Brands in Southeast Asia and India want to invest in retail media networks but remain hesitant as the industry is still in its infancy. WARC Asia Managing Editor Rica Facundo explains how the IAB’s Retail Media Council plans to evolve the ecosystem.

The “Inside” series is a collaboration between WARC and IAB SEA+India to spotlight the power of collective expertise in navigating the region’s diverse landscape based on exclusive access to board and council workshops.

Southeast Asia and India are positioned for Retail Media Networks (RMNs) to flourish. With a fast-growing digital economy and increasingly tech-savvy population, brands are primed to close the loop and use first-party data to build brand equity, increase share of voice and drive sales growth.

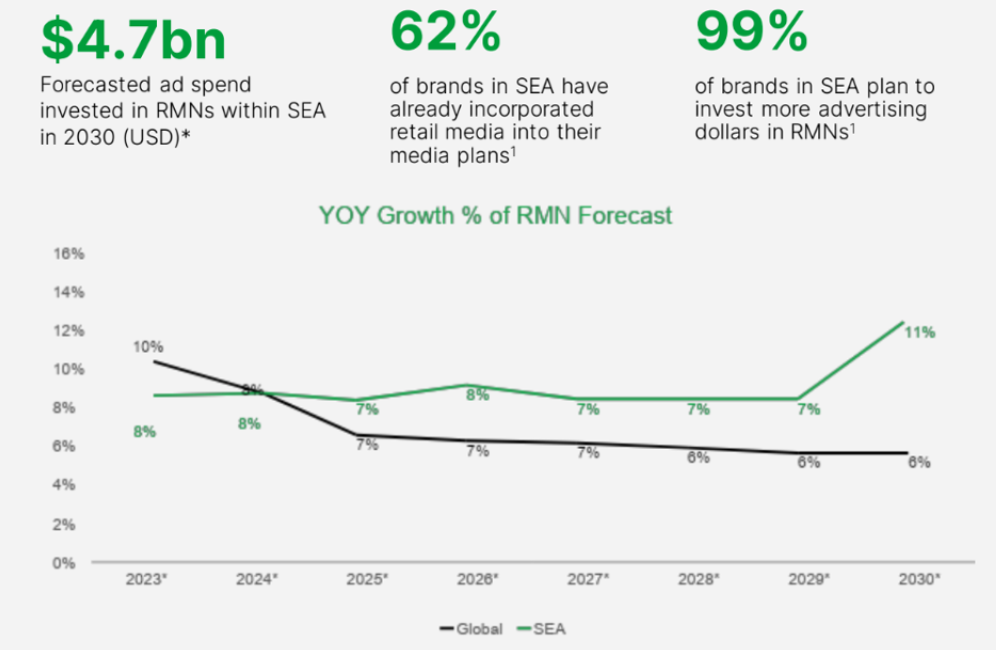

The appetite to invest is clearly there – 99% are looking to spend more in retail media networks, according to a 2023 IAB Southeast Asia+India study commissioned by the Carousell Group. GrabAds and Kantar recently forecasted that advertising spending on RMNs in Southeast Asia will hit US$4.7 billion by 2030.

Source: GrabAds x Kantar: Unleash your full potential with retail media networks, 2024

Source: GrabAds x Kantar: Unleash your full potential with retail media networks, 2024

“But like any new technology and platform, there is a lag between the desire and the actual commitment to that,” points out regional head of commercial enterprise for Grab and IAB SEA+India regional board member Dave Yang.

Based on the IAB study, most marketers (56%) have allocated less than 5% of their media spending to retail media, with only one-third (33%) saying they have allocated 5-14%.

So, despite all the new evidence and literature outlining all the opportunities in retail media networks, there’s still a sense of hesitation among IAB’s Retail Media Council members that advertisers are not investing enough, partly because the industry is still in its infancy.

At present, the industry still feels like the Wild West—rapidly changing and fiercely competitive—with many players rushing to cash in on the next big wave of advertising and leaving potential advertisers confused and wary about how to invest and measure effectiveness.

Choice overload

One of the underlying reasons for hesitation is the confusion about what a retail media network is, especially given how quickly platforms are innovating with new features and capabilities.

According to WARC, retail media is advertising within retailer or marketplace sites and apps – or using retail data on offsite media where there’s big appetite from advertisers in the region. A previous IAB report found that 78% of marketers will use retail media data for off-platform targeting on new formats such as CTV.

