White Paper | Authors: Daniel Cravero Oracle Advertising, Amy McDonough Mediacorp, Anita Munro Mindshare, Yogesh Sehgal Magnite, Katie Potter Teads

INTRODUCTION

Publishers have a shifting landscape to contend with and are tasked with setting investment priorities, testing strategies and making the right partnerships in order to plan for the post-cookie world. We explore strategies that publishers can use for surviving and thriving in the post-cookie, privacy-centric world.

Publisher Strategies

1. Bring Data Management In-House

By managing their own data, publishers are able to leverage their unique customer data and offer targeting to advertisers that may not be available elsewhere. This strategy is particularly critical for niche publishers who would be sacrificing their competitive advantage if they were to share their audience data with other publishers.

DATA MANAGEMENT OBJECTIVES

All good strategies need to start with a clear understanding of what you want to achieve. Why do you want the data? What will you do with it? And therefore what type of data should you get? For publishers, a guiding objective is often which audiences do my advertisers want to reach?

COLLECTION

First-party data can be collected across all possible touch points where you have a chance to interact with your audience or customer. Be it your existing CRM program, within your site or app, your advertising and communication channels and your content and products themselves.

For most publishers, the highest frequency touchpoints are their content websites and apps. Behaviour observed on these can be captured using a Data Management Platform (DMP) and used to build up a profile of interests and preferences that can be grouped into audiences relevant to advertisers. Logged-in users provide the richest source of data, so providing a compelling value exchange for user login is critical.

DATA COLLECTION/ORGANISATION STRATEGIES

Publishers have a range of tools at their disposal that allow them to collect, coordinate and analyse data on their customers across a range of touchpoints. These tools capture and house a variety of first-party data that can be used to segment and monetise highly valuable audiences.

In order to maximise first-party data collection it’s important to understand what the key tools are, the role they play and what insights can be extracted from them.

WEB ANALYTICS

Web Analytics tools capture a range of customer behaviours across websites, apps and devices. As users interact with your properties, these tools allow you to capture behaviours such as:

-

what websites they visited before landing (referrer URLs)

-

dwell times/bounce rates

-

to where customers are clicking through/what content they are consuming

-

on-site interactions with elements such as rich media, downloads etc.

Analytics tools are highly effective at capturing on-site behavioural data which allows publishers to segment high-value audiences for monetisation.

Email marketing tools allow publishers to centralise and coordinate email marketing communications with their customers such as:

-

automating email distribution at regular intervals (ie, news of the week)

-

retarget users based on specific actions (ie, newsletter opens)

-

segment users based on specific email behaviours (ie, renewing subscriptions)

-

content amplification (sponsorship mail-outs).

Email marketing tools provide insights on how customers are reacting and interacting with email marketing campaigns. This information can be used by publishers to execute retention strategies, grow their subscriber base and amplify news content to targeted audiences.

DMPs

Data Management Platforms are a central hub for segmenting users based on a variety of user signals and attributes, analysing those signals for insights and activating those segments as an additional monetisation stream.

A DMP collects a range of identifiers across publisher properties such as:

-

cookies

-

Mobile App IDs (MAIDs)

-

hashed emails

Segmentation can be determined by attributes such as content consumption (ie, sports fans, recipes, beauty and fashion) which can become a useful monetisation tool by giving advertisers access to those audiences.

DMP segmentation allows publishers to execute granular targeting strategies across their properties which helps create additional revenue streams leveraging their first-party data.

2. Enrich Your Data

Publishers can enrich their understanding of the audience using behavioural and ecommerce data, leveraging demographic, preference, opinion and emotion signals, both positive eg, goodwill, fascination, curiosity, happiness; and negative such as anger, dislike or concern. Or a mix of both.

3. Share Your Data with Advertisers

As audience data becomes harder to collect and share, publishers set up to mine their first-party data will be able to continue to sell targeted segments to their direct clients, albeit at a smaller scale than before in the absence of full consumer opt-in. Data can be shared via clean rooms or by using standardised taxonomies as set out by the IAB.

