Harnessing Retail Media Networks Whitepaper: Full-Funnel Strategies for Engaging Southeast Asia and India’s Digital Consumers by the IAB SEA+India Retail Media Council

This paper explores retail media strategies marketers can use to drive action across the entire customer journey, along with case studies and examples from leading brands and platforms that illustrate the power of Southeast Asia and India’s emerging retail media networks.

Authors: Emir Caglayan, Mindshare; Aniko Andras, Meta; Abhinav Mehra, GrabAds; Nathalie Pellegrini, GroupM Nexus; Jennifer Marquet, GroupM; Ryan Pham, Google; Prasetyo Nurramdhan, The Walt Disney Company

Contributors: Suvidha Bhatia, Criteo; Fai-Keung Ng, The Trade Desk; Vera Wang, TikTok; Khin Mu Yar Soe, Pubmatic; Maria Hashmi, Unilever; Meghna Apparao, Meta; Vineeth Kallarakkal, The Walt Disney Company; Warish Jain, GrabAds; Boram Ku, AppLovin; Aileen Chua, RTB House

In the rapidly evolving digital landscape of India and Southeast Asia, where mobile-first internet usage, thriving digital economies, and active social media engagement are the norm, brands need innovative ways to connect with their tech-savvy consumers. Retail media networks (RMNs) are proving to be a game-changer. With leading retail media platforms like Carousell, Flipkart, foodpanda, Grab, Lazada, Shopee and TikTok consistently dominating app store rankings, marketers can leverage these platforms to reach and engage millions of shoppers directly.

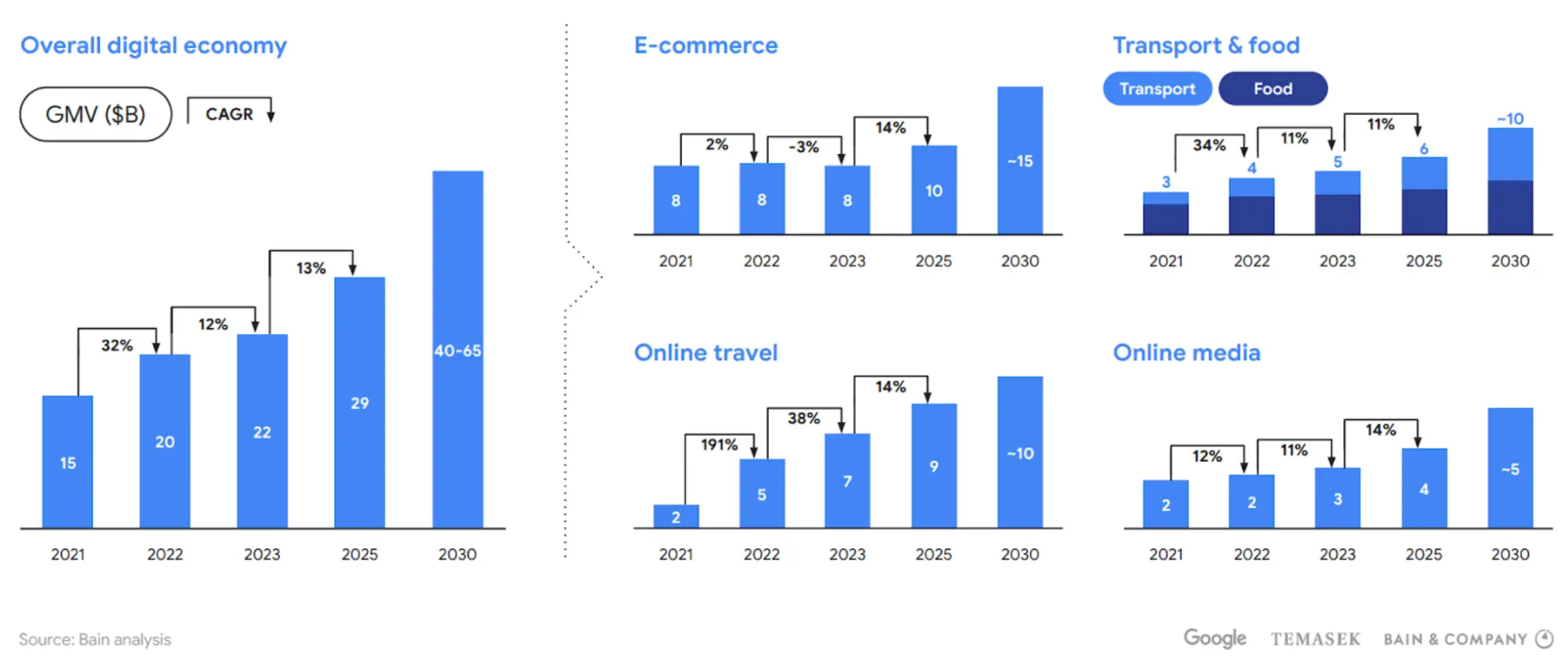

In Southeast Asia, digital engagement is rapidly evolving. The region’s digital economy is projected to reach $300 billion by 2025, while India’s will likely reach $1 trillion, underscoring the significant rise in online interactions and digital marketing activities. The Meta and Bain & Company report highlights that Southeast Asian consumers are greatly influenced by digital touchpoints, engaging in extensive research and interactions with brands before making a purchase.

Retail media networks bridge the gap between retail and advertising, enabling retailers to engage potential consumers at various touchpoints to shape and guide purchase decisions. Consider this: 76% of Southeast Asian shoppers use five or more channels during peak sales, according to a Google and Ipsos survey, further underscoring the importance of retail media networks

Many consider RMNs to be bottom-of-the-funnel conversion media, and measure ROI in terms of ROAS. However, retail media networks can influence consumer behaviour across the entire funnel. This whitepaper by the IAB SEA+India RetailMedia Council will explore strategies marketers can use to drive action across the entire customer journey, along with case studies and examples that illustrate the power of these new channels.

