Connected TV or CTV is gaining popularity for its ability to combine traditional TV’s broad reach with digital advertising’s measurement capabilities. But WARC’s Rica Facundo says this hybrid role can also make it difficult for marketers to maximise its potential.

The “Inside” series is a collaboration between WARC and IAB SEA+India to spotlight the power of collective expertise in navigating the region’s diverse landscape based on exclusive access to IAB SEA+India members.

Connected TV (CTV) is a device to stream over-the-top (OTT) video, which refers to video content delivered over the internet, bypassing traditional cable or satellite providers.

It has become increasingly popular due to its “best of both worlds” positioning – combining traditional TV’s power in broad reach and storytelling with the interactivity and measurement capability of digital advertising.

But its hybrid role is also a double-edged sword in media buying and measurement, often leading to confusion over how best to leverage its potential.

Many parts of Asia buy TV ads based on socio-economic classification like SEC A, B, and C, compared to the demographic targeting abilities that CTV offers along with other data signals, often leaving marketers grappling with how to fully harness dual strengths in a fragmented and evolving media landscape, points out Omnicom Media Group’s Bharat Khatri.

Conversely, “marketers are increasingly applying digital mobile and desktop, also taking and applying the parameters of digital to CTV planning, some of which does not translate very well”, Khatri adds.

Without clear strategies for integrating CTV into the media mix, marketers risk diluting CTV’s role and missing out on its value as a strategic channel. At an IAB event, members discussed the need for marketers to have a broader understanding of CTV’s purpose in the media mix.

As GroupM Nexus’ Deepika Nikhilender questions, “Do we start with CTV as being part of TV or digital planning? We strongly encourage our clients to plan for CTV as part of Total TV planning.”

CTV’s pricing dilemma

One of the biggest hurdles for CTV buying in APAC is how price-sensitive markets like Southeast Asia and India perceive it. When advertisers don’t recognise the value CTV delivers, “price becomes their only point of reference”, shares Tushar Tyagi of Samsung Ads.

When marketers focus solely on metrics like video views, CTV is often unfairly stacked against platforms like YouTube, where impressions come at a lower cost.

According to GroupM’s Alex Lowes, "When we think of CTV within a Total TV strategy, we need to consider the value of premium and broadcast quality content. Direct comparisons with online video environments, often hampered by limited viewability or user-generated content, undervalue CTV's unique contribution to the marketing mix.”

Another budget hurdle is reconciling the scale and returns traditionally associated with TV screen size with the realities of OTT inventory, especially on mobile devices, a key feature in Asia.

According to Teads’ Diogo Andrade, "It's hard to bring TV dollars into mobile streaming, which is where most of the OTT inventory is, because of the expectations on the type of returns that the size of the screen can deliver.”

The OTT factor

Scale is another significant barrier to CTV’s success in APAC, making it “one of the biggest issues when I talk to agencies and brands, as this is a perception hard to change even if they love the unique creativity and significant impact we can deliver through CTV Homescreen executions”, says Diogo.

This is why many buyers in the region often combine OTT and CTV in their media plans to meet the demands of larger companies. However, this approach also creates challenges because “some publishing partners in Asia don’t typically differentiate between CTV and OTT audiences”, making it difficult for buyers to target CTV specifically, says PubMatic’s Emily Yri.

In APAC, the boundaries between CTV and OTT buying are often more fluid, points out OpenX’s Evelyn Tay. "Globally, CTV is seen as a glass on the wall", akin to a traditional TV experience. However, in APAC, "OTT content is considered part of CTV". This includes any video consumed across mobile devices or various screens, expanding the traditional notion of CTV.

Discrepancy in reach

Another challenge is the lack of consistent, standardised measurement, which complicates the integration of CTV into media plans. There is a mismatch in how reach is calculated and perceived across platforms.

"The challenge is understanding the reach and co-viewership mechanism across these channels and how that trickles down to measurement. So, as an industry, we need to think about what is the reach multiplier. Because it's the same screen and content genre,” says Khatri.

Unlocking CTV’s full potential

Despite these challenges, advertising will inevitably follow where audiences spend a disproportionate amount of time, making the potential of CTV – particularly FAST (Free Ad-Supported Streaming TV) advertising – across Asia hard to ignore, especially with the proliferation of affordable data plans and growing penetration of Smart TVs.

