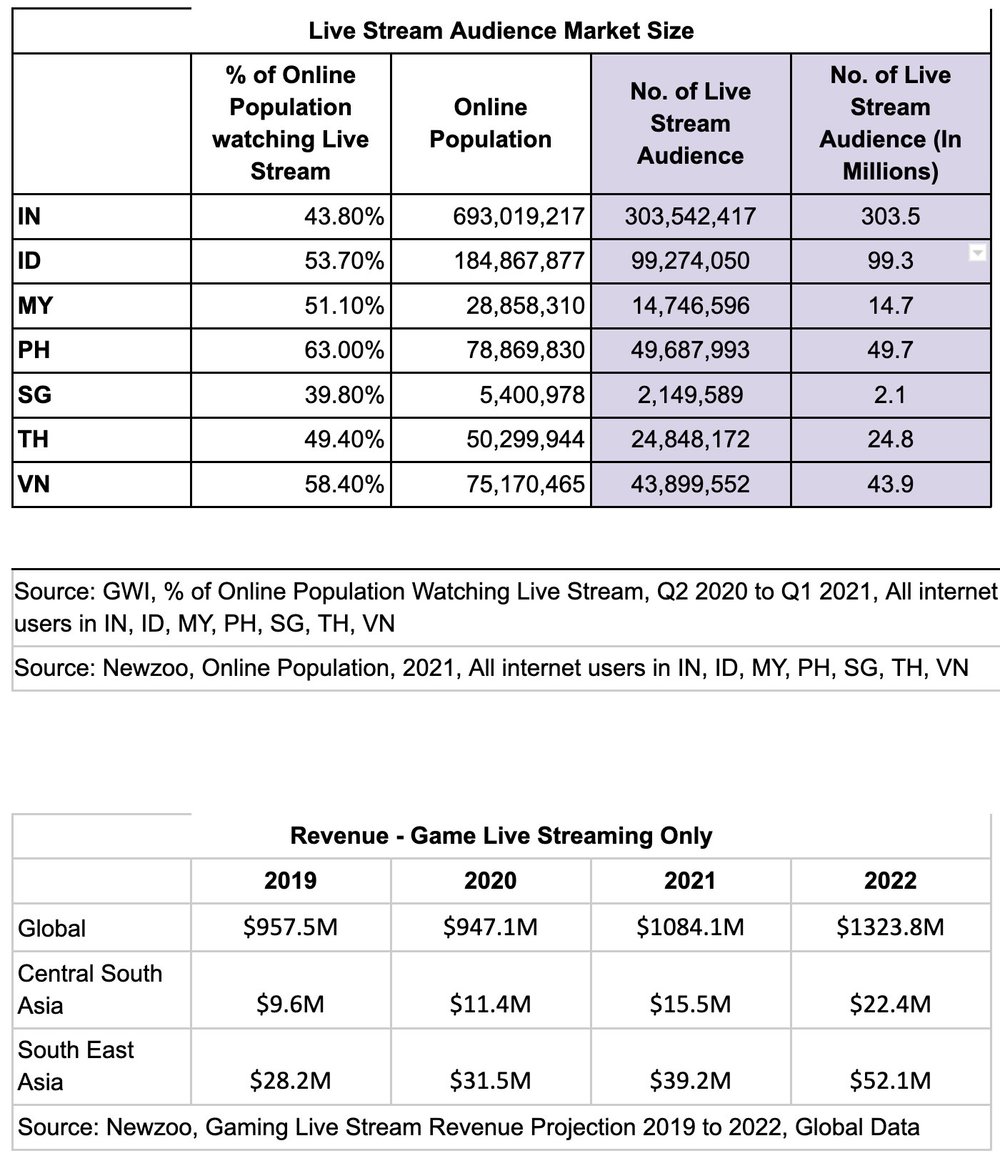

Across the countries in Southeast Asia and India, approximately 2 to 3 in 5 people (40% – 63%) have watched a live stream. This brings the total live stream audience count to 538MM people (This is approximately 1.5 times the population of the United States of America as of October 2021).

Live streaming > Gaming: According to GWI, the Southeast Asia gaming live-streaming audience will reach 234.5 million in 2021. India will reach 303.5 million in 2021.

Looking specifically at the live streaming audience for games, the market growth is huge.

-

-

The Southeast Asia games live-streaming audience will reach 234.5 million in 2021.

-

The India games live-streaming audience will reach 303.5 million in 2021.

-

The Southeast Asia revenue for game live streaming only will increase +24.4% from 2020 and +33.0% in 2020 from 2021.

-

The Central South Asia revenue for game live streaming only will increase +36.0% from 2020 and +45.0% in 2020 from 2021.

-

Live streaming > Online Shopping (Facebook, TikTok, Instagram, YouTube, Lazada and Shopee). The ‘digital natives’ in Southeast Asia who are the most web and app-loving generation, are the largest group of consumers of live content.

In particular, this age group is confident in using new technology or following the latest technology trends and news. They enjoy experimenting with new products, and often go on to become thought leaders, recommending those same products to others.

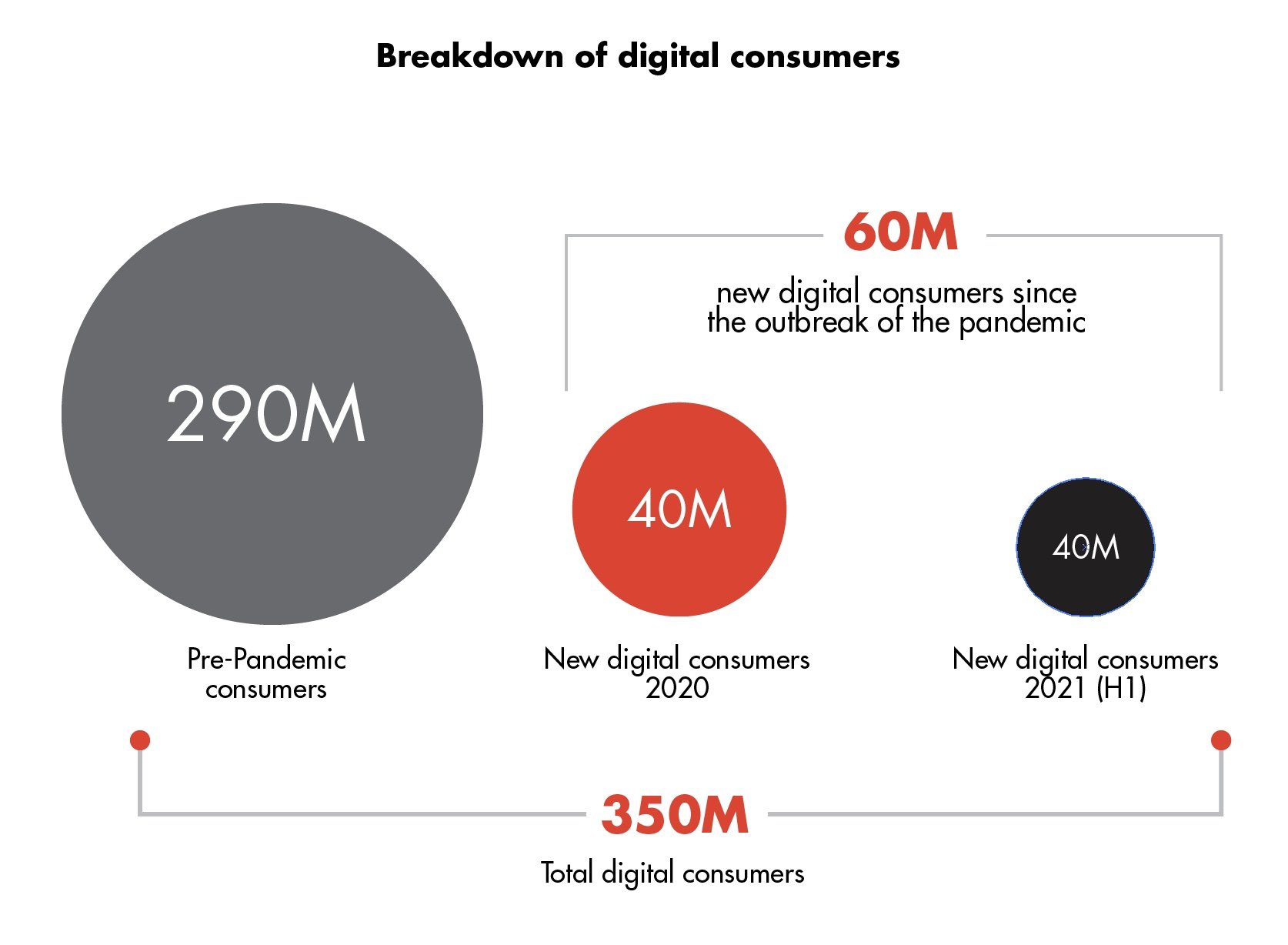

1.Vietnam and Thailand lead in Live Commerce recognition and usage rate with more than 60% of users who know about and have used it.