Upper-Funnel Strategies on RMNs

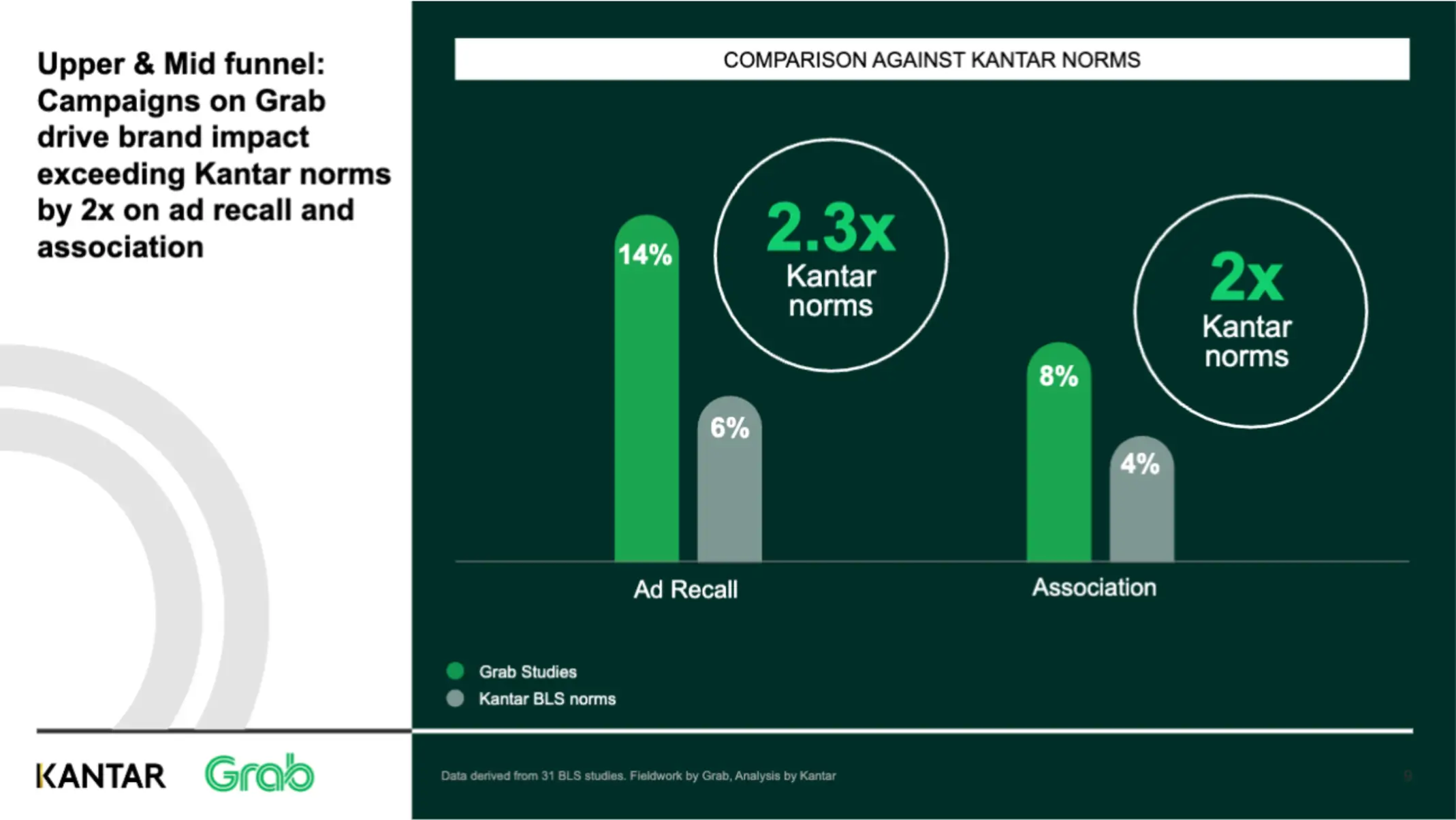

RMN’s have a substantial role to play in upper-funnel brand building, as well. Grab partnered with Kantar to investigate how RMNs can aid advertisers in creating impact and brand building in a retail media environment. 100% of campaigns saw positive ad recall – 2.3x Kantar norms on ad recall and 2x Kantar norms on association. To leverage rising demand from brands, retail media networks have developed capabilities such as measurement, audiences, creatives and formats to enable advertisers to optimise toward reach, views, and engagements at a biddable cost or a daily fixed cost.

RMNs deliver personalised ads, increasing engagement and sales by segmenting and targeting shoppers by gender and demographics. By further overlaying retailers’ first-party data like purchase history and loyalty program activity, brands can build buyer momentum and close the loop faster starting from awareness to purchase decision, for example leading up to mega shopping moments.

Experiment With New Creative Formats Paired With New Inventories

Similarly, creative plays a vital role. Advertisers can boost ad recall and association by using multiple ad formats such as video, display, or native text, and multiple creatives personalised to different customer segments. Additionally, retail media networks are experimenting and innovating with new platform specific ad inventories or features like Livestreaming, Branded Car Icon, Stamp Card Challenge, Brand Mission, In-App Gamification, Push Notifications, In-Feed Video and short-form video.

Live streaming and short-form video in particular showcase the holistic capabilities of retail media networks.

They not only influence bottom-funnel KPIs like conversions but also top-funnel KPIs like brand awareness and consideration, guiding customers throughout their journey. In fact, according to a study by TikTok and Accenture, creative content inspires consumers to progress from discovery, to consideration, to transaction.

Off-platform Reach and Measurement

In recent years, retail media networks have begun leveraging collaborative ads with platforms like Google, Criteo, Meta, RTB House, TikTok, and the Trade Desk to enable brands to extend their reach even further.

Here are some real-world examples and statistics that showcase the tangible impact they can have on branding efforts.

Leveraging Unique Platform Inventory

Retail media platforms provide an express lane toward incremental growth by helping brands reach new and existing customers at key decision stages, facilitating a seamless conversion journey.

RMNs such as Carousell, Flipkart, foodpanda, Grab Lazada, Shopee and Zomato and others offer an array of upper-funnel inventory options, catering to strategies from mass marketing to highly-targeted niche engagement. While these platforms may not offer the mass reach of social and video platforms, they instead offer access to retail data that is continually expanding, voluntarily shared, and of high accuracy.

Driving Brand Discovery With Unique Formats

RMN’s drive product and therefore brand discovery. Interestingly, a significant number of RMN platform searches remain generic in nature, indicating users are yet to decide on a specific brand or product. That means RMNs can help advertisers cultivate top-of-mind brand awareness.

