Author: Jayakrishnan Chandrasekaran, InMobi | IAB SEA+India Data, Measurement & Impact Regional Council

The world is moving towards privacy

The promise of digital and mobile for advertisers was the ability to track advertising performance at a user level. This not only brought a new level of accountability for marketing spends but also funded the development of third-party free to use apps. But this rise of micro-targeting brought both regulatory and consumer trust challenges across platforms, leading them to restrict access to unique identifiers in both the browser and mobile app environments.

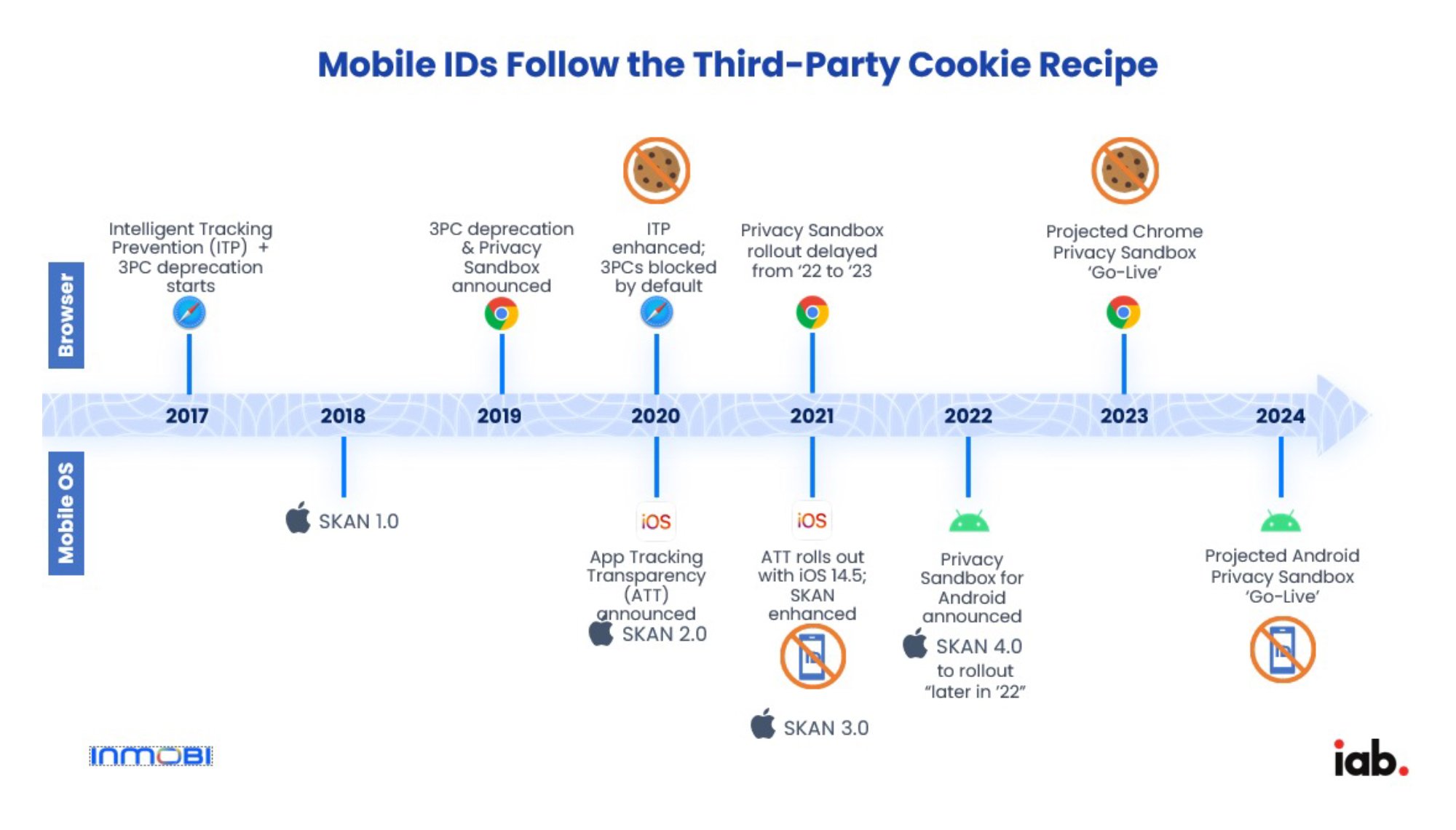

In the browser world, Apple enabled ad blockers on Safari starting in 2015. They followed this up with a new privacy feature called Intelligent Tracking Prevention (ITP) in 2017 which initiated third-party cookie deprecation. The ITP protocol was then further enhanced in 2020 when Apple began blocking all third-party cookies by default.

Google announced their Privacy Sandbox initiative for Chrome in 2019, intended to deprecate third-party cookies, but its rollout has experienced a series of delays with 2024 the latest prospective launch date. When it eventually rolls out, third-party cookies will entirely become a thing of the past across the web ecosystem.