2. Live Commerce leads with the ability to bridge information gap in real time and “in person”

3. Future intention to use Live Commerce is led by Thailand, India and Indonesia.

Source: Statista E-commerce in the Asia-Pacific region

The world is waking up to livestreaming

So slowly but surely, the world is waking up to live streaming. And the involvement from non-gaming and mainstream brands show the rising popularity of live streaming and brings us to the question of how brands can do more with and for Southeast Asia and India consumers. How can brands capture the attention and use livestreaming as an effective means of engagement and reach?

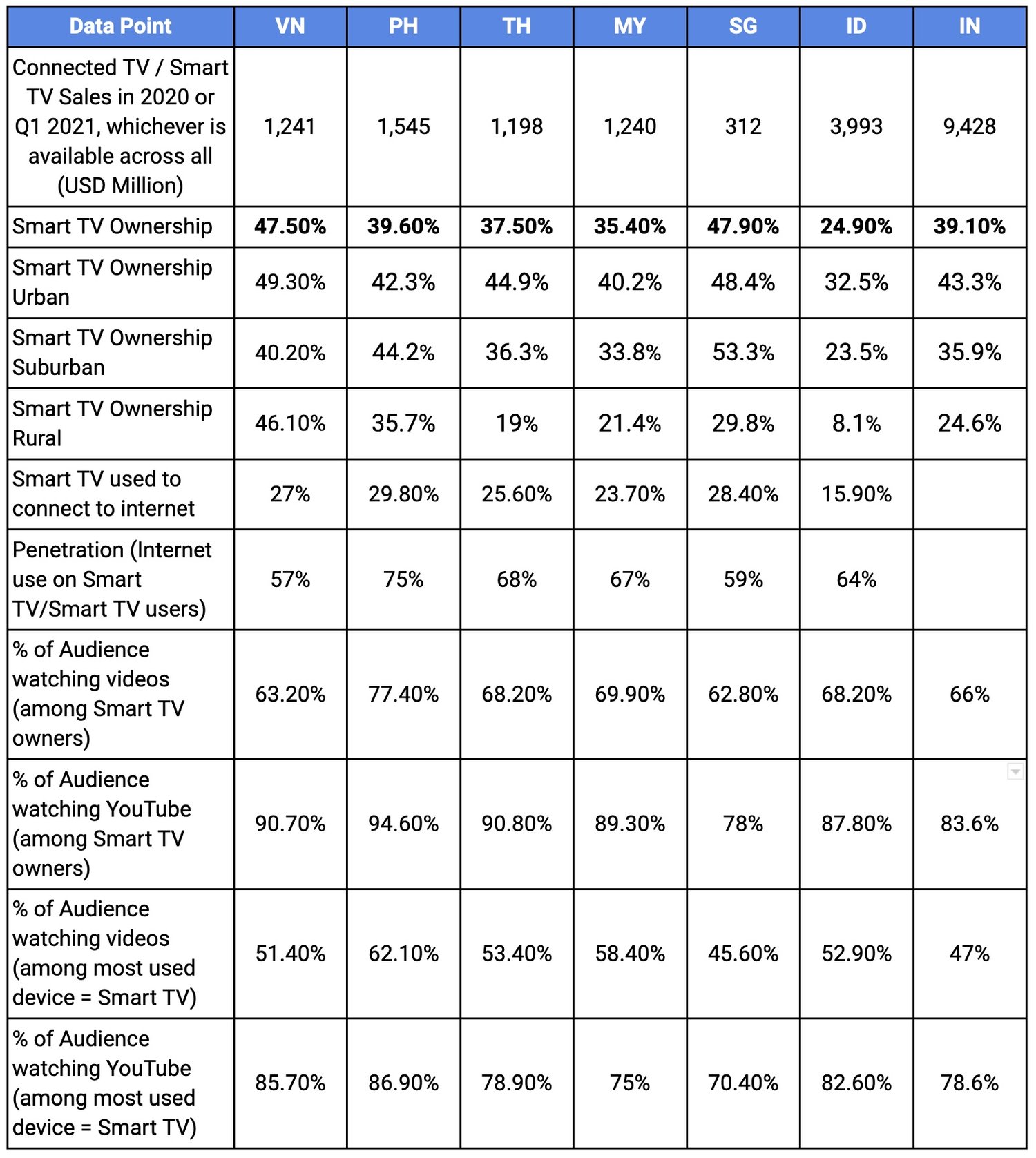

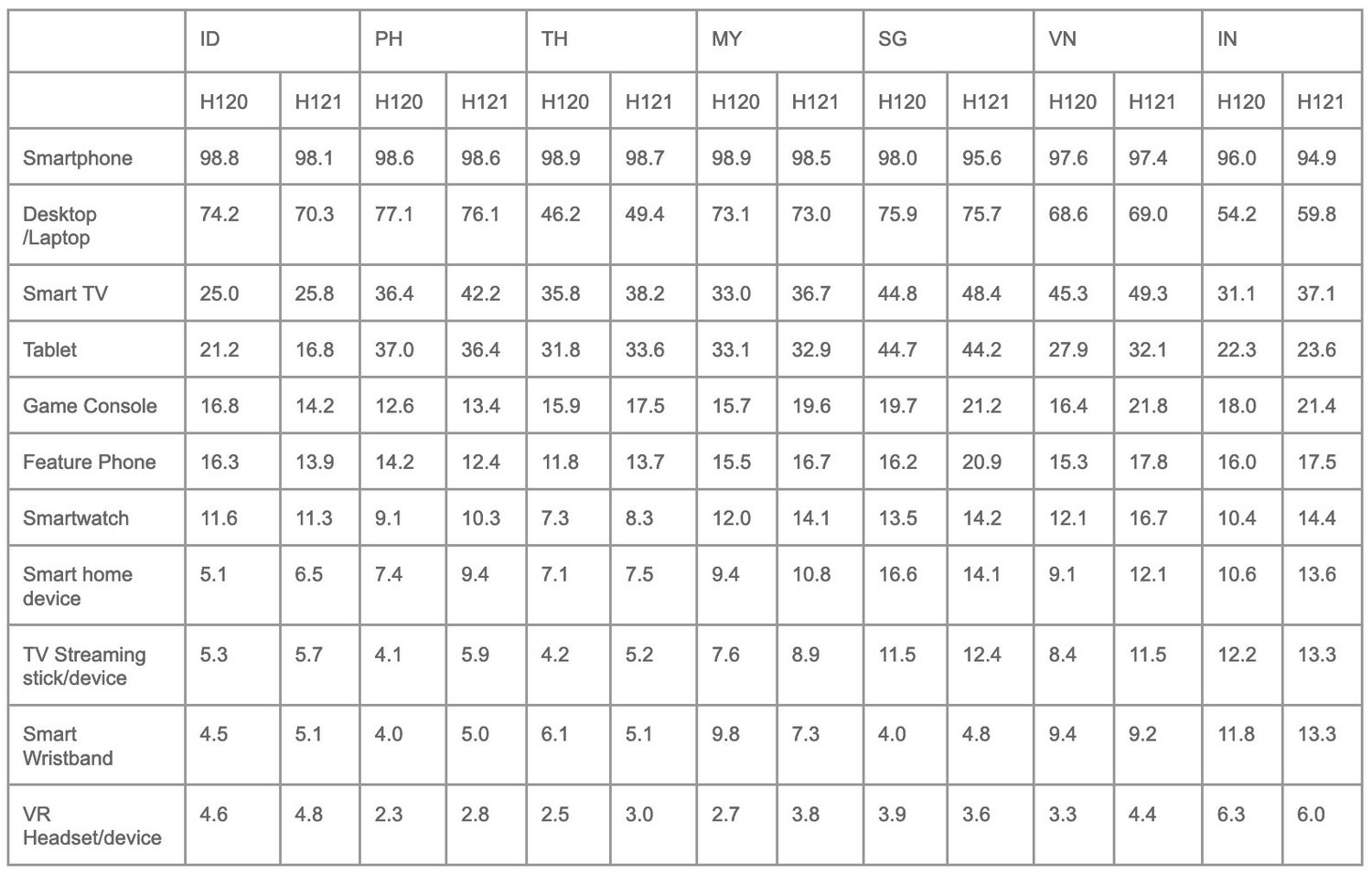

Increase in Smart TV penetration

To understand the connected TV opportunity, it is important to understand the context of TV watching behaviour. In the first era, for decades, people watched the same kinds of videos in the same places: primetime TV, sports, news, and our favorite shows on broadcast. Everyone watched at home on a TV screen. In the 2nd era, about 10 years ago, online platforms like YouTube took off. Video went mobile. Mobile technology expanded where and when to watch — during commutes, on a lunch break, in bed — and gave us new use cases for video, like making DIY projects, learning new skills, and connecting with passionate communities. Now we have entered the streaming era, which has, ironically, landed most of us back in the living room. People still watch a lot of mobile video, of course, but streaming video has taken off in Southeast Asia and globally, enabling us to use TV screens again in new ways.

The ability to watch new content that would not have ever been accessible before has really given users and consumers and viewers the power to decide what they want to watch, when they want to watch and where they want to watch.

CTV is becoming the screen of choice for many viewers. Some viewers in SEA (20% in Vietnam) watch YouTube almost exclusively on their CTV screen for 90% of the content they consume.

Why CTV is taking off

Hardware and content have both skyrocketed. Smart TV ownership has rapidly accelerated in the last two years across Southeast Asia with markets like Vietnam, Singapore, and the Philippines touching critical mass populations owning Smart TV sets.