Brand and performance shouldn’t be seen as exclusive categories, either. In fact, brands are seeing that “brandformance” approaches melding branding and performance bear fruit. Case in point: Kiehl’s launched its TikTok Shop in Vietnam to drive incremental sales for the brand’s range of natural skincare products for face, hair, and body. When they first launched, they took Shoppertainment to the next level, hosting 40 live shopping streams over 30 days to boost real-time engagement and grow their following, boosted by a mix of Video Shopping Ads. This resulted in them becoming the #1 Premium beauty brand on TikTok Shop in Vietnam, seeing +11K follower growth and exceeding their launch target GMV by 3x.

Even traditional ad formats such as masthead and banners can still pack a punch. Partnering with food delivery provider Grab, Pepsi Thailand was able to collaborate directly with restaurants, targeting patrons to additionally order a Pepsi beverage. Pepsi enjoyed a 15% rise in ad recall (2.4x higher than Kantar’s SEA digital campaign norms) and spurred an 11% and 21% increase in sales on GrabMart and GrabFood respectively. Such examples underline the potent mix of smart strategies and diversified ad formats in amplifying brand recall and driving sales.

Tapping into RMN Data to Boost Off-Platform Strategies

Retailers are increasingly recognising the power of first-party data to shape their marketing strategies and drive better business results. This data universe typically encompasses shopper spending history, shopping cart contents, and data from loyalty programs that paint a granular picture of consumer behaviour.

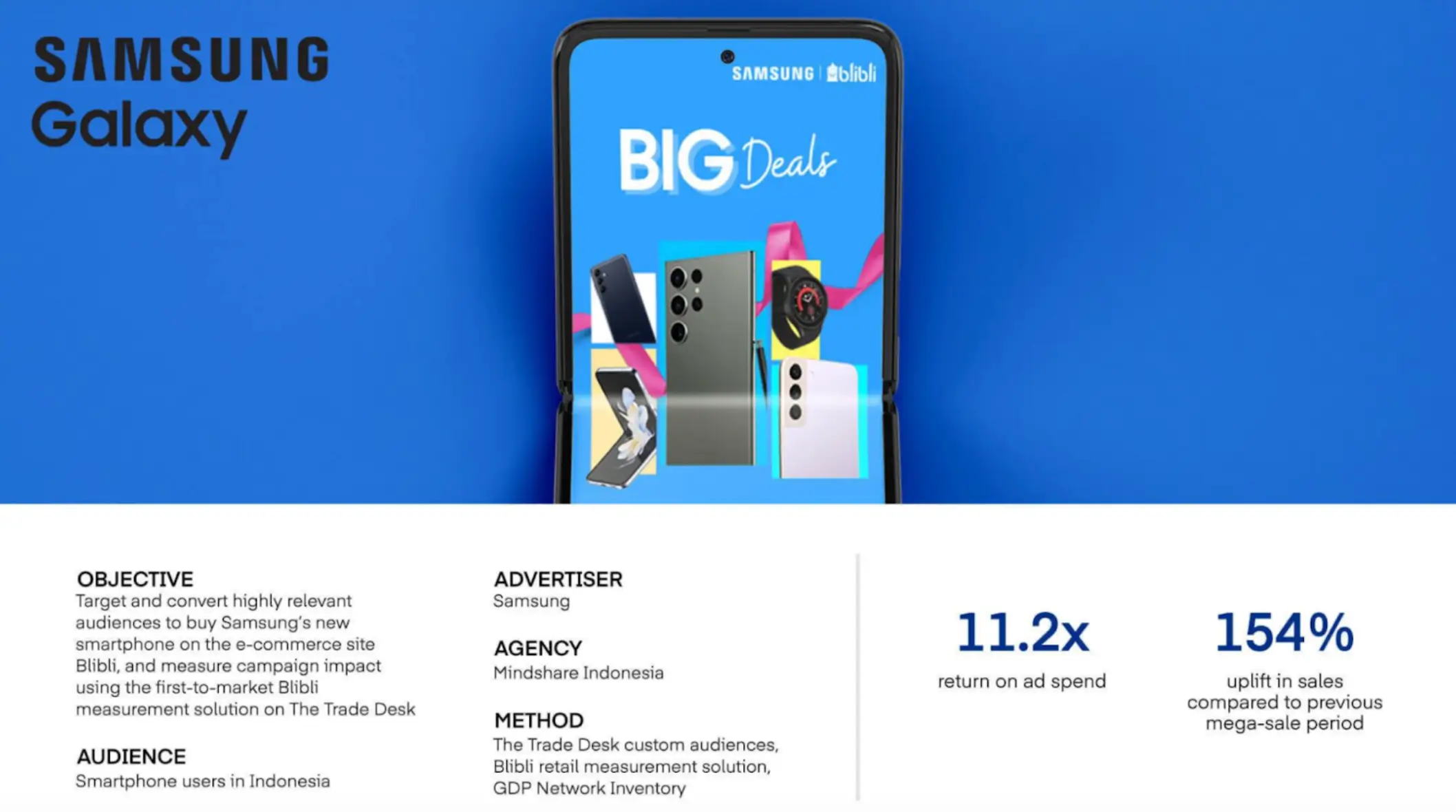

Two standout strategies for making the most of this data are retargeting consumers who have previously interacted with a store, and creating lookalike or custom audiences based on active store customers or visitors. These closely mirrored profiles enable brands to target the right people, at the right time, with the perfect value proposition.One brand benefiting from this data-driven approach is Samsung. By designing custom audiences using data from The Trade Desk as well as Indonesian e-tailer Blibli, the company saw a 154% uplift in sales compared to Blibli’s previous mega sale period. Similarly, personal care brand Olay leveraged their partnership with Shopee and Google to drive consumers to its official store. This strategic move utilised retailer first-party data and led to a 1.5x increase in store traffic and double the orders.