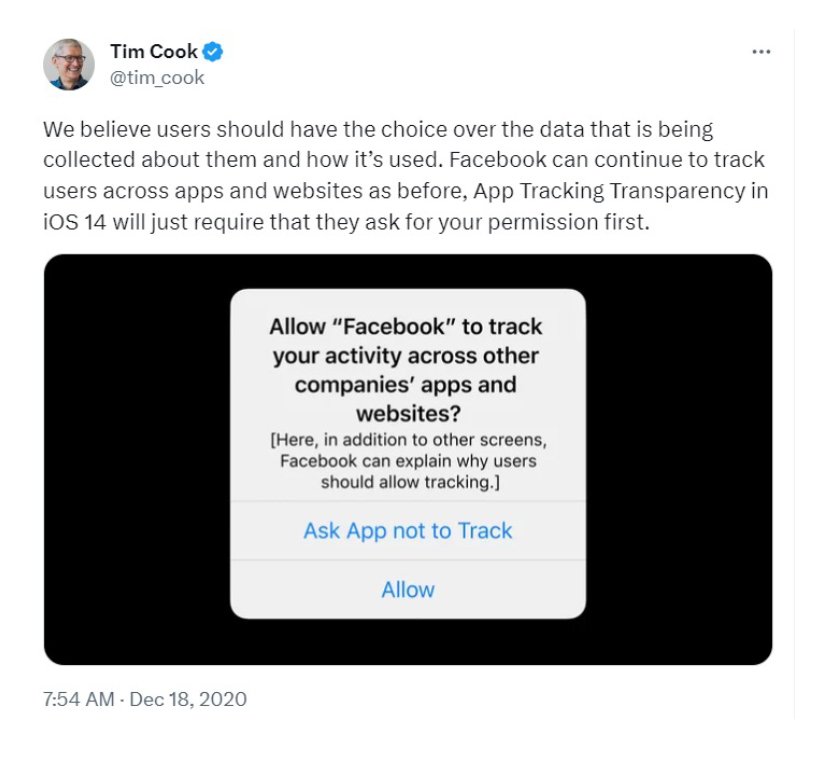

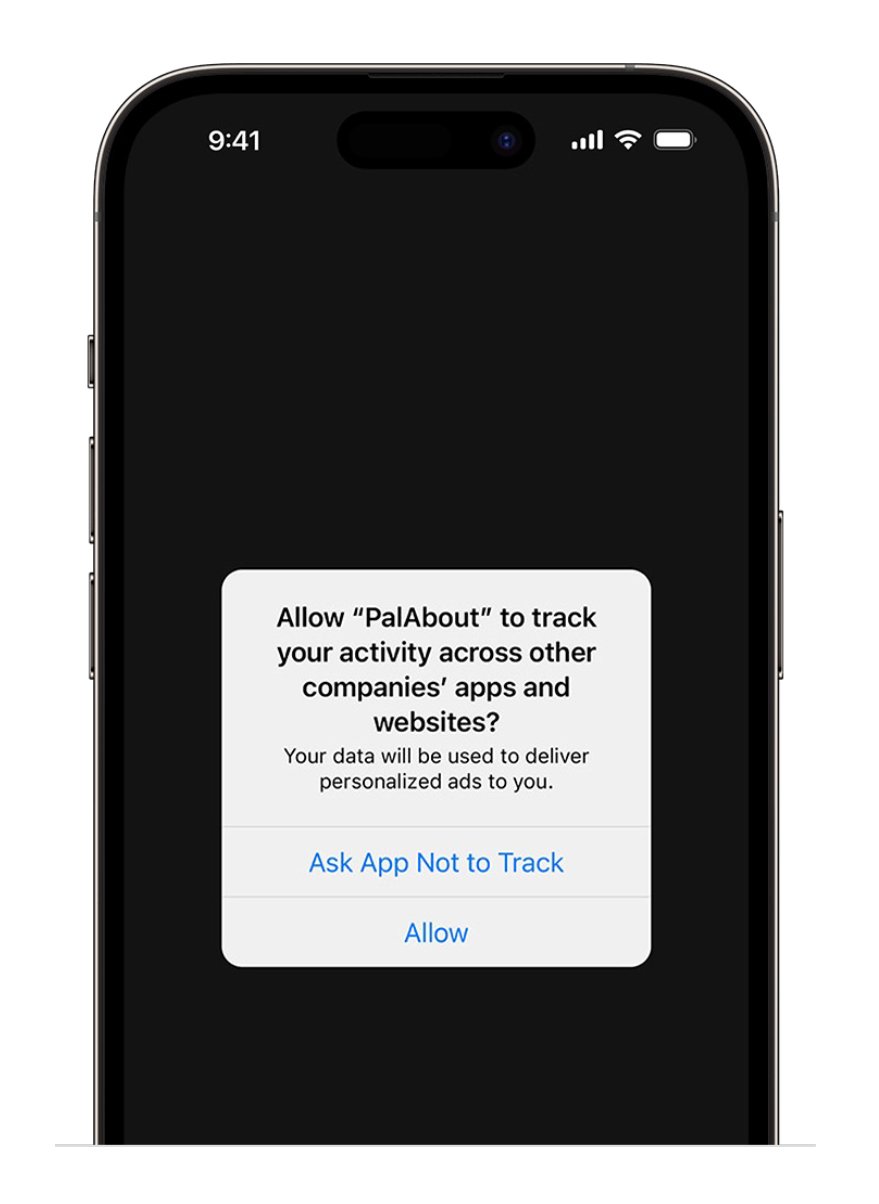

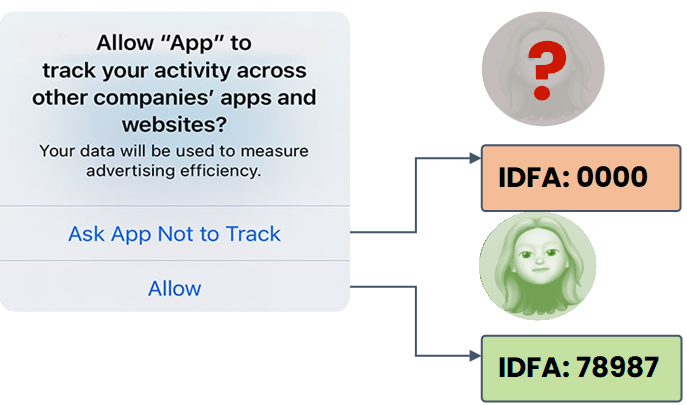

On the app side of things, Apple once again led the way with the introduction of the first version of its privacy-preserving attribution framework SKAdNetwork (SKAN) in 2018. At that time, SKAN went fairly unnoticed by the industry. It was later thrust into the forefront with the announcement of App Tracking Transparency (ATT) in April of 2020, which became mandatory the following year, requiring app developers to obtain permission from iOS users in order to track their actions across apps owned by separate entities. If you have seen messages on your phone like the ones below, then you have experienced ATT in action.

The release of ATT with iOS 14.5 back in 2021 managed to upend the entire iOS mobile marketing industry. Rather than the previous approach of giving iOS users the ability to opt out from being tracked in their device settings, now they must actively opt-in to being tracked across apps owned by separate developers. In Tim Cook’s words, ATT gives users the freedom of choice to control how their data is collected and used.