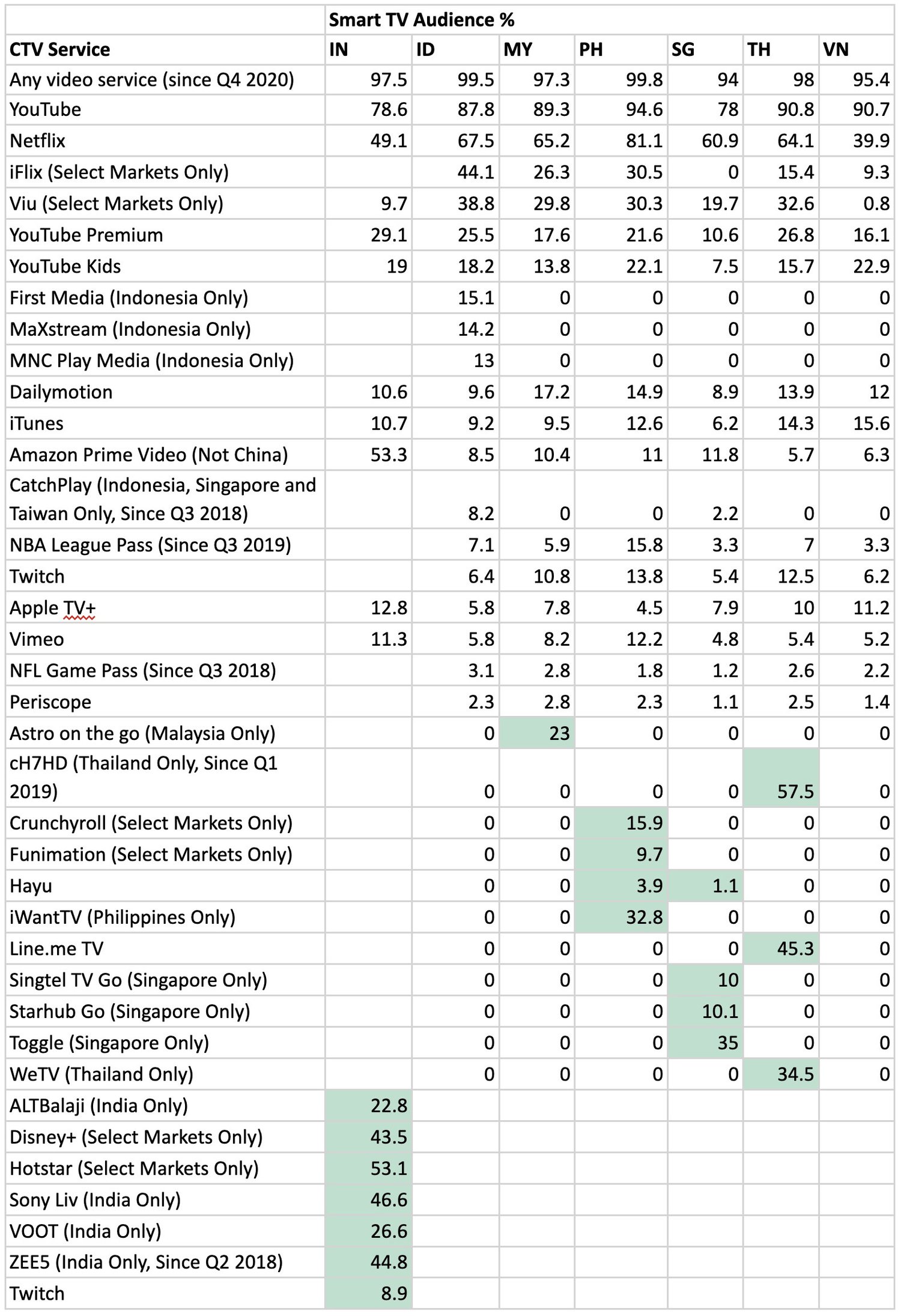

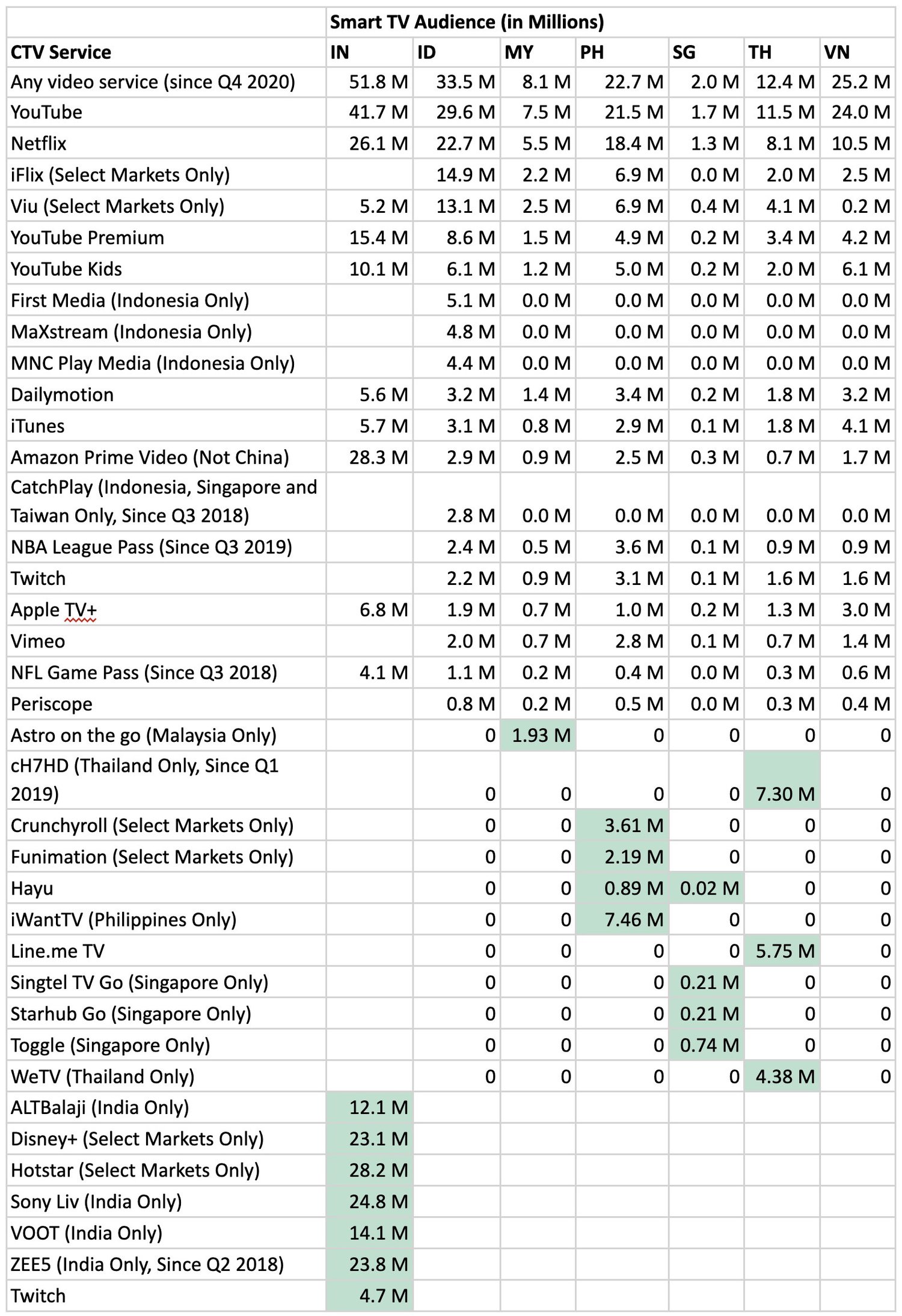

On the content side, the CTV landscape is rich with global, regional and local content players. Netflix, YouTube, iFlix, Viu, etc are household names in Southeast Asia. According to GWI, YouTube is watched by 90% of CTV audiences in most Southeast Asian countries, followed by Netflix, iFlix and Viu.

Local players are relevant within individual markets such as Astro in Malaysia, iWantTV in the Philippines, Line TV and WeTV in Thailand, and Toggle in Singapore.

The versatility of video streaming has contributed to increased viewership on TV screens. In Southeast Asia and India, watch time on TV screens is up across several content categories including sport, comedy, and food. According to YouTube internal data, comedy content increased 140% in India, March 2020 vs March 2021 and variety show content increased 200% in Vietnam in May 2020 vs. May 2021.

CTV attracts a highly engaged audience

CTV presents an opportunity for brands to connect with a highly engaged audience. Research shows that viewers tend to spend more time in front of their CTV screens compared with streaming on mobile or desktop devices.

Content freshness adds to the appeal of streaming. Between mid-March and mid-April, 60% of viewers signed in to YouTube on TV screens to watch a video that had been published in the past seven days. There is a larger appetite for long-form content, with viewers in countries, like India, watching videos on their CTVs that are up to 200% longer than those they watch on other devices.

When a video plays on a CTV screen, there are more co-viewing opportunities for friends and family to gather in the same room to watch the content they love. For marketers, this third wave of viewership is filled with opportunities to reach the audiences you care about, and brands should look to enhance, not disrupt the CTV experience.

Chapter 3: industry size

How big is the digital video industry?

OTT Revenue (USD)