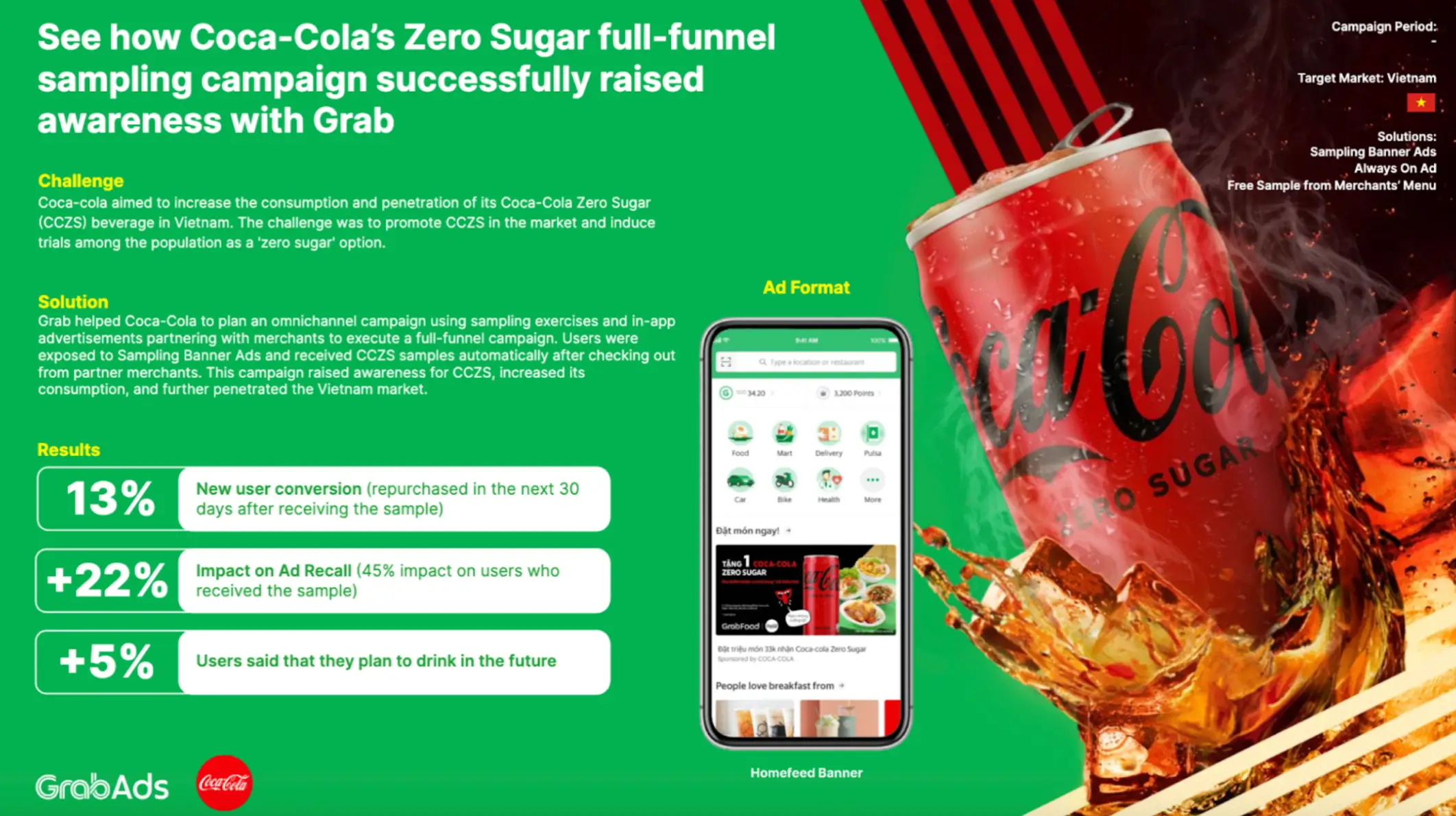

In Vietnam, The Coca-Cola Company took advantage of Grab’s network to boost awareness and trial for their Coke Zero product among non-users or less frequent users of Coke. By executing a full-funnel sampling campaign, which used first-party data to track sample receivers and measure future purchase behaviour, they noted a 22% increase in ad recall and a subsequent 13% rise in purchases from new users.