Some publishers are already seeing an increase in marketer interest in direct buys using first-party data, as marketers test their post-cookie strategies in what is currently the most scalable way.

Data clean rooms allow client and publisher first-party (deterministic) data to be matched and used without any exchange of the data and without democratisation of data which helps to hold data value for publishers.

The way that these data clean rooms work is that both the publisher and the client upload their data. The data is then connected using an ID that exists in both. Once data is connected the client can see the amount of matches and generate aggregate insights, and data can also be enriched with further data. These matched IDs can then be activated via the ad server or Demand-Side Platform.

If there is no ID that matches, a bridging partner can be brought in to further connect the dots.

In terms of the benefits of this approach:

-

it provides a closed ecosystem that enables matching of multiple data sets with data sharing for mutual benefit and retained value

-

no data is shared – no data moves, eliminating risk of data leaks

-

queries are run only to provide intersection of data owners already have

-

privacy compliant as opt-in and consent has been gained on both sides.

The challenge currently is on the scalability of such solutions given that many publishers and advertisers are still building their first-party data strategies. However as probabilistic signals continue to deteriorate we do expect that this will grow in scale and opportunity.

4. Partner with Experts

Smaller publishers who don’t have the resources to hire a sales team, build a first-party data infrastructure and keep up with the rapidly changing landscape are expected to lose revenue as their targeting options become limited.

One option for smaller and niche publishers is to join an ad management platform such as Cafemedia, Freestar or Mediavine. Already these platforms are seeing a growth in their clients in general and a shift to mid to large publishers seeking their services as some publishers choose to outsource the management of their ads inventory rather than tackle the post-cookie uncertainty and investments themselves.

A second option is to form a partnership with a larger publisher to leverage their sales team and technical expertise. In Singapore this is already being done on a revenue-share basis with both small local publishers and global publishers looking for local sales expertise.

5. Explore Shared Identity Solutions and Privacy Sandboxes

Publishers will need to explore the options becoming available and how they fit with their individual strategy. Some publishers will rely on these solutions to monetise their inventory, while others with strong in-house capabilities may work without them. Others will adopt a hybrid approach where they monetise the long tail using shared identity solutions or probabilistic IDs or privacy sandboxes

6. Adhere to New Standards of Consent, Leveraging the Value Exchange

CONSENT

Given the current context of data privacy and legislation, ensure you have a proper process in place around opt-in and consent. This centres on establishing trust with the audience by providing a clear and simple explanation of how the data will be used.

The collection of data should be done with a privacy-first approach to allow ethical and sustainable marketing practices, and transparency and control for consumers. Publishers may develop their own software for user management or this may be a feature of an adtech product, such as one of the shared ID solutions that are offered in the market.

VALUE EXCHANGE

To encourage your customer to share their information you will need a value proposition that is appealing and simple to understand.

For subscription services this value exchange may already be apparent. Will you provide a richer customer experience with personalization, give access to greater utility, provide exclusive content, solutions or pricing? The options are vast, and may include testing the water with new technology such as nonfungible tokens (NFTs). Brands are now using NFT’s to provide customers with unique ownership opportunities in exchange for their data. An example of this has been Clinique who have given away 3 NFT’s that visually tell the brand story, for customers who submitted an entry and joined their Smart Rewards CRM program.

Different publishers have a different relationship with their audiences, and this means that there is no one-size fits all approach to the value exchange that will resonate with their audience. Publishers need to evaluate how their audience relates to them in terms of trust, loyalty, expectations and the publisher’s role in the community.