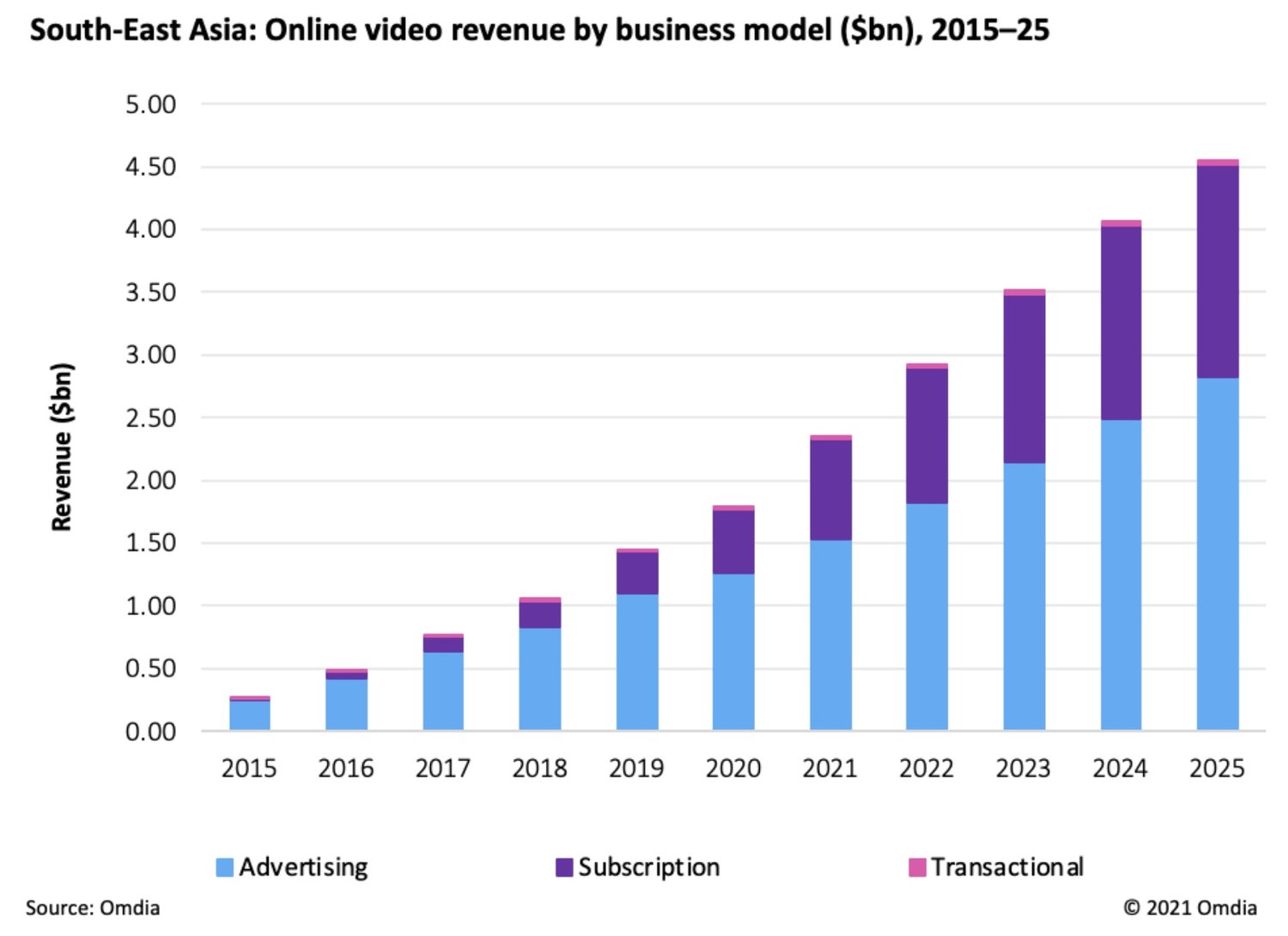

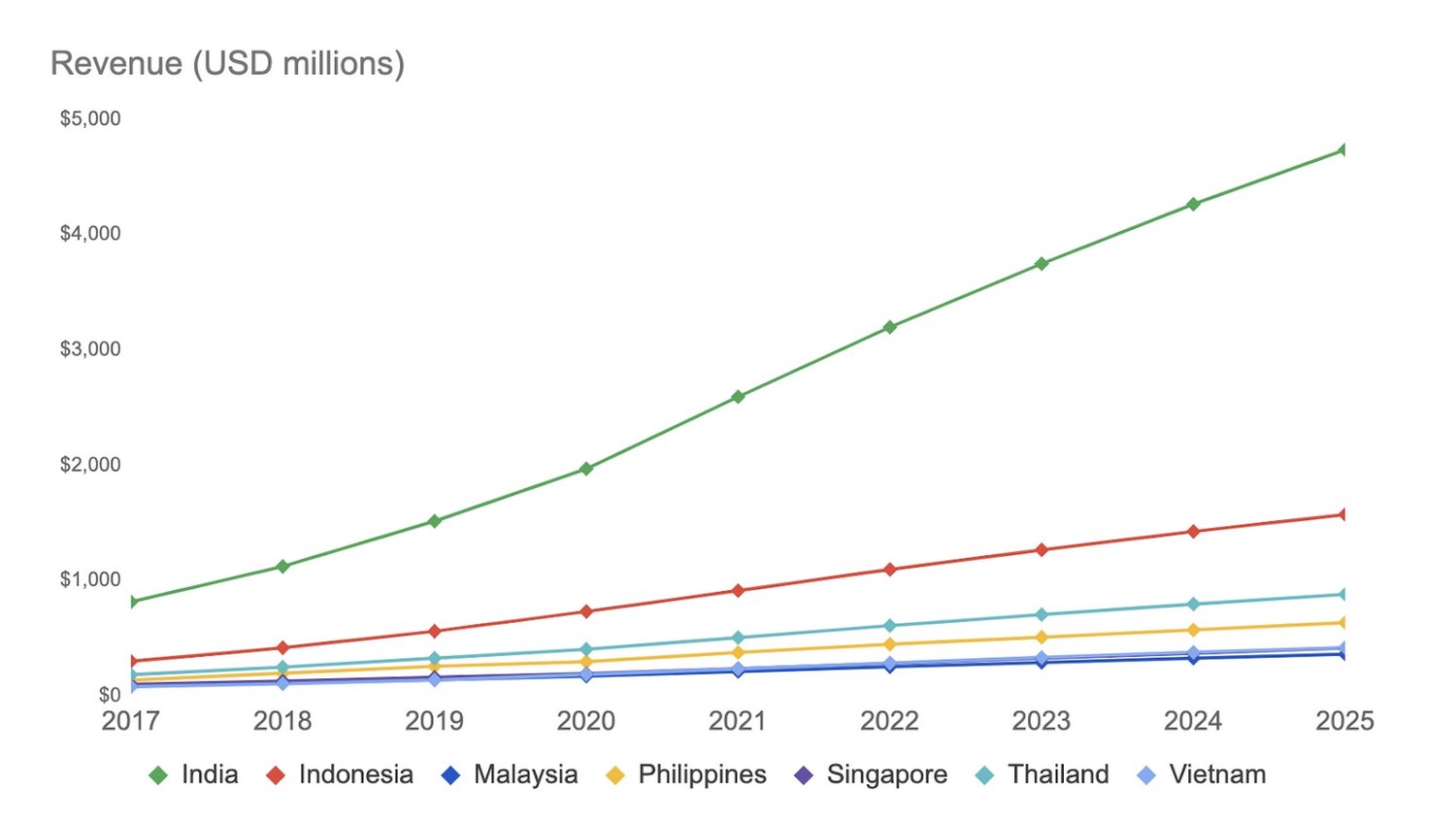

According to Omdia, the online video industry is poised to grow to $US4.5bn by 2025 in Southeast Asia.

In 2025, advertising is forecast to support 62% of the revenue for video services in Southeast Asia. Total revenues from online video services are expected to grow up to $US4.5bn in Southeast Asia. According to a report published by Media Partners Asia, in India alone the online video industry is expected to reach $US4.5bn by 2025, of which $2.6bn is the expected contribution from advertising,

Transactional video revenues are meagre across Southeast Asia. Omdia estimates 75% of in-stream video ad revenue comes from mobile and 20% from PC. Though only 5% is from connected TV (CTV), Omdia expects the CTV segment to grow during the forecast period, albeit at a slower pace than in the US and Western Europe markets.

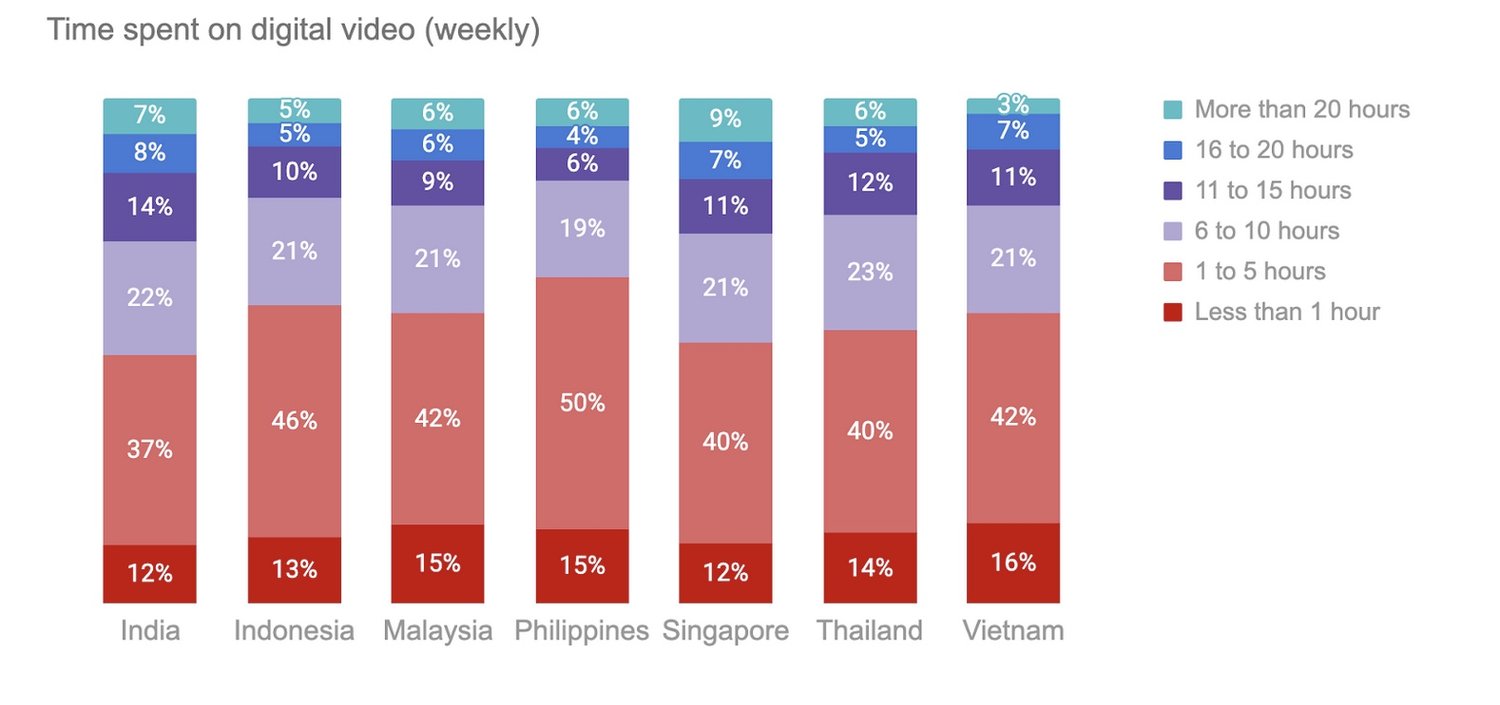

Consumption of digital video

Source: Data points extracted from 2021 Digital Media Report by Statista (report provided)

Industry Players:

Please note these are not exhaustive. They serve as examples of digital video players who are active in the region of India and Southeast Asia.