Online to Offline (O2O) Strategy in Action

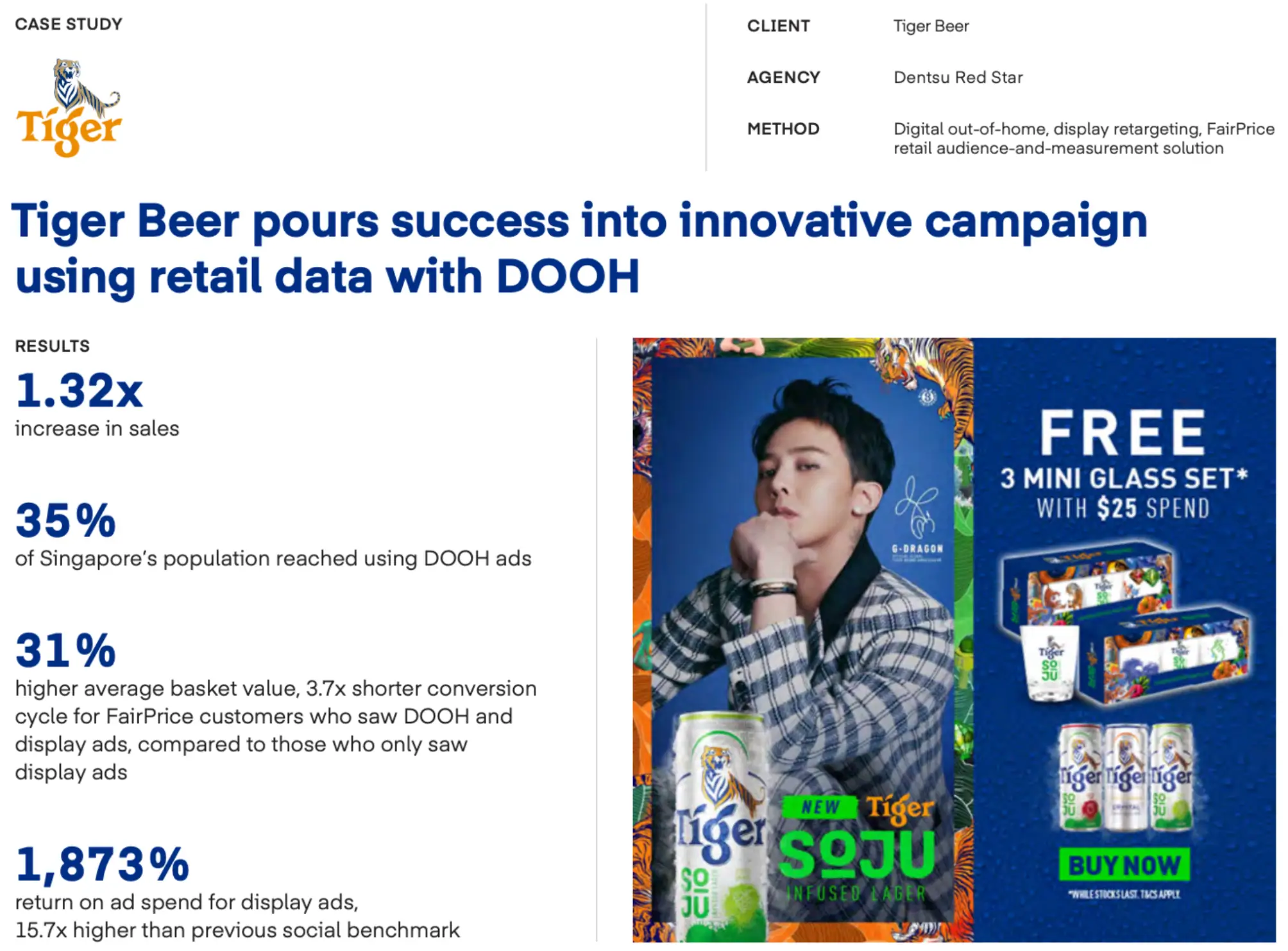

O2O strategies are essential components of some RMN platforms. For instance, the Tiger Beer Soju campaign who leveraged FairPrice’s first audience-and-measurement data for a closed-loop measurement system, tracing both in-store and online sales generated by their digital out-of-home (DOOH) and display ads. This not only allowed the brand to become one of the first to track a DOOH campaign with retail measurement solutions but using a Demand-Side Platform (DSP), also permitted them to reach high-value FairPrice customers beyond traditional out-of-home channels or FairPrice-owned media.

Leading Indian jewellery brand Tanishq drove awareness for nearby stores by leveraging geo-targeted “click-to-Whatsapp” campaigns on Meta platforms Facebook and Instagram, where consumers see an ad, and on clicking are linked to WhatsApp which is the most popular messaging app.

This was an India-first success with strong results on driving store footfall +15% and achieved a 14x ROAS via store sales, generated over 9000 leads in a hyperlocal setup spanning 4 cities. The same brand also achieved 667X improvement in return on ad spend (ROAS) using Google’s store sales measurement tool, proving the transformative power of connecting online efforts to offline return on investment (ROI).

Middle of the Funnel Strategies on RMNs

The Middle of the Funnel (MOFU) represents a pivotal phase in the customer journey. It’s the stage where potential customers actively engage and consider their purchasing options. It’s the bridge that connects interest to commitment, nurturing consumers towards conversion.

Brands need effective MOFU strategies that enable sustainable, profitable growth to transform hesitant buyers into loyal consumers.

During the MOFU phase, brands have the opportunity to deepen their engagement with consumers through personalised content, educational materials, and interactions tailored to consumer pain points. Effective MOFU strategies can include targeted content such as product demonstrations, reviews, and more, all aimed at building trust and guiding potential customers towards making a purchase.

Overcoming the Limitations of Traditional MOFU Strategies

Traditional marketing approaches often fall short, for several reasons: first, brands don’t tailor campaigns to cater to diverse consumer segments, each with their own unique needs. This leads to wasted resources and missed opportunities. Consumers crave relevance, authenticity, and a deep understanding of their needs. And with over 2,000 languages spoken across SEA & India, a one-size-fits-all approach to messaging is a recipe for failure. Well-executed hyper-personalisation can deliver the return on investment on marketing spend, and lift sales by 10% or more. Second, brands don’t tap into the wealth of data available within the SEA & India e-commerce and superapp ecosystem. 69 percent of customers appreciate personalisation as long as it is based on data they have explicitly shared with a business. Third, brands may not recognise the power of collective influence via social proof.

Conquering the “Messy Middle” by Allocating Budget Where it Matters

One of the most significant challenges brands face is effectively allocating budget across the marketing funnel. The MOFU, often referred to as the “messy middle,” can be more challenging to measure than the top-of-funnel (TOFU) brand awareness campaigns or bottom-of-funnel (BOFU) direct response initiatives. That’s partially because many brands treat different funnel stages as separate entities. But it’s crucial for brands to adopt a holistic approach, because consumer journeys are rarely linear. For instance, a customer might discover a brand through a social media ad (TOFU), read reviews and compare options (MOFU), and then make a purchase (BOFU). Each stage is interconnected.

Another key to conquering the “messy middle” is measurement and attribution. It’s essential to accurately attribute conversions and return on investment to specific MOFU tactics. Many retail media platforms offer increasingly sophisticated measurement tools that can help brands track the impact of their efforts: this information helps justify budget allocation and optimise campaigns.

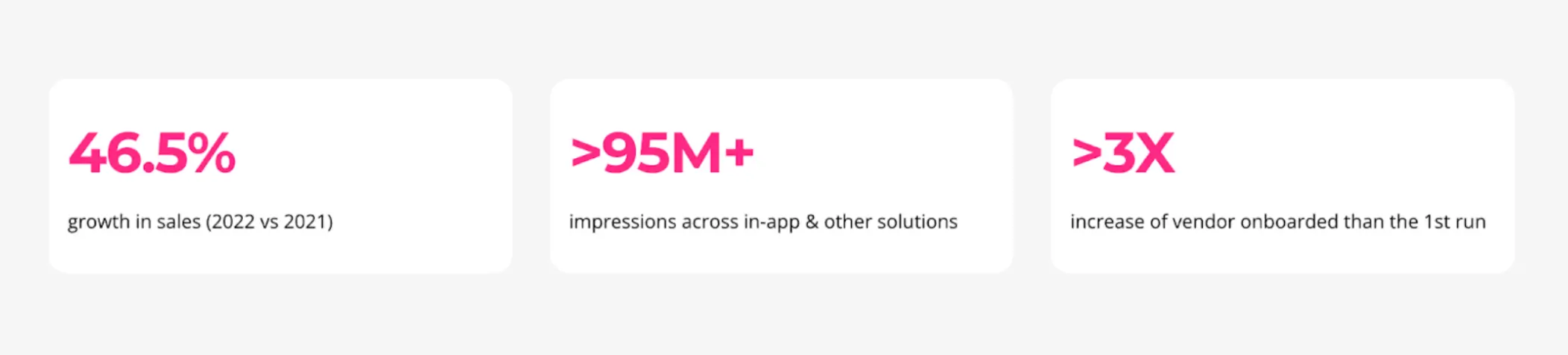

A case study from The Coca-Cola Company, featured on foodpanda’s Panda Ads platform, illustrates this point well. The Coca-Cola Company used foodpanda’s platform to reach consumers during the MOFU phase with personalised ads based on user preferences and behaviours. By leveraging foodpanda’s rich data insights, The Coca-Cola Company was able to optimise its campaign performance, leading to increased engagement and sales.