Retail media networks (RMNs) are the advertising platforms created by retailers that give brands access to advertising inventory across owned retailer channels.

The confusion becomes exacerbated because there are endless retail media networks from which to choose. A Criteo report states that 45% of brands say their biggest challenge is managing too many retail media networks.

“What do those three words actually mean? The answer is that retail media means different things to different stakeholders and what part of the funnel they are responsible for,” says Yang.

Choice overload is more pronounced in Southeast Asia and India. Unlike the US and China, where dominant original e-commerce platforms like Amazon and Alibaba have robust retail media networks, the region has a mix of local, regional and international players competing for market share.

“Southeast Asia’s retail sector is characterised by a high degree of fragmentation, with no single player commanding a dominant market share. While online marketplaces have experienced rapid growth, offline retailers continue to play a vital role”, says Google’s Shabana Badami, especially as Asians are omnichannel shoppers who like to browse products online but buy them in a retail store.

If you compare RMNs to the social media industry, where there are generally only a handful of big platforms such as Meta, TikTok, Instagram, etc., “there are just so many options available,” says Fai-Keung Ng from The Trade Desk.

It makes the buying process rather challenging for clients. To expedite the growth of retail media spend, as an industry, we want to make the retail media and data easier to access and integrate with the existing buying process.

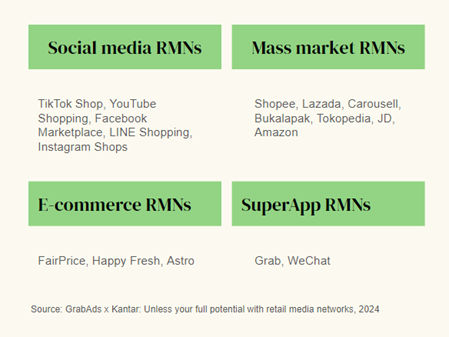

A place to start is understanding the type of RMN according to the purchase stage. According to GrabAds, there are four types in SEA:

- Impulse and WOM

- Price-motivated

- Trial and Repeat

- Versatile

EFFECTIVENESS EXPECTATIONS

The willingness to invest in retail media also depends on the type of returns you expect to receive, which varies greatly depending on the key stakeholder you are pitching to and the source of the budget.

According to the IAB study, seven out of 10 respondents (73%) fund their investments through shopper/trade budgets. However, what they use these budgets for merits closer inspection.

Retail media is often regarded as a first-party data-fuelled performance marketing opportunity for brands, enabling brands to close the measurement loop.

Yang says, “In many ways, retail media networks have solved the hardest marketing problem ever created about how to get direct attribution. “But in reality RMNs can do so much more than drive bottom of the funnel metrics.”

Brands must be wary of using retail media merely as a “performance plughole” and direct investment into only lower-funnel conversions.

Globally, conversion is moving beyond the binary view of brand versus performance towards a more outcome-focused approach, especially now that digital platforms’ capabilities are becoming more full-funnel. However, only 38% of marketers expect to use retail media for full-funnel campaigns.

Despite this, there’s a sense that Asian marketers are still “stuck at the bottom of the funnel”, says RTB House’s Aileen Chua, where the primary metrics of success are still GMV, transactions or sales.

To reconcile this and reap the full benefits of retail media networks, the council members recommend a few things that need to happen to evolve the ecosystem.

- Educate advertisers on the “wear out effect” on demand: Adding in brand building can improve the effectiveness of performance marketing and make campaigns more efficient when growth starts to plateau on pure performance.

- Invest in capabilities: Retailers must invest in a full suite of capabilities that give advertisers confidence to track performance across RMNs. This can also include linking results from “walled gardens” of retail media with performance data from other platforms to understand the synergies and ‘halo’ effects between online and offline advertising.

- Educate platforms to widen the inventory available: Offer more formats that enable advertisers to build brands on retail media and deliver on full-funnel marketing.

Want more exclusive insights from the IAB SEA+India x WARC Inside Series?

Discover how India’s unique cultural nuances, data landscape, and digital infrastructure are shaping marketing effectiveness in this rapidly growing market. Featuring insights from the IAB SEA+India Regional Board, this deep dive into India’s marketing landscape is a must-read for anyone looking to succeed in this diverse region.