-

-

SVOD Platforms : Netflix, Amazon Prime Video

-

AVOD Platforms : YouTube, Meta, Vimeo, Dailymotion, TikTok

-

Hybrid VOD Platforms : Iflix ,Viu, Twitch

-

Transactional VOD Platforms : iTunes

-

Advertising Exchanges : Google Marketing Platform (aka Doubleclick), TheTradeDesk, Xander, Unruly, Tremor

-

Source: GlobalWebIndex

Chapter 4: The new stars: CTV and live streaming

CONNECTED TV

Audience penetration

Question: In the last month, which of these services have you used to watch / download TV shows, films or videos? Please think about any sort of TV, video or film content that you have watched, streamed, downloaded or accessed in any other way.

Source: GlobalWebIndex

Source: GlobalWebIndex

LIVE STREAMING

KEY PLAYERS

Here are the key players in Southeast Asia and India:

-

Twitch

-

Youtube Live

-

Facebook Gaming

-

Bigo Live

-

TikTok and TLive

Chapter 5: The Streaming Consumer Profile

In a way, it is easy to think of the digital video consumer as the average internet user. Almost all Internet users watch some form of digital video on any or many of their devices of mobile, PC, or connected TV. Below, we have consolidated some data from the emarketer global media intelligence report 2021, which provides a macro view of our digital video consumer.