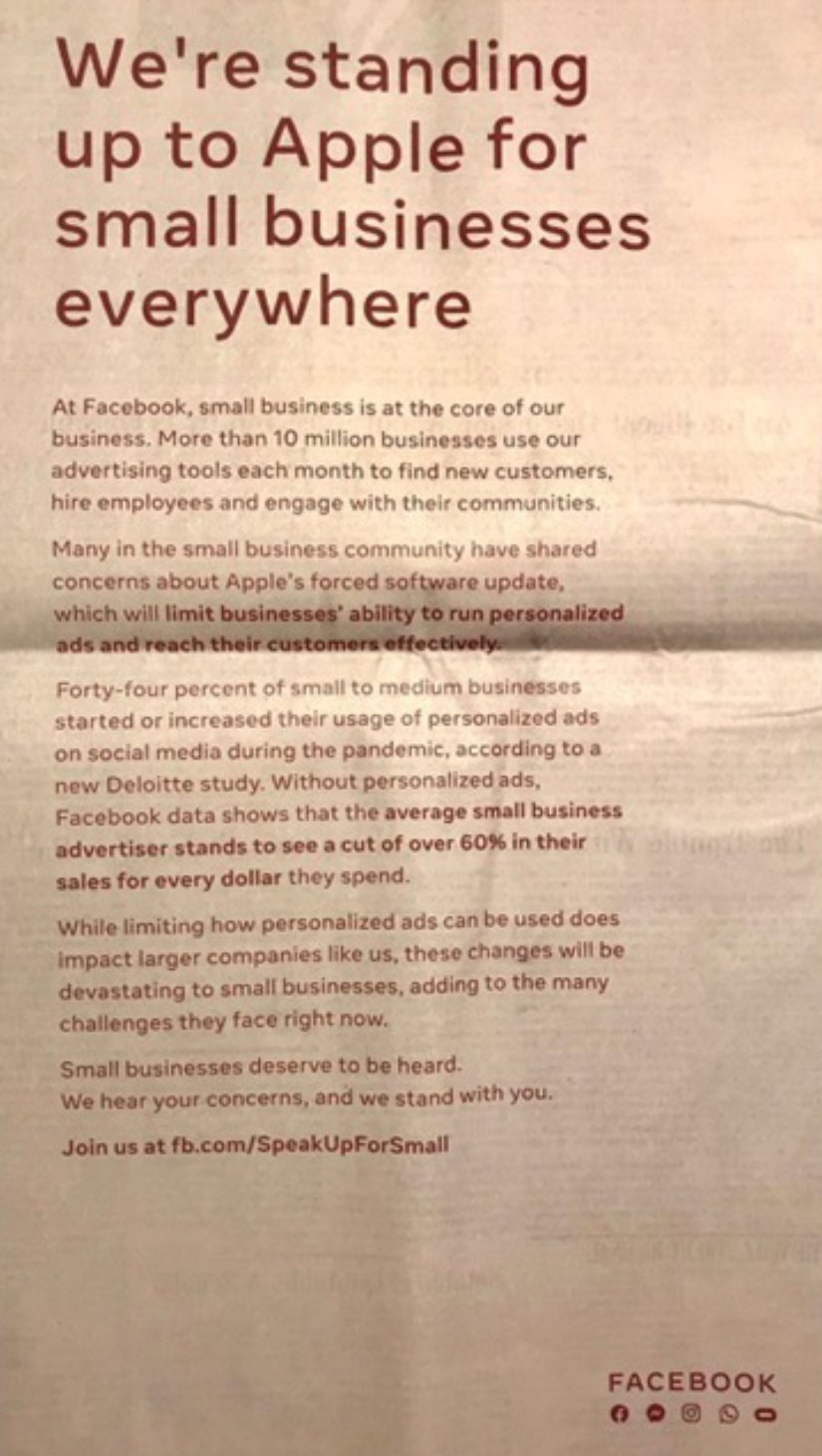

In the eyes of the digital and mobile advertising industry, this was a significant disruption. Meta (then Facebook) ran a series of full-page ads in The New York Times, The Wall Street Journal, and The Washington Post calling out Apple for greatly disadvantaging small businesses because of the digital ad limitations from ATT.

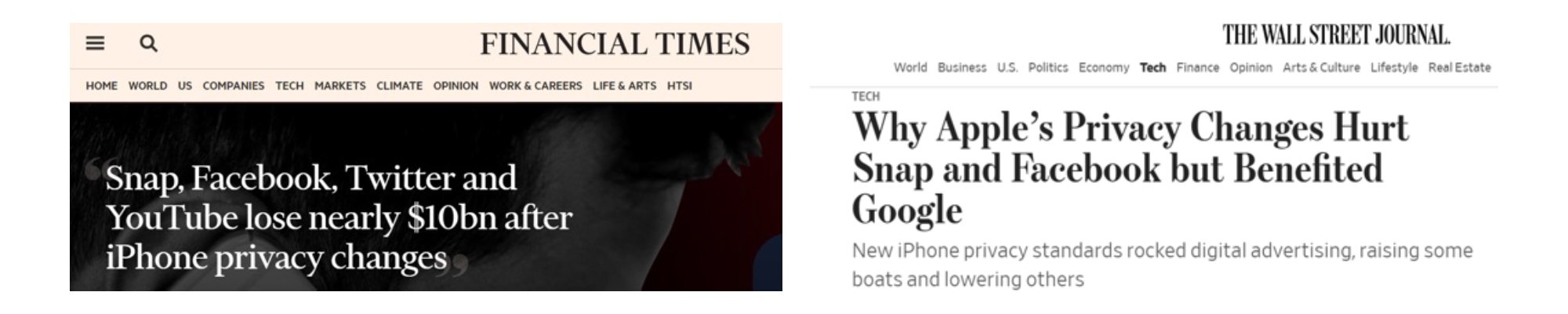

The outcry had no impact on Apple proceeding with its plans to restrict access to unique identifiers in the name of user privacy, with ATT subsequently cited as a frequent culprit behind disappointing financial results from leading ad platforms as evidenced by a string of headlines such as:

Building on its Privacy Sandbox for Chrome, an Android version of Google’s proposed framework intends to follow Apple’s lead with the sunsetting of its own user-level mobile identifier slated for 2024.

Suffice it to say, a lot has happened regarding privacy and consent management in a relatively short amount of time. The sections that follow aim to further unpack

-

Changes afoot with user privacy

-

How consent management is evolving

-

Subsequent impacts on the advertising ecosystem

-

Who will be the winners in the privacy-first era?

Given the vastness of this topic, we will focus on In-app (as opposed to web environment), and iOS.

What then is new with performance marketing?

Let’s start with the message that started it all. The pop-up you see on the image above is part of Apple’s ATT (App Tracking Transparency) framework, the key lynchpin in their privacy push on mobile.

Essentially, any app wishing to track users across a variety of apps owned by different developers for the purposes of campaign targeting and attribution must show a prompt and obtain explicit opt-in from the user in order to engage in these activities. This prompt gates access to the user’s Identifier for Advertisers (IDFA), a unique device-level ID that enables advertisers and their partners to connect a user’s behavior across the various apps they interact with as part of the customer journey. This amounts to the collection of IDFA becoming a new universal consent management requirement for all app developers and geos on iOS.

What are the implications of this change?

ATT has upended how the ecosystem collects and processes device IDs for digital advertisers (IDFA). IDFA are essentially needed for three functions:

Attributing campaign performance

- To connect which ads influenced a user to install an app or engage in other post-install actions important to an advertiser in order to assess Return On Ad Spend (ROAS) and lifetime value.

Personalisation & retargeting

-

To target the right new users with personalised messaging based on their profile; and to drive loyalty and lifetime value amongst existing users by re-engaging them based on their in-app activities and other characteristics.

Efficiency

-

To frequency cap the number of ads shown to the same users in order to provide the best user experience and limit wasted ad spend.