Vision:

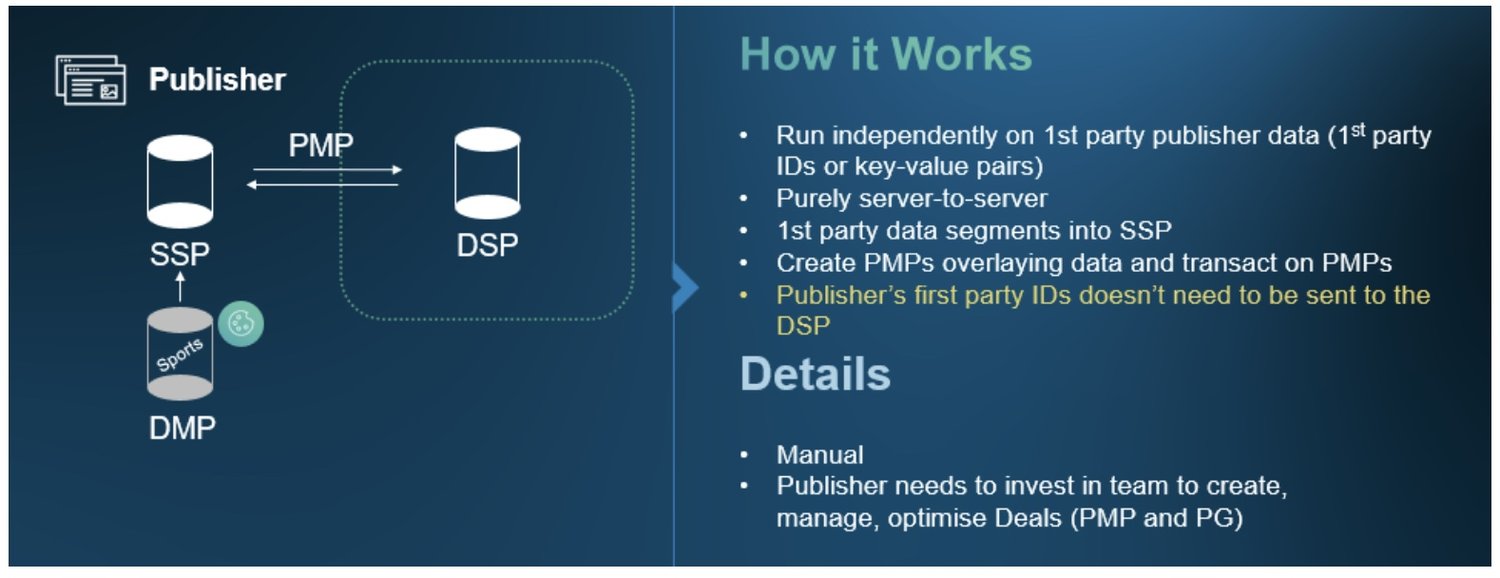

- Targeting will shift to the supply side vs buy side in the absence of consistent Identifier

- More focus will be on transactions via deals; publishers will ask for more controls

- Open auction to be driven via: Contextual signals, Privacy sandbox, Publisher FP ID, ID partners

The New Targeting Standards

- User-consented information: email ID, mobile number

- Collection and activation of publisher first party data

- 1o1 deals

2. Federating segments with like minded publishers

- Privacy Sandbox: especially for smaller publishers

- Data collected based on the same ID graph (controlled and activated by publishers) Q: Is it same as Federating segments?