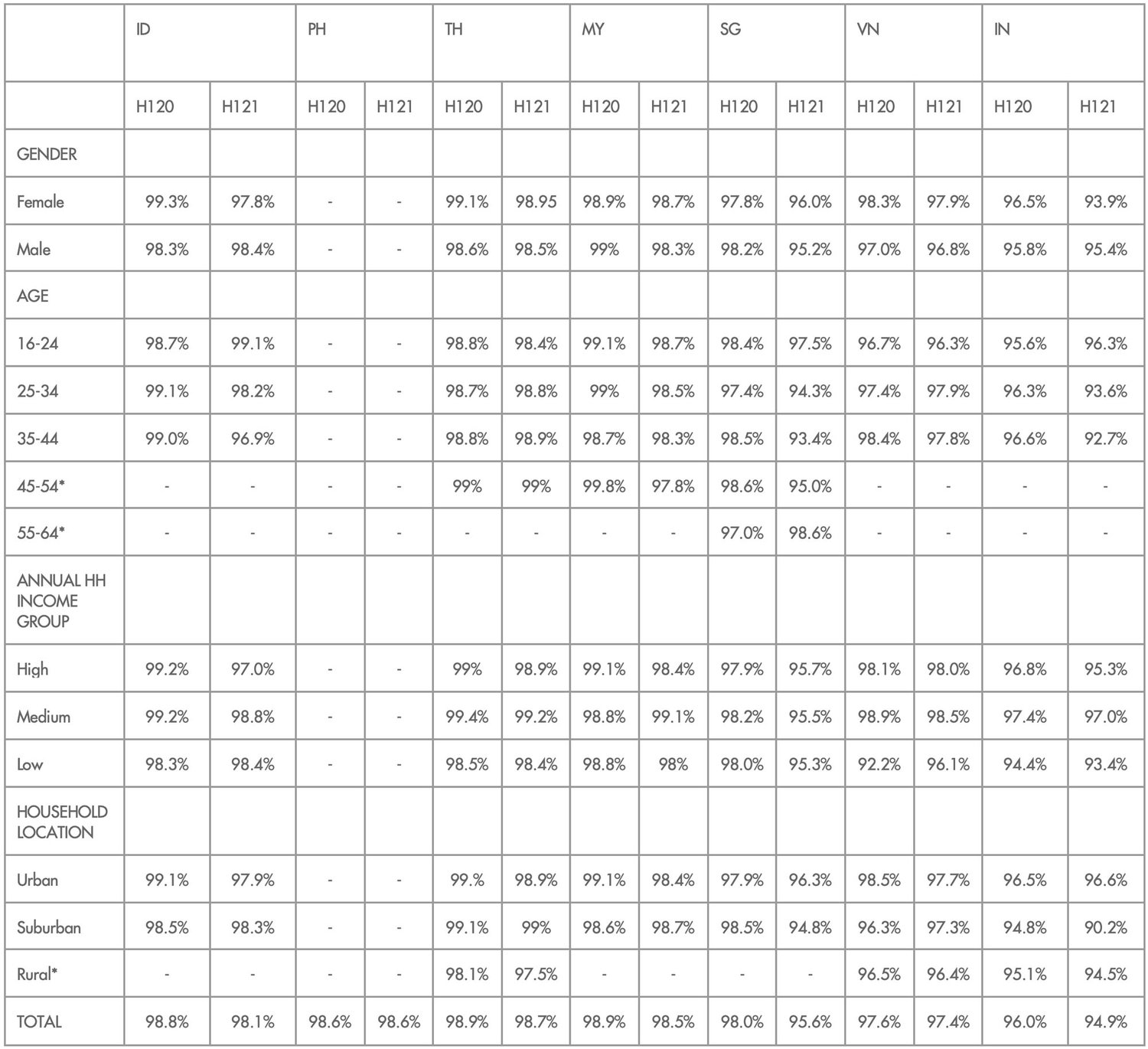

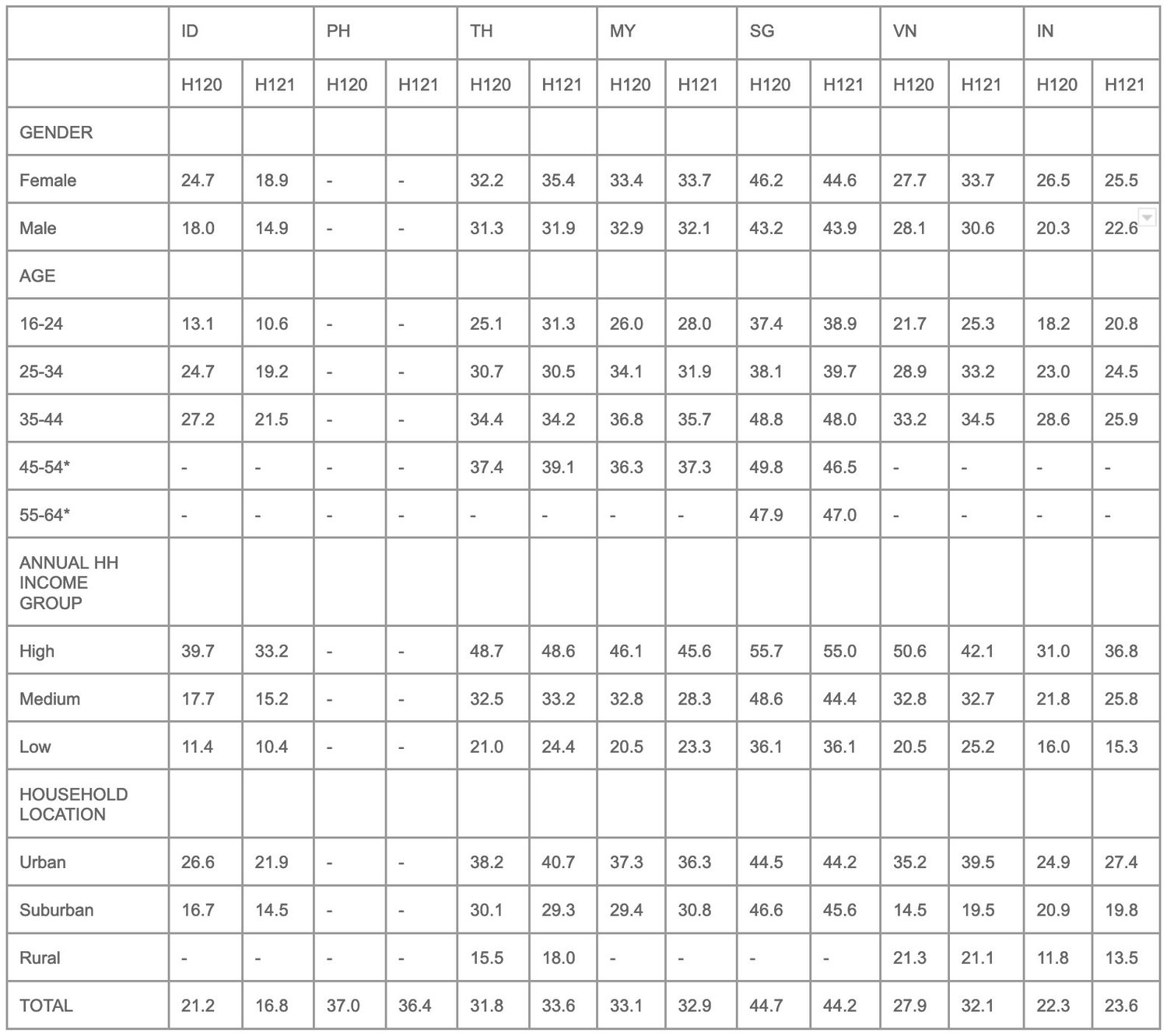

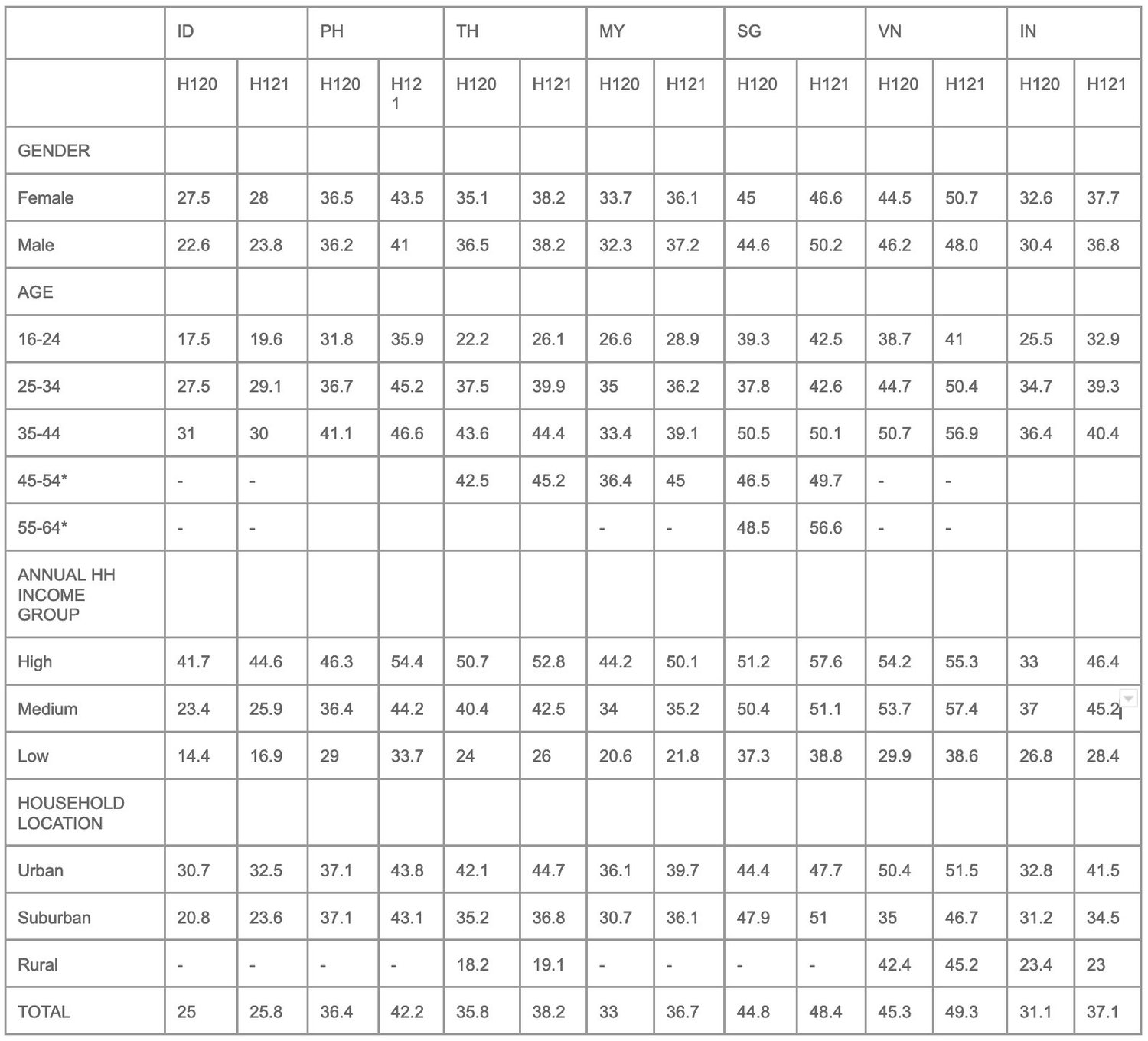

1. Device ownership

2. Audience profile for Smartphone & Tablet owners, Smart TV owners

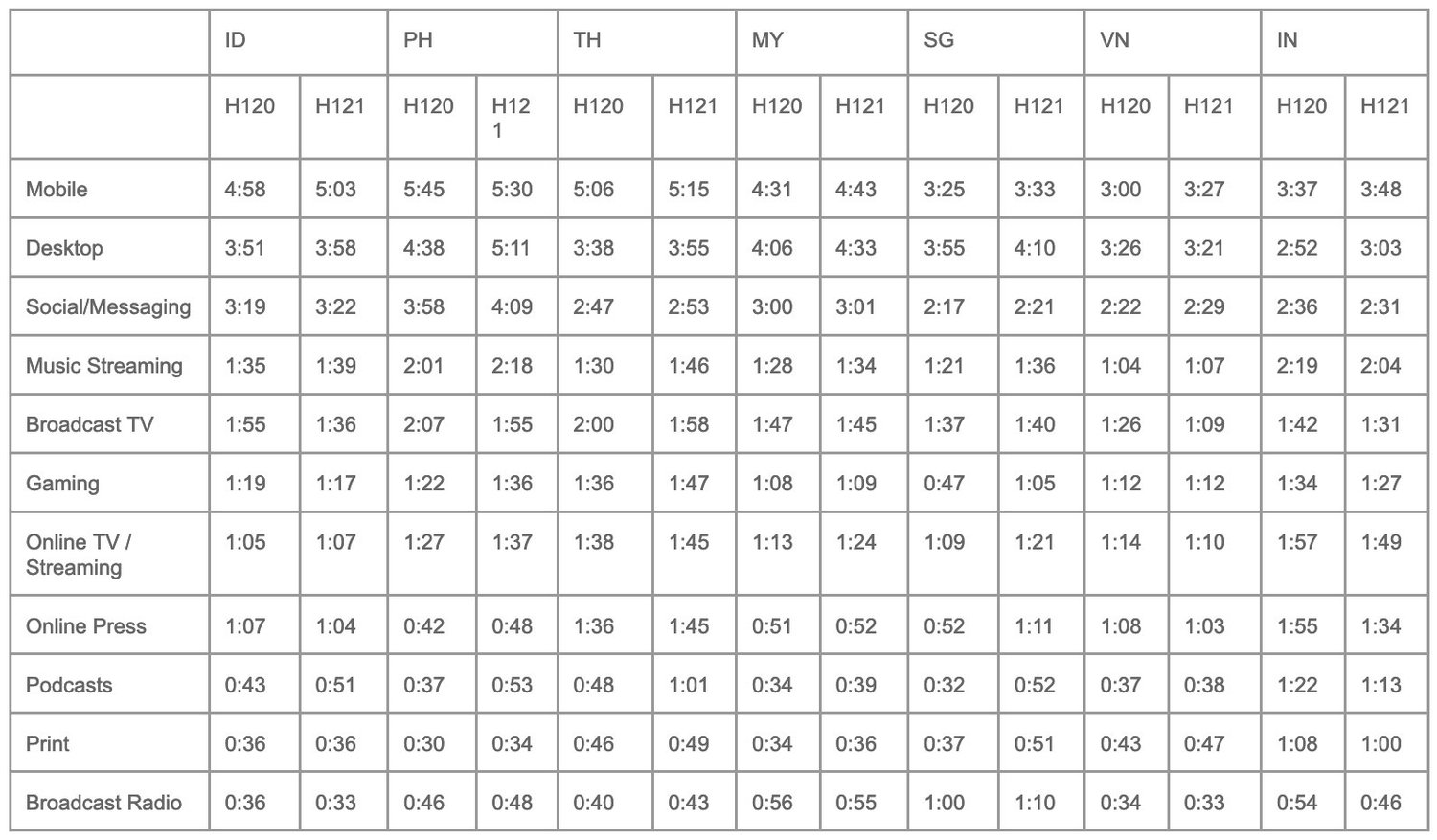

3. Average time spent with media

4. Video on Demand viewers

Device Ownership (%)

Note: ages 16-64; respondents were asked, “which of the following devices do you own?” Source: GWI, August 2021

Audience profile for Smartphone owners (%)

Note: respondents were asked, which of the following devices do you own?