Research has shown that only about 30% of users give permission to be tracked when shown an ATT prompt which means we have collectively lost access to around 70% of IDFAs almost overnight. For a user who does not share permission to be tracked, the IDFA returns a null value to the app, ad network and measurement partner.

Why is this important?

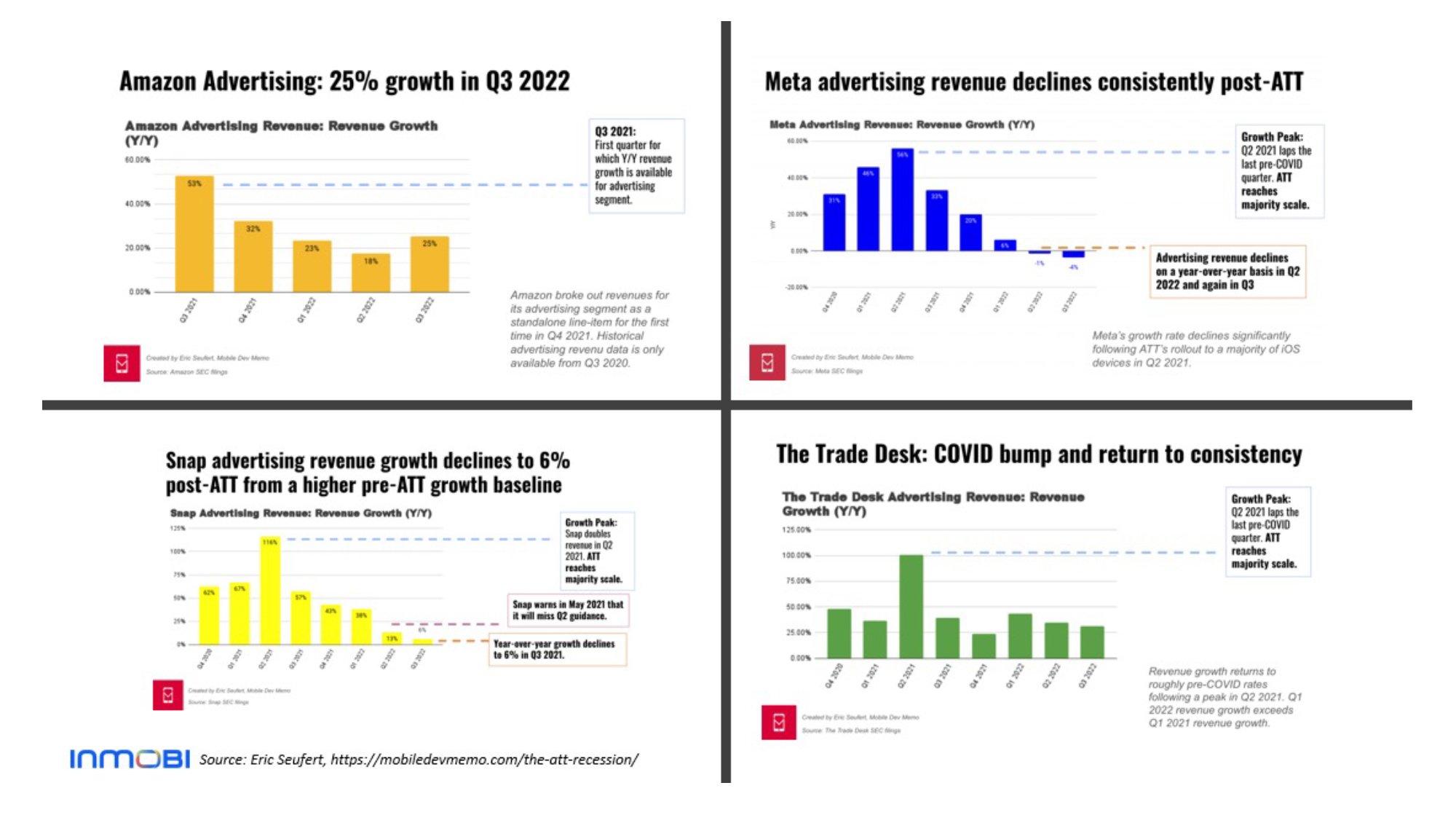

ATT severely restricted the ability to connect ad campaigns to the users they reach and conversion events they drive on iOS, which has varying impacts depending on the type of campaign. The graphs below show the financial performance of four key companies in the digital media space – Amazon (Ads only), Meta, Snap, TTD (The Trade Desk) – in the quarters directly following ATT’s rollout. Each of these companies or the specific line of business reported count advertising as their main source of revenue and the USA (which has a >50% iOS market share) as their primary market.

The results show quite different levels of impact across these four companies. Why is that?

Source: Eric Seufert, the ATT recession

The answer is the kind of advertising categories these companies dominate – broadly classified between Brand and Performance.

IMPACT ANALYSIS – BRAND VS PERFORMANCE

BRAND

This category refers to advertisers using digital and mobile marketing predominantly to create top-of-the-funnel user awareness about a brand, product or specific promotion. For these types of campaigns, one of the immediate impacts seen in the aftermath of ATT for advertisers using audience targeting was a deterioration in the performance of targeting segments they’d relied on before. Frequency capping also presented challenges since it is difficult to identify the same user across multiple apps without having their IDFA to make that connection. But in the two years since, the industry has come together to innovate privacy-safe solutions for addressing these challenges with contextual targeting solutions and new breeds of identity graphs.