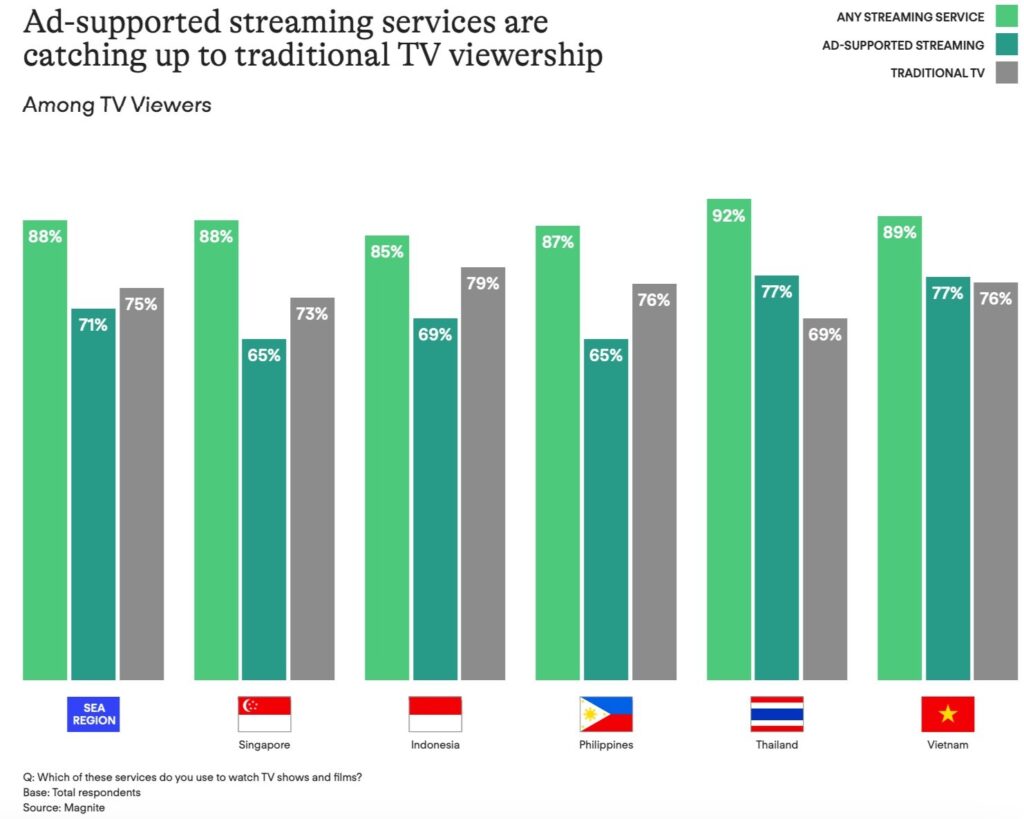

According to Magnite research, 79% of TV viewers in Southeast Asia prefer watching free or reduced-cost content with ads, versus 21% prefer an ad-free experience.

CTV offers unique capabilities and value propositions that cannot be directly compared to mobile, linear TV or other digital formats.

"Every time we have had a win with CTV, it is because we've placed it in a strategic role in the plan," asserts Nikhilender.

For example, in a campaign for Range Rover and Samsung Ads by OMG, the use of CTV to reach hard-to-reach HNI audiences led to 110% higher CTR versus benchmarks, +25% message association and +19% purchase intent.

In Indonesia, Nestlé launched a new limited edition NESCAFÉ Biscuit Coffee with Marie Regal Biscuit by leveraging the popularity of OTT streaming in the country on key streaming platforms such as WeTV, Viu and Vidio. The campaign, facilitated by Magnite, featured a 15-second video ad optimised for delivery at peak traffic hours and resulted in a 34% uplift in purchase behaviour, a 15% uplift in positive perception and a 41% uplift in ad recall.

For marketers looking to use CTV with similar success, consider the following strategic advantages:

Audience targeting

- Household-level targeting: CTV viewing often happens at the household level rather than the individual level. This allows brands to reach high-income, high-value consumers who may be difficult to target through other digital channels.

- Home screen placements: CTV platforms often feature branded content or advertisements on the home screen, the first thing viewers see when they turn on their connected TVs. This provides an opportunity to reach audiences who may not actively seek out or engage with advertising on other platforms.

- Geo-first strategy: This allows advertisers to activate CTV campaigns tailored to local or regional markets rather than taking a national or state-wide approach.

Full funnel marketing

- Top funnel awareness: CTV provides the best placement for running brand awareness campaigns, as it offers a large canvas for interactive and engaging creatives. It can also deliver reach and scale comparable to linear TV but with more addressability and targeting capabilities.

- Middle funnel engagement: CTV enables better measurement of frequency and exposure, allowing brands to build consideration through targeted and sequential messaging. Unlike linear TV, CTV’s household-level targeting and attribution capabilities help brands track the impact on consumer consideration.

- Lower funnel conversion: CTV is not just for upper funnel marketing – it can effectively drive lower funnel performance by reaching audiences less engaged with social or search ads, resulting in incremental conversions. Brands can utilise shoppable ad formats and e-commerce integrations for direct sales. Magnite research shows that 48% of ad-supported viewers in Southeast Asia purchased something after seeing an ad on streaming, compared to 39% of social video users.

- Cross-media effectiveness: CTV’s geo-targeting capabilities can upgrade or extend the reach of a client’s existing linear TV campaigns within specific regions and supplement social media or other digital campaigns, providing additional reach and frequency in targeted local markets.

Formats

- CTV is not only for premium content: CTV can accommodate a wide range of content, from premium broadcaster channels to user-generated content (UGC) on platforms like YouTube. Buyers have the flexibility to apply filters and targeting to access the specific type of CTV content that aligns with their brand and campaign objectives.

- Addressable creative: Combining a geo-first approach with addressable creative allows advertisers to further customise their messaging and offers for specific regional or local markets.

- Interactive content: The interactive capabilities of CTV, such as QR codes and branded content integrations, can help drive deeper engagement and consideration.