*omitted due to small sample size

**don’t know/prefer not to say

Source: GWI, August 2021

Audience profile for Tablet owners (%)

Note: respondents were asked, which of the following devices do you own?

*omitted due to small sample size

**don’t know/prefer not to say

Source: GWI, August 2021

Audience profile for Smart TV owners

Note: respondents were asked, which of the following devices do you own?

*omitted due to small sample size

**don’t know/prefer not to say

Source: GWI, August 2021

Average time spent with media – Hrs:mins per day among internet users

Respondents aged 16-64 were asked “roughly how many hours do you spend on x?” They selected a period of time (ranging from <30 minutes to up to 10 hours) with GWI then averaging these figures; the averages also include those who selected “do not use.” GWI, August 2021

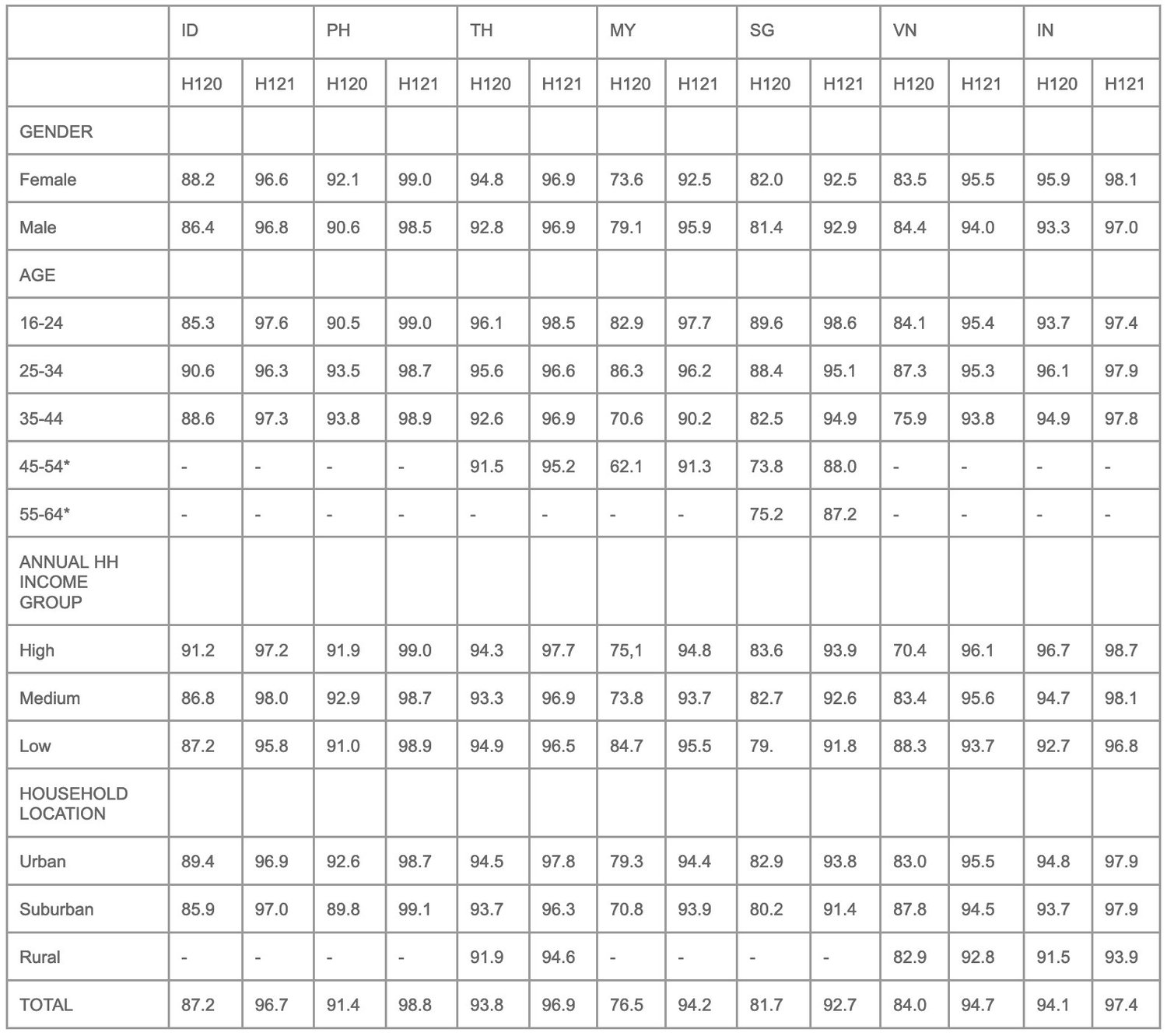

Video on Demand (VOD) viewers

% of internet users, by demographic

Respondents were asked, “in the last month, which of these services have you used to watch/download TV shows, films, or videos? Please think about any sort of TV, video, or film content that you have watched, streamed, downloaded, or accessed in any other way” where you used at least one of these services in the past month via any device; services include local/regional VOD services and/or Amazon Prime Video, Google Play, iTunes, Netflix, Vimeo, others; note the addition of YouTube to this list in 2021.

*omitted due to small sample size

**don’t know/prefer not to say

Conclusion

The new normal: Just as people have been spending more time on multiple digital services since the advent of Covid, more people are watching more digital video than before… Every individual market across India and SEA showed a sharp increase in this metric, and almost every market has called out the rise of streaming services, both SVOD and AVOD.

Constantly evolving: The digital video space is constantly evolving as consumers demand more choice of content that fits every attention span, from scrolling unending feeds of ultra short-form user-generated videos to binge watching entire seasons of professionally produced dramas and movies. On digital, your personal time is your primetime. This what’s-in-it-for-me question is giving rise to several local content streaming services that provide culturally relevant content to their audiences such as iFlix, Line and Zee.

It’s not just the type of content, but also the attention span that is defined by which device is used to view content.. We are clearly seeing a transformation of device platforms. While most of the digital video continues to be consumed on mobile screens, Connected TV is a fast emerging experience where users are co-viewing their favorite content in their living rooms and personal spaces. proves beyond doubt the significant growing population that now has access to big screens and multitude of streaming services at their fingertips.

The 3rd dimension of evolution within Digital Video is the rise of live streaming and interactive video. New verticals like gaming have truly democratized live streaming where gamers spend hours streaming their favorite content and see their idols battle it out in their favorite game titles on platforms like YouTube, Facebook and Twitch. eCommerce players are combining shopping and entertainment to create new forms of shoptainment content where bargain hunters enjoy the latest shopping promotions being doled out by a new wave of content creators, the professional shopping Key Opinion Leaders on eCommerce and social platforms.

There is a huge opportunity for brands and advertising: needless to say, the exploding digital video landscape provides a tremendous opportunity for brands. How do you tap into surging audiences, ever-increasing time spent watching digital video, a wide spectrum of content that fits all imaginable attention spans, across multi-device platforms; from live, interactive video to ubiquitous video-on-demand to new mega verticals like gaming and shopping?

We hope this Guidebook provides you with a better understanding of this space, clearer definitions, and inspires you to foray into this interesting territory.