Amazon and TTD are the dominant players in the category of advertising. Amazon Ads uses its Owned and Operated (O&O) retail media properties and its Demand Side Platform (DSP) to cater to brand advertisers who are selling on its app. TTD is predominantly used by agencies and brands to set-up brand-objective led campaigns aimed at reaching and engaging with the right audiences at scale.

As evidenced by the financial results in the charts above, the Brand model of advertising faced less impact from ATT and recovered faster.

PERFORMANCE

In general, Performance Marketing can refer to any form of digital marketing in which advertisers only pay when specific actions have been taken, such as a click, sale, or lead. In other words, it is performance-based marketing. But for the scope of this paper, we will refer to performance marketing only in the content of in-app user acquisition and engagement business.

User acquisition & engagement are foundational to the Digital Native vertical.

ReMarketing (REM) refers to driving retention on the target app. An average mobile phone user has 80 apps installed but users don’t often utilise 62% of the 80 apps installed on mobile devices; others are only opened once.

A REM campaign can help to increase an app’s usage. The common KPIs on a REM campaign are Cost Per App Open (CPO) and Cost Per Action (CPA). A post-install action can refer to registration on an eCommerce app; or first ride booking in using a taxi app; or tutorial completion of a game. After the ATT rollout, we saw a drastic, immediate impact on app remarketing campaigns since it severely restricted the ability to identify an existing user of the advertiser’s app on an ad publisher’s app and remarket to them.

User Acquisition (UA) is basically driving app downloads for a target application. Some of UA campaigns’ common KPIs are Cost Per Install (CPI) and Cost Per Action (CPA) post-install. The actions here refer to the same post-install action called out for REM. After the initial ATT roll-out, we did not see a major impact on UA.

This was because most Mobile Measurement Platforms (MMPs) deployed probabilistic attribution models that rely on fingerprinting. Fingerprinting is a way to approximate, or probabilistically identify users without their consent when device IDs are not available. It typically works by combining IP addresses with other device attributes such as handset info, operating system and mobile carrier to make an educated guess about who a user is. This practice is prohibited by Apple in their developer policies, but has not been strongly enforced to this point.

Most advertisers adopted the fingerprinting-based probabilistic attribution methods provided by MMPs, which allowed them to limit the disruptions of ATT temporarily. The alternative to these methods is SKAN, Apple’s privacy-preserving attribution framework. In the two years since ATT rolled it out, SKAN has been on the rise considering it is Apple’s only sanctioned method for conducting campaign attribution while protecting user privacy. Apple has been making significant investments in improving SKAN, which is currently in its 4th version. SKAN 5 is expected to launch before the end of 2023, and will include support for REM, addressing one of the biggest functionality gaps in earlier versions.

In addition to the steady cadence of improvements with SKAN, Apple also rolled out other new privacy features in iOS 17 that take effect in spring 2024. These are aimed at finally enforcing their policies against fingerprinting by holding apps and their third-party SDK partners accountable for ensuring all the ways they access and consume user data comply with developer policies. This long expected change will require advertisers to accelerate their adoption of SKAN, and abandon interim fingerprinting-based workarounds.