Unlocking the Full Potential of Retail Media in SEA & India’s MOFU

RMNs help brands address many of the challenges above.

Data-Driven Personalisation: Brands can use the granular first-party data provided by retail media platforms to create personalised experiences that address specific consumer needs and preferences as shoppers evaluate and compare options.

Native Integration Within Apps: Brands can nurture potential customers through the messy middle by reaching them within their trusted digital environments. By integrating brand messaging within popular RMNs and super apps like Grab, Gojek, and Shopee, brands can deliver content that helps consumers evaluate their offerings.

Amplifying Social Proof at Scale: Consumers in the MOFU stage are looking for validation. Incorporating user-generated content, reviews, and influencer marketing directly into retail media campaigns can significantly enhance a brand’s credibility. Garnier Thailand leveraged Facebook’s targeting capabilities to reach potential customers with personalised ads featuring user-generated content and reviews. This resulted in a 10-point lift in brand lift and a 4-point lift in ad recall.

Omnichannel retargeting: In Singapore, Tiger Beer sought to blaze a trail with the introduction of Tiger Soju Infused Lager. Through retargeting people who were exposed to DOOH ads with display ads, this audience had a 42% higher click-through rate than the display aggregate. Using the close-loop sales measurement powered by The Trade Desk and FairPrice, the audience exposed to omni-channel media saw 31% higher basket value and a 3.7 times shorter conversion cycle, compared to those who only saw display ads.

Retail media offers powerful tools for optimising the MOFU in SEA and India. Granular first party data enables both data-driven personalisation and personalised experiences. Native integration within ecommerce and superapps helps brands reach prospects within a trusted digital environment. Brands can boost credibility by incorporating user-generated content, reviews, and influencer marketing directly into retail media campaigns.

Here are some fast-emerging MOFU tactics:

Innovative Engagement: Brands should think beyond traditional product placement and explore innovative formats to engage consumers. Shoppable livestreams, interactive quizzes, broadcast chat, complementary product pairing and augmented reality experiences are just a few examples of immersive techniques that can capture consumer interest and drive engagement. For instance, Alibaba’s Singles Day Gala incorporates shoppable livestreams, turning shopping into an entertaining event.

Embracing Vernacular Marketing: Catering to linguistic diversity in SEA & India means brands must tailor their messaging and creative assets to resonate with local languages, dialects, and cultural nuances. This means going beyond translation and adapting content to reflect local idioms, humour, and cultural references. According to KPMG, vernacular internet users in India are expected to reach 740 million by 2027, highlighting the importance of this approach. For instance, Myra Philippines used a combination of vernacular marketing, shoppable livestreams, and influencer partnerships on Facebook to drive brand awareness and sales. This resulted in a 20% increase in brand lift and a 15% increase in purchase intent.

Measurement That Matters: Brands need to go beyond traditional metrics like clicks and impressions and focus on KPIs that align with their specific MOFU objectives. This could include add-to-cart rates, product page views, and conversion rates from specific campaigns. By focusing on these metrics, brands can gain deeper insights into their MOFU performance and make data-driven decisions to optimise their strategies.

Key Considerations when Creating a Future-Proof MOFU Strategy

Data Privacy and Security: As brands dive deeper into data-driven personalisation, they’re collecting and leveraging increasingly granular consumer data. While this can enhance MOFU effectiveness, it also brings about significant responsibilities. Prioritising data privacy and security is non-negotiable. Brands must ensure compliance with local regulations such as India’s Personal Data Protection Bill and build trust with consumers by being transparent about how they collect, use, and protect personal data.

Retail media within brick-and-mortar: Although most MOFU solutions we’ve covered are offered by digital-native platforms, a significant portion of consumer products are still bought offline. The synergy between online and offline channels (O2O) is crucial for a brand’s comprehensive omni-channel strategy. In the US, Walmart Connect‘s growth highlights the value of brick-and-mortar retail media networks. While retail media from brick-and-mortar is still in its early stages in Southeast Asia and India, solutions from retailers like Fairprice, Watsons and Lotus are emerging.

Finally, building a robust MOFU strategy isn’t a sprint; it’s a marathon process of testing, learning, and refining strategies to achieve sustainable growth. Brands need to invest in the resources and expertise needed to navigate the complexities of these dynamic markets. This could involve investing in advanced analytics tools, upskilling teams, or partnering with local experts who understand the nuances of these markets.

Bottom of the funnel

Bottom of the funnel (BOFU) is the final and crucial stage in the customer journey. BOFU strategies aim to drive sales as well as repeat purchases, and to foster customer loyalty. The challenges brands face at this stage of the funnel include intense competition from advertisers vying for similar shopper audiences, consumer price sensitivity and lack of retailer loyalty, standardised attribution, data and platform maturity and, sometimes, fragmentation of the media investment due to the plethora of formats and placements available across the ad ecosystem.

On-retail platforms: closed loop measurement

Fortunately, BOFU is where RMNs really shine. RMNs track consumers from ad exposure until purchase. Because purchases happen on platform, these RMNs can offer closed loop attribution, meaning that sales can be directly linked to on-platform advertising. This enables brands to attribute tangible results to advertising spend.

On-Retail Platforms: Engaging Consumers at the Point of Purchase

RMNs offer high-intent environments, and a unique opportunity to capture consumer attention at crucial decision points.

- Lotteria: Lotteria utilised a mix of banner, video, and search ads with GrabAds to engage consumers throughout their purchase journey. This strategy yielded 9.3x ROAS and attracted over 8,000 new customers, demonstrating the effectiveness of reaching consumers within a high-intent environment.