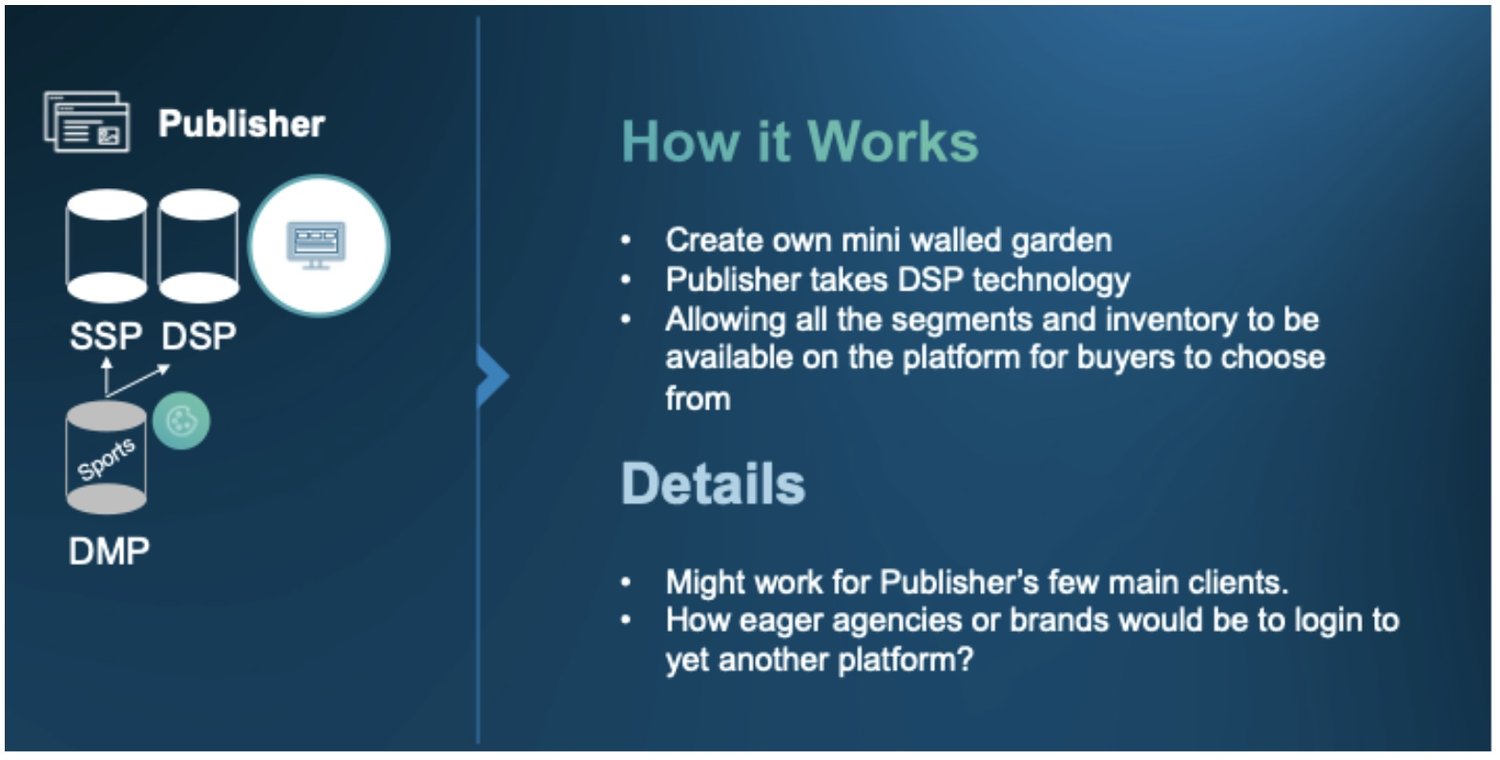

- Publishers building mini walled gardens, where buyers could buy that publisher inventory with their data.

What is needed from the industry for publishers to succeed:

- Clear communication to the user of the value exchange in order for them to provide their information for logging in.

- Standardisation and adoption: everyone in the ecosystem should aim to adopt the audience taxonomy provided by IAB and transact on it.

- Controls: Tech partners should provide controls especially to publishers so they can share their valuable data in a privacy safe environment.

- Sell/Buy side relationship: Expect leading buyers and publishers to work closely on a solution addressing brand needs. Much closer collaboration than transactional as it happened in the past.

- Measurement and attribution: Need an industry-driven measurement and attribution solution once the anchors like Cookies, Device IDs are removed.

CONCLUSION

For publishers to thrive they need to set a course with the strategies that best fit with their individual business and resources for the transition to a more privacy-centric way of doing business. Testing strategies for new targeting methods before the imperative of cookie deprecation will give publishers time to tweak and enhance their strategy before supplementary methods are gone. There is a wider need for the industry to collaborate and lead with standardisation and tools to allow the whole industry to succeed.