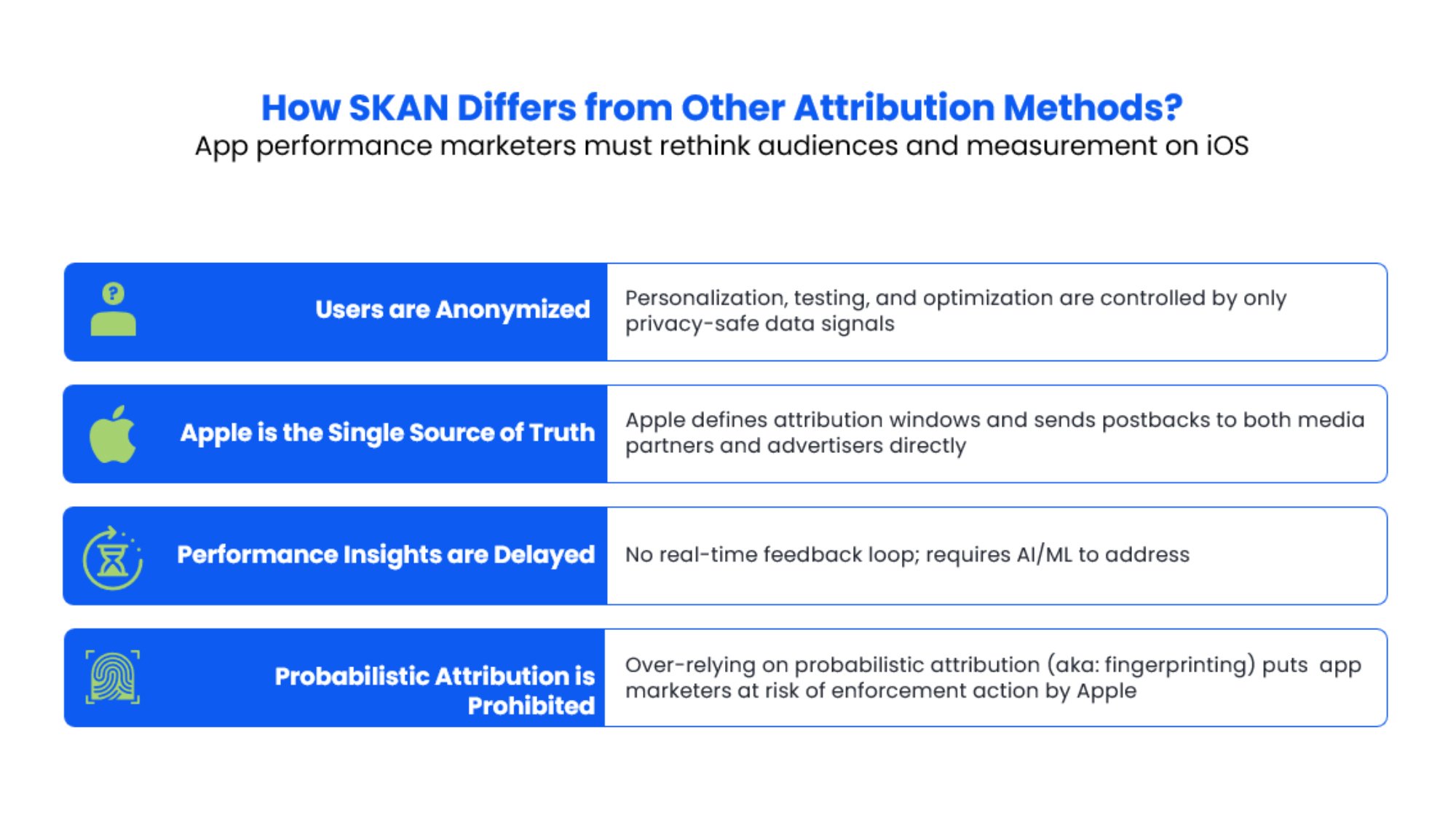

What is SKAN & Why Does it Exist?

SKAN is Apple’s privacy-preserving attribution framework that provides advertisers and their partners with insights on campaign performance while respecting user wishes for privacy. Anonymised attribution insights are provided to advertisers and their media partners via a postback. The following graphic provides a high-level outline of key differences between SKAN and other attribution methods.

Isn’t APAC an Android-heavy market? How big is my impact?

Let us answer this question with 3 data points.