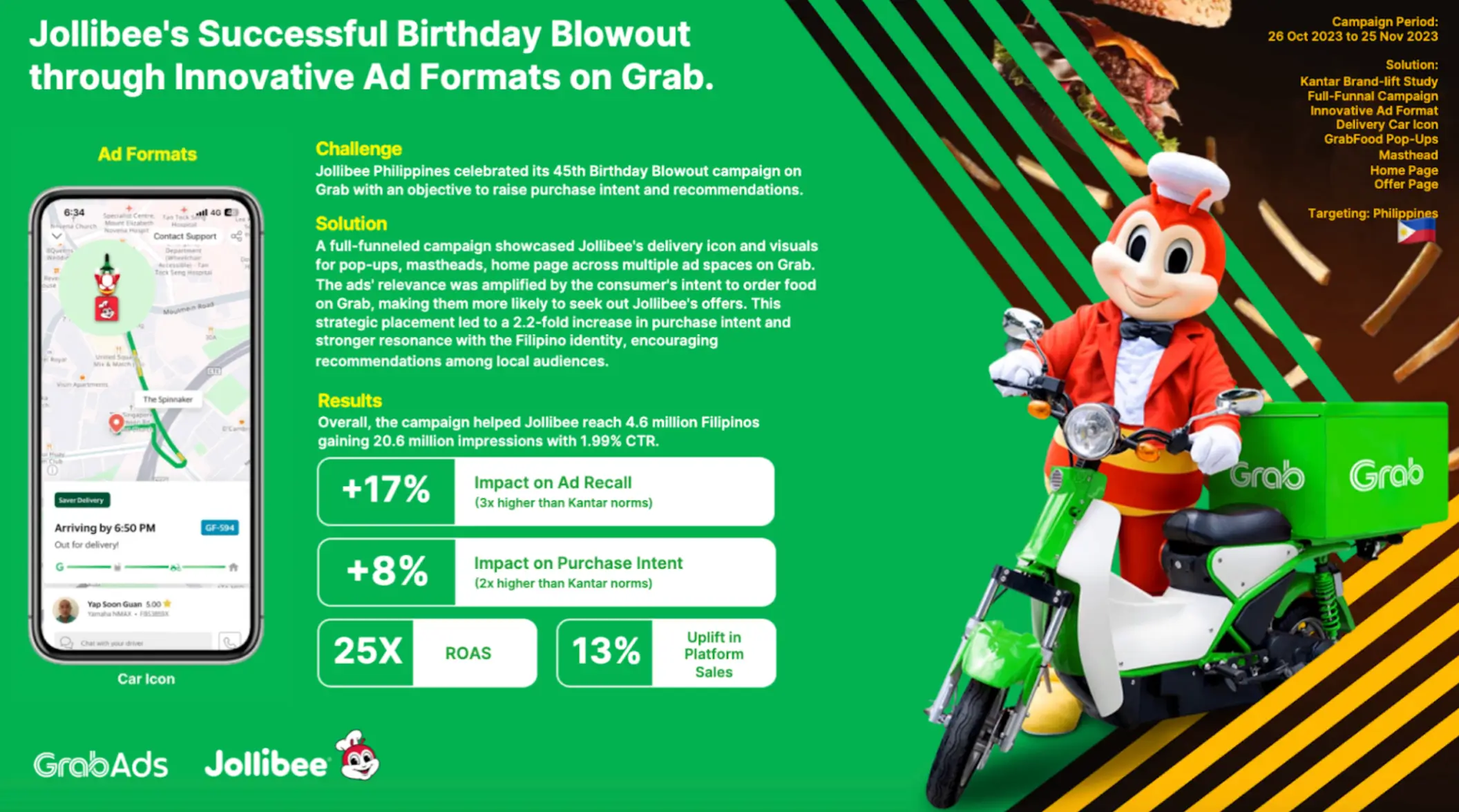

- Jollibee: Jollibee capitalised on GrabAds’ innovative upper funnel ad formats, including delivery car icon and GrabFood pop-up ads, to maximise visibility and engagement during their 45th-anniversary campaign. This full funnel strategy resulted in a 25x ROAS and a 13% uplift in platform sales, highlighting the impact of creative ad formats in driving conversions.

- Myra: Filipino skincare and beauty brand Myra leveraged Meta Collaborative Ad campaign on Facebook and Instagram and added new customer engagement formats e.g. Reels to earn a 3X increase in incremental add-to-cart events to its campaign.

RMNs have found ways to extend their reach beyond the immediate online retail environment. Many now enable brands to leverage their data and technology to reach consumers via social platforms like those owned by Meta and open web platforms like The Trade Desk. In doing so, advertisers can influence purchasing decisions both online and offline. Here’s how top brands utilised these types of integrations to drive impact beyond the RMN environment:

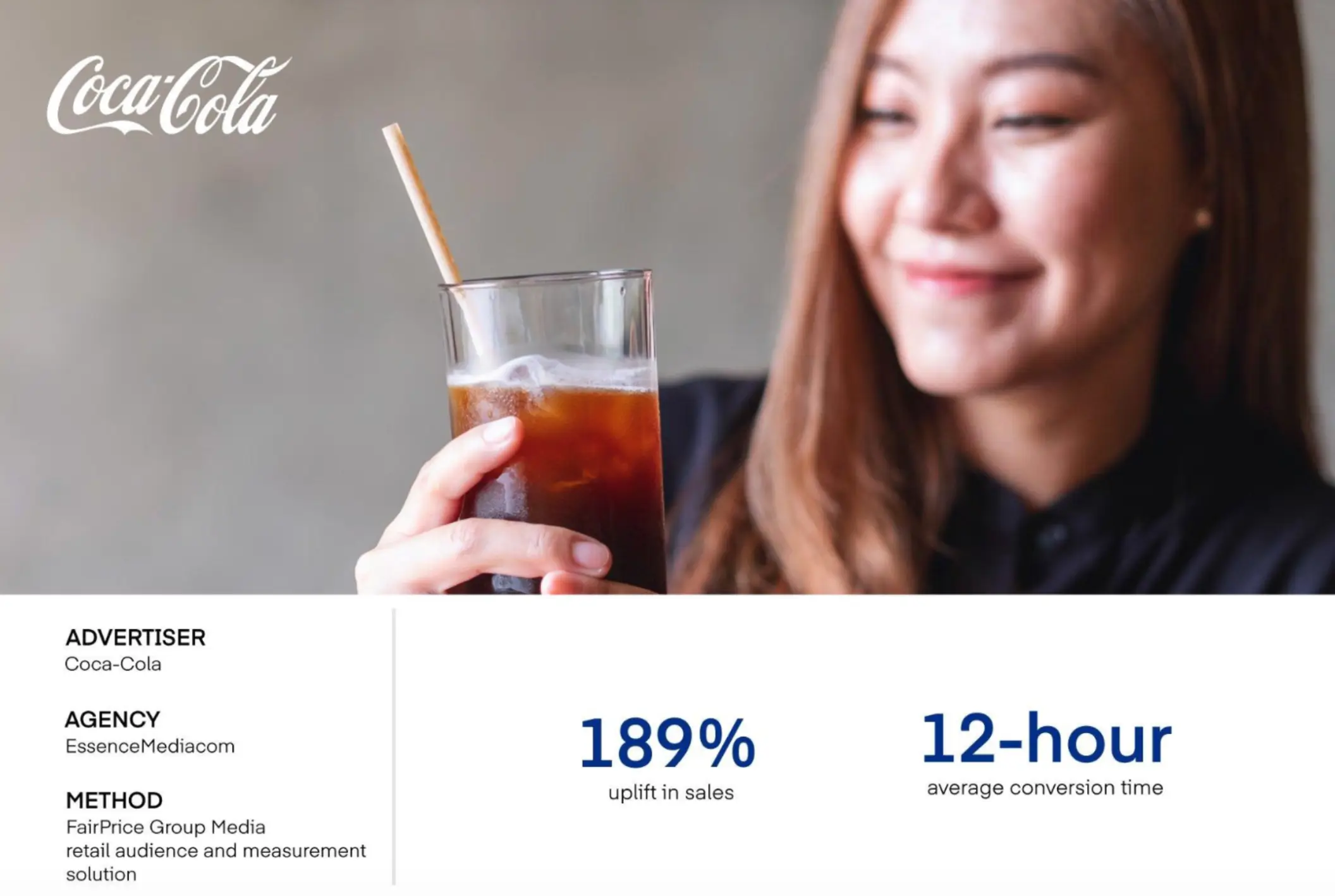

- The Coca-Cola Company: Collaborating with The Trade Desk and FairPrice Group, The Coca-Cola Company leveraged retail data to target recent purchasers with programmatic display ads. This data-driven strategy yielded a 189% uplift in sales (tracked both online and in-store), showcasing the impact of precise targeting on driving immediate purchase behaviour.

- Unilever: Seeking to drive sales for new Ben & Jerry’s desserts, Unilever partnered with Mindshare and leveraged foodpanda’s first-party retail data on The Trade Desk platform. This enabled them to target high-value audiences, including past purchasers of Ben & Jerry’s and frozen dessert consumers. By connecting ad spend to sales on the foodpanda app, the campaign achieved a 1.5x ROAS overall, with the targeted “past customers” audience segment delivering an exceptional 26x ROAS and a 94% lower CPA than the campaign average.

- Collapsing the funnel with business messaging on Messenger & WhatsApp: Business messaging is the next era of customer engagement. 78% of Thai and 79% of Vietnamese online adults message a business at least once a week, while in India over 60% of WhatsApp users message a business account every week. So Meta and Shopee integrated brand catalogs directly into Messenger, so shoppers could browse and purchase from their messaging. This seamless shopping experience not only simplifies the process but also personalises it, mirroring casual interactions with friends and family while making shopping effortless. AlwaysHealthy, a Thai clothing brand, saw a 71% increase in return on ad spend using this integration; Beebox Printing, a biodegradable paper products company, streamlined its sales process and improved customer service, leading to an increase in return on ad spend and a significant percentage of Messenger conversations turning into purchases. This integration exemplifies the future of retail media networks.

Ongoing challenges

While RMNs hold tremendous promises, challenges do remain. For one, SEA and India contain a universe of cultural nuances, with diverse demographics shaping complex consumer habits. For instance, live streaming on TikTok Shop and Shopee have become major revenue drivers in SEA, whereas this trend is in its infancy stages in India. Additionally, unlike the US, the retail landscape is highly fragmented with a far wider range of major players across superapps, marketplaces and retailers with strengths in specific local markets. This fragmentation is compounded by the proliferation of ad formats and placements within RMNs, sometimes leading to a lack of investment sufficiency.

There’s also room for measurement to evolve. Measurement and attribution models aren’t standardised across retailers, leaving some advertisers unsure about the true conversion contribution of each touchpoint and ad placement. Data can also be siloed within each retailer, with no way for brands to share that data outside the original platform. This adds a challenge for brands to fully connect the dots across the consumer journey and to be able to maximise the potential of retail media.

As the digital advertising landscape continues to take shape, strategic partnerships and close collaboration between RMNs, brands and tech providers will be a key driver of this innovation at the bottom of the funnel in the coming years. Tech providers likeThe Trade Desk can use exposure logs to close the loop between ad exposure and online or instore purchase. These partnerships can unlock new opportunities for personalisation, omnichannel consistency, and seamless conversions, ultimately enhancing the overall customer journey, loyalty and driving better results for all parties involved.

Conclusion

RMNs have emerged as a powerful bridge between retail and advertising, enabling retailers to engage potential consumers at various touchpoints and guide purchase decisions. They have proven their effectiveness in both bottom-of-the-funnel conversion media and upper-funnel brand building – and in between in the “messy middle.”

The popularity of RMNs lies in their efficacy, and their ability to offer brands both first-party data and innovative ad formats within a new crop of apps and platforms across the region. Together, these two strengths enable RMNs to deliver personalised ads that increase engagement and sales.

Partnerships and innovations have enabled RMNs to expand beyond the immediate online retail environment. Collaborations with platforms like Meta, Google, TikTok, and The Trade Desk have enabled RMNs to extend their reach even further both on and offline. This off-platform reach, combined with unique platform inventory and creative formats, drives brand discovery and boosts off-platform strategies.

Despite the tremendous promises of RMNs, challenges remain. The diverse demographics and cultural nuances of SEA and India, the fragmentation of the retail landscape, and the lack of standardised measurement and attribution models are some of the hurdles to overcome. However, as the digital advertising landscape evolves, strategic partnerships and close collaboration between RMNs, brands, and tech providers will be key drivers of innovation.

RMNs have proven to be a game-changer in the retail and advertising landscape. By leveraging their full-funnel power, brands can maximise sales, build brand awareness, and foster customer loyalty. As we move forward, the continued evolution and innovation of RMNs will undoubtedly unlock new opportunities and drive better results across our region.