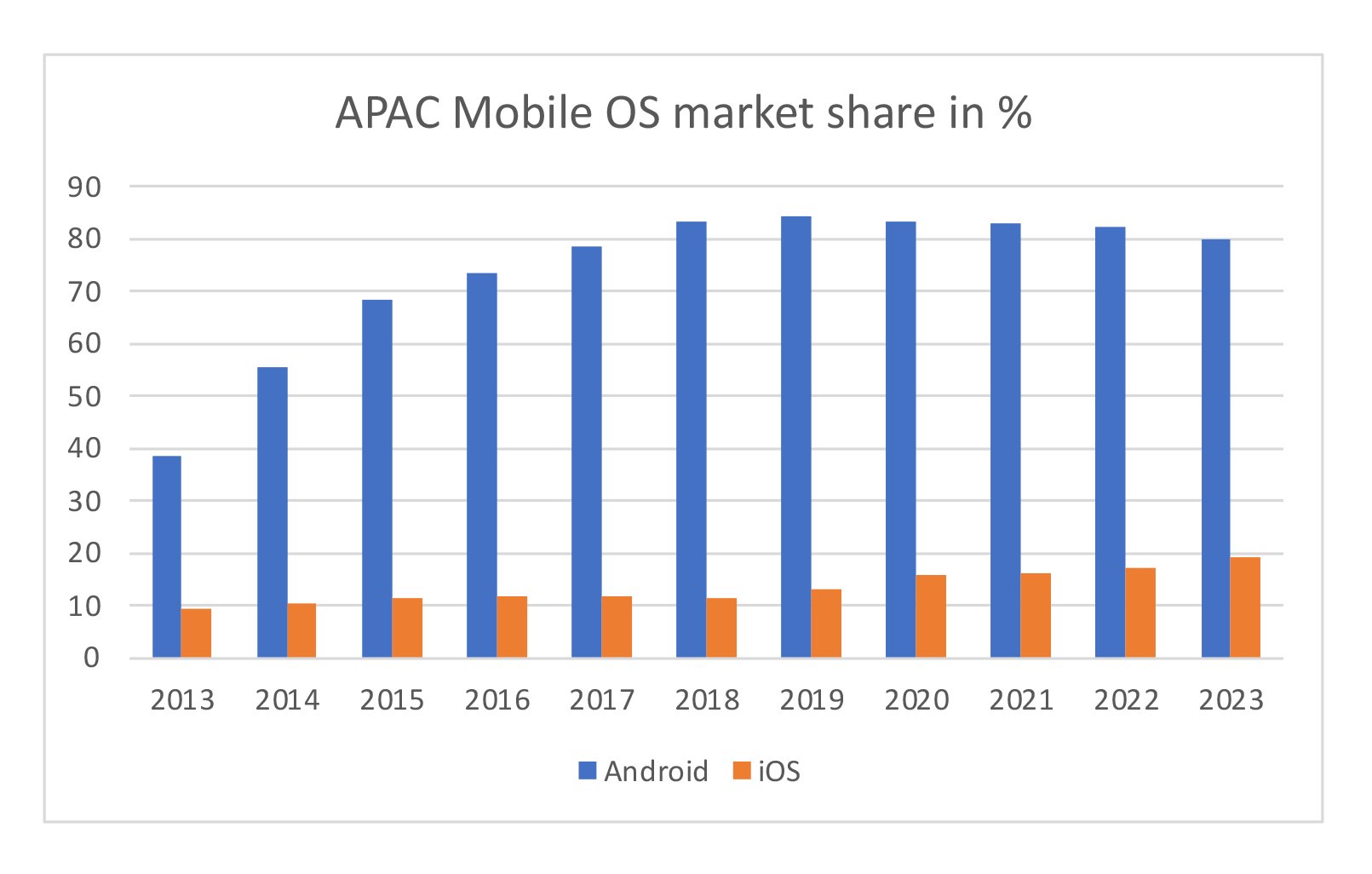

1. The iOS Global Market Share is 27%; APAC is 20%, but this varies significantly by country.

In all, APAC (minus China) has 186M iOS Smartphone users. Note that Apple device owners, in general, represent a more affluent class of users. Hence it is more valuable for advertisers to target them.

2. Ad business on iOS is sizable.

Let us use some data points and guesstimates to arrive at the iOS ad size in APAC.

-

2023 APAC Mobile Ad Spending Forecast: $171B

-

APAC Android vs iOS market share: 80:20

-

Potential iOS app business size/impact: $34B in APAC.

3. iOS is growing.

The chart below on APAC mobile operating system (OS) market share trends shows that iOS is capturing share from Android. As users move towards a more premium mobile segment, Apple devices become the upgrade option for many.

Source: gsstatcounter

Considering all three points, it is fair to conclude that the iOS market is important for APAC and any disruptions to it will impact all the marketers in the region.

Understood the situation and impact. What should I do next?

Now that you have a better sense of the market dynamics at work in the iOS mobile ecosystem, the first thing to do is acknowledge that marketing to Apple users has changed dramatically, and your marketing mix will need to change as well. A good place to start is identifying the risks in your current marketing mix. You will need to understand the nuances of your campaign performance, not only based on the channels you are investing in, but also in terms of the attribution mechanisms leveraged. If you can get familiar with the nuances, the risks in your current portfolio will become clear.

Armed with these insights, next you need to calibrate your marketing mix for both the short and long-term. In your performance campaigns, the existing UA models relied on will rapidly deteriorate as Apple’s efforts to combat fingerprinting take hold in 2024. This means SKAN will become the dominant attribution solution, and you should rapidly adjust your plans accordingly. You currently have the advantage of testing fingerprinting-based attribution alongside SKAN to model your KPIs, and shouldn’t waste this opportunity. After Apple fully implements their new processes aimed at shutting down fingerprinting in spring 2024, you will no longer have this liberty.

Privacy needs to be top-of-mind in all your mobile marketing strategies. Following in the footsteps of Apple, Google is moving ahead with its Privacy Sandbox framework for Android, with a current estimated launch date of late 2024. This means advertisers will need to adapt their strategies to thrive in a privacy-first world free from mobile identifiers on both iOS and Android by the end of next year, which requires a complete rethinking of current attribution models and KPIs. The chart below shows the current timeline of privacy-centric changes across mobile environments.

Both Android & iOS will move to a non-device ID environment. Operating and winning here requires a rethinking of current models and KPIs.

Conclusion

Let us summarise the questions we set out with.

What exactly is the privacy change? On iOS, IDFA (unique device ID) sharing permission rests with the user, and most choose not to share this information.

What is the state of consent management? Apple has made IDFA sharing a universal consent system on iOS.

How is it going to impact our advertising ecosystem? Brand advertising models have adapted for the most part, but Performance (UA and REM) models need urgent action.

Who will be the winners in the new world? The players who can successfully future-proof their mobile marketing strategies by adapting to the privacy-first world will thrive.

There’s also a ‘surprise’ winner, and that is Apple itself. Since the rollout of ATT, Apple has seen its App Store search ads business grow up and is estimated to reach $7.5B in 2023. Apple has also been ramping up ad offerings on its native apps such as Apple News and Music, and is also rumored to be building its own DSP tech stack. So ‘who watches the watchmen?’. Time will tell, but it’s safe to say global regulators have taken note of Apple’s moves and disruptions in the advertising sector.

As students of marketing, our best plan is to spot the trends, understand the implications and adapt the medium. After all, “To improve is to change; to be perfect is to change often.” Winston Churchill.